Flow Chemistry Market to Reach USD 4.6 Billion by 2033, Growing at 10.6% CAGR from 2023-2033

Flow Chemistry Market size is expected to be worth around USD 4.6 bn by 2033, from USD 1.7 bn in 2023, growing at a CAGR of 10.6% forecast period 2023 to 2033

NEW YORK, NY, UNITED STATES, January 27, 2025 /EINPresswire.com/ -- Report Overview

Flow chemistry involves chemical reactions run in a continuously flowing stream, rather than in batch production. In this method, reactants are pumped together at a mixing junction and flowed down a temperature-controlled pipe or tube. This approach is highly efficient, offers excellent reaction selectivity, and can lead to safer reactions when handling hazardous compounds because of the smaller volumes and more controlled conditions.

The flow chemistry market has been growing steadily, driven by the pharmaceutical and chemical manufacturing sectors. Its benefits of higher safety, lower footprint, and cost-efficiency contribute to its expanding application base, ranging from petrochemicals to agrochemicals, and from fine chemicals to biotechnologies.

The primary growth factor for the flow chemistry market is its ability to enhance safety and scalability in chemical manufacturing. As industries continuously seek safer and more efficient production methods, flow chemistry systems reduce the risk of chemical accidents due to their closed systems and controlled reaction environments.

Demand for flow chemistry technologies is driven by the increasing need for sustainable and green manufacturing processes. Industries are adopting flow chemistry solutions not only to improve the efficiency and yield of chemical reactions but also to minimize environmental impact by reducing waste and energy consumption.

Opportunities in the flow chemistry market are abundant, particularly in the pharmaceutical industry, where the need for precise control over reaction conditions can lead to better quality products and reduced time-to-market for new drugs. Additionally, the adaptability of flow systems to continuous processing aligns with industry trends toward more streamlined manufacturing processes.

A significant driving factor for the flow chemistry market is the technological advancement in process analytics and control technologies. These enhancements make flow chemistry systems more attractive by providing better monitoring and optimization capabilities, leading to improved outcomes and greater adoption across various chemical-using industries.

Get a Sample PDF Report: https://market.us/report/flow-chemistry-market/request-sample/

Key Takeaways

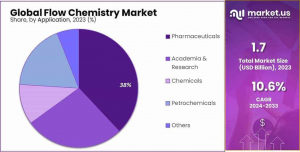

• The market is expected to grow to around USD 4.6 billion by 2033, from USD 1.7 billion in 2023, showcasing a CAGR of 10.6% during the forecast period from 2023 to 2033.

• Continuous Stirred-Tank Reactors (CSTRs) dominated in 2023, holding over 39.2% market share due to their adaptability and consistency in conducting various chemical processes.

• Chemicals sector dominated the market (38.7%) followed by Pharmaceuticals (29.4%) and Petrochemicals (21.5%), showcasing diverse applications and acceptance of flow chemistry techniques.

•North America held the largest market share (37.5%) in 2023, driven by pharmaceutical and chemical product demand, while APAC is expected to witness the highest CAGR of 11.9%.

Flow Chemistry Market Segment Analysis

By Reactor Type Analysis

In 2023, Continuous Stirred-Tank Reactors (CSTRs) dominated the flow chemistry market, holding over 39.2% share due to their versatility in various chemical processes, providing controlled and consistent conditions. Beyond CSTRs, the market features reactors like Wet Chemical, Direct, Indirect, and specialized types, each designed for specific applications, enhancing the field's diversity. The dominance of CSTRs highlights their efficiency and reliability, while other reactors address particular needs, contributing to the breadth of options in flow chemistry.

By Purification Method

In 2023, Powder purification methods led the Flow Chemistry market, capturing a significant share due to their versatility and efficiency in various chemical processes. While Pellets and Liquid forms also contributed, they held smaller shares; Pellets are favored for their controlled-release properties and specific applications, and Liquid purification is preferred in specialized scenarios requiring liquid dispersion. The dominance of Powder underscores its effectiveness and widespread application across diverse chemical reactions and industries in flow chemistry.

By Application Analysis

In 2023, the Flow Chemistry market was predominantly led by the Chemicals sector, which accounted for over 38.7% of the market share, due to its role in enhancing synthesis and production efficiency. Pharmaceuticals and Petrochemicals followed, capturing 29.4% and 21.5% of the market, respectively, utilizing flow chemistry for precise drug synthesis and petrochemical refining. Academia and research also contributed underlining flow chemistry's role in advancing scientific innovations. The market's distribution illustrates the widespread application and efficiency gains across various industries.

