Ammonium Sulfate Market Size to Reach USD 6.1 Bn by 2033 - Rise with Steller CAGR 6.8%

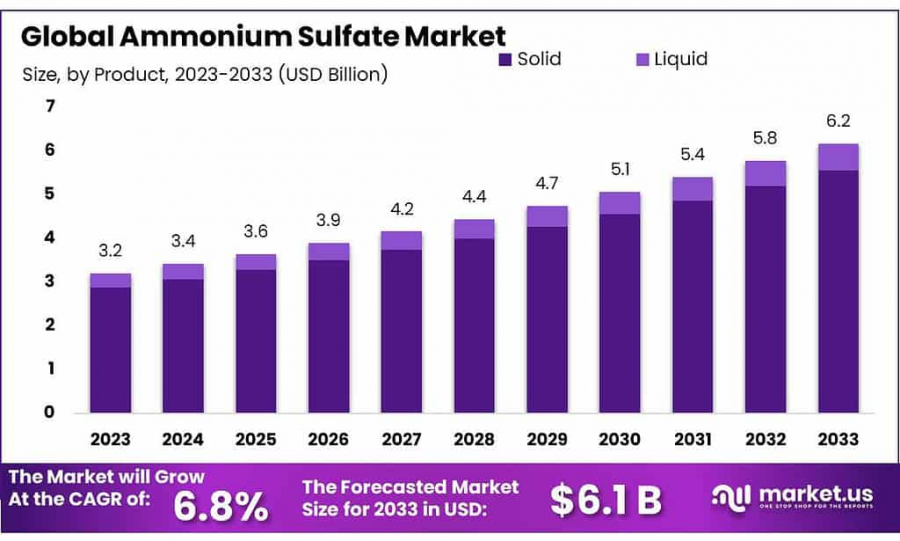

Ammonium Sulfate Market size is expected to be worth around USD 6.1 billion by 2033, from USD 3.2 billion in 2023, growing at a CAGR of 6.8%

NEW YORK, NY, UNITED STATES, January 27, 2025 /EINPresswire.com/ -- The Global Ammonium Sulfate Market is currently navigating a dynamic landscape, shaped significantly by its extensive application in agriculture and industrial sectors. Ammonium sulfate, a crystalline salt used primarily as a nitrogen fertilizer in agriculture, is also utilized in pharmaceutical applications, textile manufacturing, and as a food additive, demonstrating its versatility across diverse industries. The demand for ammonium sulfate is heavily influenced by the agricultural sector's need to boost crop yield amidst growing global food demands.

The rising demand for water-soluble fertilizers, a category in which ammonium sulfate excels due to its ability to provide readily available nitrogen to plants. Its efficacy in alkaline soils, where it helps in lowering the pH balance, enhances its desirability, addressing specific agricultural challenges faced in significant markets such as North America and Europe.

Environmental concerns regarding the use of synthetic fertilizers, coupled with stringent regulatory frameworks governing chemical use across the globe, pose potential restraints. Moreover, the volatility in raw material prices can impact production costs and market stability. To navigate these hurdles, companies are investing in production efficiency and developing eco-friendly production methods, which may also serve as a market restraint due to the high costs associated with such innovations.

Future growth opportunities for the ammonium sulfate market are anticipated in the development of specialized agricultural blends that cater to specific crop needs, enhancing the efficiency of nutrient delivery and minimizing environmental impact. Additionally, the expanding biofertilizer sector presents a complementary growth avenue, as research into bio-ammonium sulfate formulations could open new market segments, combining the effectiveness of chemical fertilizers with the environmental benefits of organic alternatives.

👉 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐑𝐞𝐪𝐮𝐞𝐬𝐭: 𝐔𝐧𝐥𝐨𝐜𝐤 𝐕𝐚𝐥𝐮𝐚𝐛𝐥𝐞 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐟𝐨𝐫 𝐘𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://market.us/report/ammonium-sulfate-market/free-sample/

Key Takeaways

— Market Growth Projection: The Ammonium Sulfate Market is expected to witness significant growth, reaching around USD 6.1 billion by 2033 from USD 3.2 billion in 2023, exhibiting a projected CAGR of 6.8%.

— Applications: Fertilizers: Leading application with over 67% market share, utilized for soil fertility and crop growth.

