Eurozone Inflation Slows Sharply In March As Energy Costs Drop

Inflation in the eurozone slowed more sharply than expected in March but food prices jumped even as energy costs declined, official data showed Friday.

Investors on both sides of the Atlantic are focused on inflation to gauge what next steps central banks will take, with all eyes on the United States later Friday when the latest consumer data comes out.

Central banks will need to carefully balance taming inflation with interest rate rises, against the risks that more hikes could hurt their banking sectors.

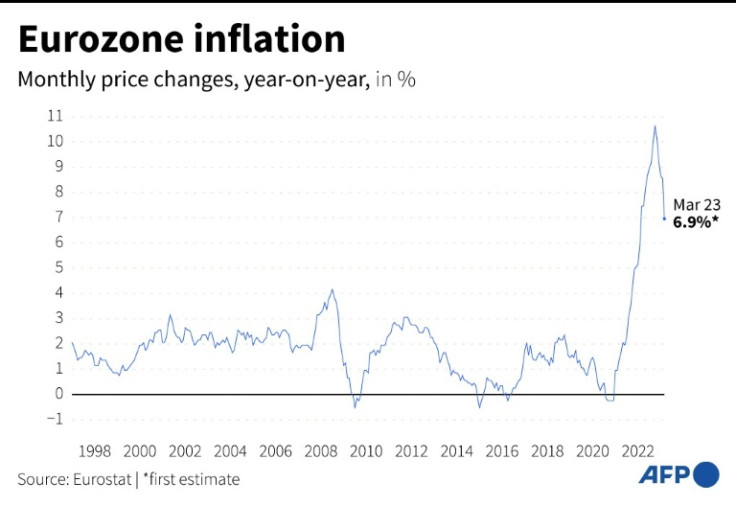

Consumer prices rose by 6.9 percent on an annual basis in the eurozone, down from 8.5 percent in February, according to the European Union's statistics agency.

It is the lowest rate recorded in a year.

Analysts for Bloomberg and financial data firm FactSet had forecast the inflation rate to reach 7.1 percent in the single currency area in March.

Despite falling from a peak of 10.6 percent in October, eurozone inflation still remains well above the European Central Bank's two-percent target.

The ECB has raised interest rates repeatedly to tame red-hot inflation but the size of the next rate hike is unclear after recent turbulence in the banking sector.

Energy prices fell by 0.9 percent after rising by 13.7 percent in February, according to Eurostat, the first drop since February 2021.

Russia's invasion of Ukraine sent oil and gas prices soaring last year but they have become more stable in recent months, helped also by mild weather.

Food and drink prices rose, however, by 15.4 percent in March, compared with 15 percent in the previous month, it added.

"This indicates that price pressures remain high for the moment, although this should improve in the coming months," ING senior eurozone economist Bert Colijn said.

Fears over price growth remain as the eurozone's core inflation, which excludes volatile food and energy prices, edged up to 5.7 percent in March from 5.6 percent a month earlier.

"Descending headline inflation thanks to cooling energy prices will not be enough for the ECB to stop tightening, as policymakers are looking for clear signs of core inflation easing," said Riccardo Marcelli Fabiani, economist at Oxford Economics.

Analysts said they expected further rate rises by the ECB this year as a result.

"The potential for core inflation to remain stickier than hoped will be the main reason for the ECB to continue to hike in the near term. We expect another 25bp hike in May and another in June," ING's Colijn said in a note.

Inflation also slowed in some of Europe's biggest economies in March, fuelling hopes that the region is past the worst price increases.

In Germany, annual price growth slowed to 7.4 percent in March from 8.7 percent in the first two months of 2022.

The annual inflation rate came in at 5.6 percent in France in March, compared to 6.3 percent the previous month.

The slowdown was more pronounced in Spain, with inflation coming in at 3.3 percent compared to six percent in February.

Among the 20 countries that use the euro, Luxembourg had the lowest inflation rate in February at 3.0 percent, Eurostat said.

According to other Eurostat data published Friday, the unemployment rate in the eurozone remained stable in February at 6.6 percent.

In the United States, investors will be closely scrutinising the February update to the personal consumption expenditure (PCE) index -- the Fed's favoured inflation measure -- for signs that price increases slowed last month.

PCE inflation unexpectedly increased in January at an annual rate of 5.4 percent, far above the Fed's long-term two percent target, due to a higher-than-expected rise in new home sales.

Core PCE, which excludes volatile food and energy prices, rose by 4.7 percent.

© Copyright AFP 2024. All rights reserved.