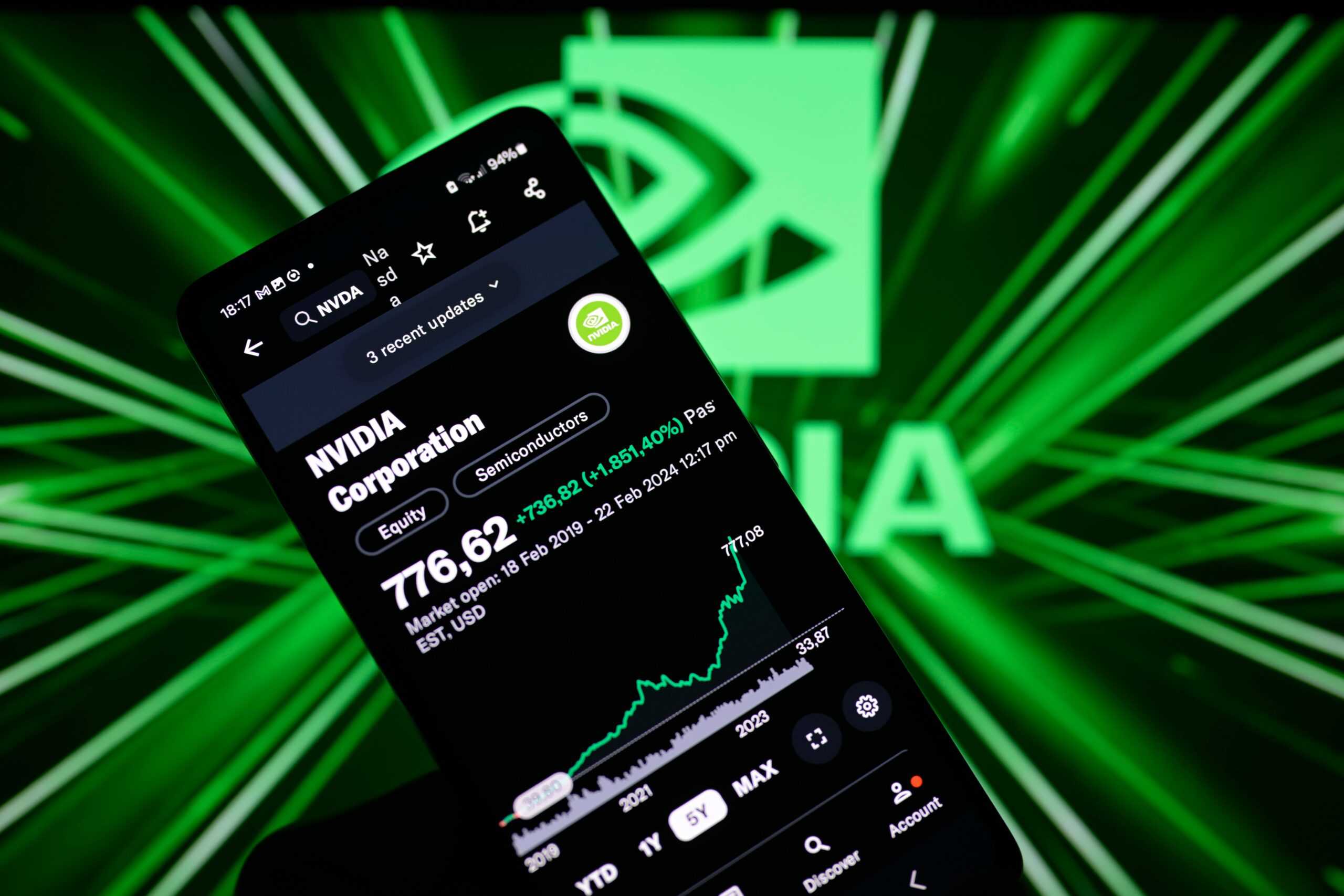

AI stocks were sold off big on Friday. NVIDIA (Nasdaq: NVDA) closed down an even 10% while Super Micro Computer (Nasdaq: SMCI) plummeted 23.14%. There were some earnings in the AI space that spooked investors during the week (both Taiwan Semi and ASML fell after earnings), but the reality is that Friday was likely just a rotation out of AI stocks that are seen as risky ahead of earnings season.