— Pharmaceuticals and Food and feed Additives: Combined share of about 14.5%, finding limited yet specific applications.

— Regional Analysis: Asia Pacific: Largest revenue share due to the rise in demand for fertilizers, particularly in economies dependent on farming.

Ammonium Sulfate Statistics

Product Analysis

As of 2023, solid ammonium sulfate dominated the market, securing over 90% of the total market share. This preference is largely attributed to its stability, ease of handling, and versatile applications, ranging from agricultural fertilization to various industrial processes involving chemical production. In contrast, liquid ammonium sulfate, though available, occupies a smaller market segment. Despite its advantages, such as ease of application and suitability for specific uses, it significantly lags behind the solid form in terms of market presence.

By Production Process

In 2023, the ammonium sulfate market predominantly employed the Gypsum process for production, which stood out due to its significant market share. This method, which involves a reaction between gypsum and ammonium carbonate, is celebrated for its reliability and efficiency, making it the preferred choice for manufacturing ammonium sulfate to meet diverse industrial demands. While the Gypsum process led the market, other production methods such as Caprolactam, Coke Oven Gas, Neutralization, and a few alternatives also contributed, albeit with a smaller combined market share compared to the Gypsum process.

Application Analysis

In 2023, fertilizers were the primary application for ammonium sulfate, capturing over 67% of the market share. This significant usage is attributed to its high nitrogen content, which is essential for enhancing soil fertility and promoting robust crop growth. Meanwhile, the compound also played a critical role in water treatment, holding around 15.5% of the market share. In this sector, ammonium sulfate is valued for its ability to reduce alkalinity and remove impurities, ensuring cleaner and more balanced water systems.

👉 𝐃𝐫𝐢𝐯𝐞 𝐘𝐨𝐮𝐫 𝐆𝐫𝐨𝐰𝐭𝐡 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐲! 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞 𝐭𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐭𝐨 𝐔𝐧𝐜𝐨𝐯𝐞𝐫 𝐊𝐞𝐲 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬: https://market.us/purchase-report/?report_id=38253

Key Market Segments

By Product

— Solid

— Liquid

By Production Process

— Caprolactam

— Coke Oven Gas

— Gypsum

— Neutralization

— Others

By Application

— Fertilizers

— Water Treatment

— Pharmaceuticals

— Food & Feed Additives

— Other Applications

Emerging Trends

1. Increased Use in Agriculture: The Ammonium Sulfate Market is witnessing a notable rise in demand within the agricultural sector, primarily driven by its efficacy as a soil fertilizer. This compound provides essential nutrients, notably nitrogen and sulfur, which are crucial for crop growth. Its ability to release nutrients at a rate that matches crop uptake makes it highly valued among farmers, particularly in regions with high rainfall, where soil nutrient depletion is frequent.

2. Industrial Applications on the Rise: Beyond agriculture, ammonium sulfate is gaining traction in various industrial applications. It is increasingly used as a flame retardant in materials that require fire suppression properties. Additionally, the compound serves as a useful additive in the pharmaceutical industry, where it is employed in the purification of proteins and vaccines.

3. Production from Synthetic Routes: There is a growing trend towards the synthetic production of ammonium sulfate through the reaction of anhydrous ammonia and sulfuric acid. This method is preferred for its efficiency and control over product purity, which is crucial for applications demanding high-quality standards, such as pharmaceuticals and food additives.

4. Environmental Regulations Influence: Regulatory frameworks are shaping the market landscape significantly. As governments worldwide tighten regulations on agricultural run-off and industrial emissions, the demand for environmentally friendly fertilizers and additives like ammonium sulfate is expected to increase. This trend is prompting manufacturers to invest in production practices that are both sustainable and compliant with global environmental standards.

5. Innovations in Production Technology: Technological advancements in production processes are emerging as a key trend. Innovations aimed at improving the efficiency of ammonium sulfate manufacturing processes are becoming pivotal. These include the development of methods to recycle the by-products of other industries to produce ammonium sulfate, thereby reducing waste and optimizing resource use.

Regulations on Ammonium Sulfate Market

In the United States, ammonium sulfate is regulated primarily under the Environmental Protection Agency (EPA) due to its classification as a chemical substance. The EPA mandates proper handling, storage, and disposal practices to mitigate its environmental impact. Additionally, as a fertilizer, it must comply with the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA), which ensures that its use in agriculture does not pose a significant risk to the environment.