If you’ve been investing for a long time, you’ve certainly seen the FOMO (fear of missing out) stocks are the ones sold the most quickly when the tide turns. With the Nasdaq and S&P 500 showing deep losses across the past week, we’re once again seeing this situation play out.

With both NVIDIA and Super Micro being two of the most likely stock split candidates, one question on investors’ minds might be whether recent price action could delay any splits. Let’s dive into the details.

At What Price Did NVIDIA Last Split Its Shares?

NVIDIA’s last stock split occurred on July 20th, 2021. At the time of the split NVIDIA traded for $744.48 per share, which is remarkably close to the price it trades for today. NVIDIA closed Friday trading at $762 per share.

Yet, it’s worth noting that the most important price is where NVIDIA was trading when it announced its stock split. It announced its last split on May 21, 2021. At the time NVIDIA was trading for slightly less than $600 per share.

From that standpoint, NVIDIA is still well above the price it was trading at when it announced its last stock split.

Environment May Matter

However, the overall environment may come into a decision around whether NVIDIA approves a stock split. As I noted above, NVIDIA last announced a stock split on May 21, 2021. That date is important because it was in front of their Annual Meeting of Stockholders where the split could be approved.

As I’ve written about recently, it’s likely NVIDIA would approve another split ahead of this year’s Meeting of Stockholders. That leaves about a month before any decision would be made on a stock split.

If the market continues selling off headed into when NVIDIA executives make a stock split decision, splitting the company’s share price may not be as much of a priority. NVIDIA’s executives have been through several market cycles and likely wouldn’t want the distraction of splitting its stock (generally a signal of strength) into a choppy market for AI stocks.

My vote is that an NVIDIA stock split is still likely in 2024. However, if the stock drops another 10% or more, it simply won’t be a priority for management. Either way, the zone when NVIDIA is most likely to announce a stock split is just weeks away.

Is NVIDIA’s Sell-Off Warranted?

The big question at this point if you’re an NVIDIA investor is “Did the company deserve this sell-off?”

It’s important to remember that stocks normally go down faster than they go up. That is, you might sit patiently as a stock grows 40% across two years only to see a single bad earnings unwind growth by 20%. Investors are quick to hit the exits when bad news appears.

Was the news in artificial intelligence particularly bad this week? I don’t believe it was. ASML (Nasdaq: ASML) – a company that sells the most advanced technology for making chips – reported disappointing earnings. However, the company has lumpy earnings that are hard to read too much into in any particular quarter. In addition, executives affirmed their 2024 expectations.

Another company that disappointed Wall Street was Taiwan Semiconductor (NYSE: TSM). The stock technically beat expectations, but saw its shares slide in the days that followed. Once again, my review of Taiwan Semiconductor’s earnings was largely positive for artificial intelligence stocks. While the company saw sluggish growth in fields like smartphones, EVs, and the Internet of Things, it affirmed expectations its AI sales would grow at a sizzling 50% compounded annual growth rate over the next five years.

So, was NVIDIA’s sell-off unwarranted? It’s important to remember that even after its recent sell-off the stock is still up 58% year-to-date! When expectations are sky high for stocks you own, they’re liable to sell off for very small reasons.

As an example, a part of Super Micro Computer’s sell-off today appears to be the fact they didn’t pre-announce spectacular earnings. I’ve been investing for a long time, and have never seen a stock sell-off (never mind for 23%!) because it didn’t pre-announce earnings.

So, even though momentum for the artificial intelligence space appears to be in place, I don’t think the sell-off is “unfair.” The greatest stock stories of the past 20 years (Amazon, NVIDIA, Meta, etc.) all saw significant sell-offs investors had to persevere to reach their long-term gains. Personally, I’m very excited to add to my NVIDIA positions if the market keeps punishing AI stocks.

More NVIDIA and AI News

- Is the AI Stock Rally Over?

- Netflix Stock Reeling 9% Today

- 2 AI Stock That Could See Faster Growth than NVIDIA

Smart Investors Are Quietly Loading Up on These “Dividend Legends” (Sponsored)

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.