In the European Union, ammonium sulfate falls under the Regulation (EC) No 2003/2003 of the European Parliament and of the Council on fertilizers. The regulation stipulates that ammonium sulfate must meet specific safety, health, and environmental standards to be marketed as an EC Fertilizer. The EU's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation also applies, requiring companies to register ammonium sulfate if manufactured or imported in quantities exceeding one tonne per year.

From a market perspective, these regulatory frameworks impact production costs and market growth. Compliance with stringent regulations can increase the production cost, influencing pricing strategies and competitive dynamics in the market. Despite these challenges, the global market for ammonium sulfate is projected to grow.

This growth is driven by the increasing demand for ammonium sulfate as a nitrogen fertilizer in agriculture, particularly in regions with high crop production. The demand is also supported by its use in industrial applications, such as the pharmaceutical and food additives sectors. However, market expansion is tempered by environmental concerns and the availability of substitute products offering lower ecological footprints.

Regional Analysis

In 2023, the Asia Pacific (APAC) region dominated the ammonium sulfate market, capturing over 45% of global revenue. This dominance is primarily driven by increased demand for fertilizers within the crop-growing sector across agricultural-dependent economies such as India, Sri Lanka, and Bangladesh. Despite modest growth in the agricultural sector, the demand for fertilizers presents significant growth opportunities in these regions.

Europe followed as the second-largest market in terms of volume in 2021, fueled by rising demand for versatile fertilizers applicable to various crops. The region has also seen a tightening of regulatory controls on synthetic fertilizers, influencing market dynamics.

During the forecast period, South America and Central America are projected to experience a robust compound annual growth rate (CAGR) of 6.3% in revenue, spurred by growing needs for high-quality ammonium sulfate-based fertilizers. These fertilizers are essential for the healthy growth and maintenance of principal crops like grapes, sunflower seeds, and wheat. Notably, the agricultural sector, featuring key countries such as Argentina, Bolivia, and Paraguay, represents half of the GDP in these regions, highlighting its significance to the local economies.

Key Players Analysis

Leading companies in the Ammonium Sulfate market are adopting strategies such as innovation, partnerships, and geographic expansion to maintain their dominance. Key players include:

— Lanxess Corporation

— BASF SE

— Sumitomo Chemical

— Royal DSM

— Honeywell International

— Evonik Industries

— Novus International

— AdvanSix

— J.R. Simplot Company

— Other Key Players

Strategic Initiatives

— Product Portfolio Expansion: Companies are investing in R&D to develop advanced formulations that meet regulatory and consumer demands.

— Geographic Expansion: Focus on high-growth regions like Asia-Pacific and the Middle East to capitalize on industrialization trends.

— Sustainability Initiatives: Efforts to align with global sustainability goals and minimize environmental impact.

𝐄𝐱𝐭𝐞𝐧𝐬𝐢𝐯𝐞 𝐂𝐨𝐯𝐞𝐫𝐚𝐠𝐞 𝐢𝐧 𝐭𝐡𝐞 𝐂𝐡𝐞𝐦𝐢𝐜𝐚𝐥 𝐃𝐨𝐦𝐚𝐢𝐧:

3-Thiophenemalonic Acid Market : https://market.us/report/3-thiophenemalonic-acid-market/

Thymine (CAS 65-71-4) Market : https://market.us/report/thymine-cas-65-71-4-market/

2,6-Dicarboxypyridine Market : https://market.us/report/26-dicarboxypyridine-market/

Trans-1,2-Dichloroethylene Market : https://market.us/report/trans-12-dichloroethylene-market/

2 - Ethyl Anthraquinone Market : https://market.us/report/2-ethyl-anthraquinone-market/

7-Amino Heptanoic Acid Market : https://market.us/report/7-amino-heptanoic-acid-market/

Acrylonitrile Butadiene Styrene Market : https://market.us/report/acrylonitrile-butadiene-styrene-market/

Cis-4-Hydroxy-L-Proline Market : https://market.us/report/cis-4-hydroxy-l-proline-market/

1,4-Butanediol Market : https://market.us/report/1-4-butanediol-market/

1,2 Hexanediol Market : https://market.us/report/12-hexanediol-market/

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Chemical Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release