Buy Now: https://market.us/purchase-report/?report_id=33902

Key Market Segments

By Reactor Type

• CSTR (Continuous stirred-tank reactor)

• Microreactor

• Plug Flow Reactor

• Microwave Systems

• Others

By Purification Method

• Crystallization

• Distillation

• Liquid-Liquid Extraction

• Membrane Filtration

• Others

By Application

• Pharmaceuticals

• Academia & Research

• Chemicals

• Petrochemicals

• Others

Top Emerging Trends

1. Green Manufacturing Techniques: Environmental concerns are steering the flow chemistry market towards greener manufacturing processes. These methods reduce waste and energy consumption, aligning with global sustainability goals. This trend is not just beneficial for the environment but also cost-effective for producers, enhancing long-term viability and regulatory compliance.

2. Advanced Process Analytics: The incorporation of advanced analytics technologies is a significant trend in the flow chemistry market. These technologies enable real-time monitoring and precise control over chemical reactions, improving yields and process efficiency. This trend is particularly influential in high-stakes industries like pharmaceuticals, where product consistency and quality are critical.

3. Customized Reactor Systems: There is a rising demand for customized reactor designs that cater to specific industrial applications. Custom reactors can optimize conditions for unique chemical reactions, providing flexibility and enhanced control. This trend is driving innovation in reactor manufacturing and enabling more industries to adopt flow chemistry techniques.

4. Scale-Up Solutions: Scaling up flow chemistry from laboratory to industrial scale is increasingly feasible due to improvements in reactor design and system integration. This trend is crucial for industries looking to transition from batch processing to continuous flow systems, offering significant cost and time efficiencies at larger scales.

5. Integration with Pharmaceutical R&D: Flow chemistry is becoming deeply integrated into pharmaceutical research and development. This trend is driven by the need for faster drug development cycles and the precise synthesis capabilities offered by flow chemistry. It allows for quicker iterations and streamlined scaling of new medicines, aligning with the rapid pace of innovation required in the pharmaceutical sector.

Regulations on the Flow Chemistry Market

The flow chemistry market is subject to various regulatory frameworks across different regions, primarily focusing on environmental safety, chemical handling, and process optimization. Regulatory bodies such as the U.S. Environmental Protection Agency (EPA), the European Chemicals Agency (ECHA), and the Food and Drug Administration (FDA) impose stringent guidelines to ensure safe and sustainable chemical production using continuous flow systems.

In Europe, the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) regulation governs the use of chemicals in flow chemistry processes, ensuring compliance with safety and environmental standards. The U.S. Occupational Safety and Health Administration (OSHA) and the EPA regulate hazardous chemical handling and emissions to minimize industrial risks.

Additionally, Good Manufacturing Practices (GMP) compliance is critical for pharmaceutical and fine chemical applications in flow chemistry. The International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH) provides guidelines on process validation, ensuring consistent quality in drug manufacturing.

With a growing emphasis on green chemistry, regulatory frameworks are evolving to encourage the adoption of flow chemistry for reduced waste, improved efficiency, and lower environmental impact. Companies must stay updated on these evolving regulations to ensure compliance and gain a competitive edge in the industry.

Regional Analysis

North America dominated the flow chemistry market in 2023, accounting for over 37.5% of global revenue, driven by pharmaceutical and chemical sector growth and increased R&D investments.

The APAC region is expected to register the highest CAGR of 11.9%, fueled by rising government spending on pharmaceutical production and a strong chemical and petrochemical outlook. Europe focuses on medical R&D, leveraging flow chemistry for cost-effective drug manufacturing.

Brazil's pharmaceutical investments and rising oil production will further support industry expansion. Additionally, the growing emphasis on biotechnology and green production processes will drive global market growth in the coming years.

Key Players Analysis

◘ Am Technology

◘ CEM Corporation

◘ Milestone Srl

◘ Biotage AB

◘ Syrris Ltd.

◘ Vapourtec Ltd.

◘ ThalesNano Inc.

◘ Hel Group

◘ Uniqsis Ltd.

◘ Chemtrix BV

◘ Ehrfeld Mikrotechnik BTS

◘ Future Chemistry Holding BV

◘ Corning Incorporated

◘ Cambridge Reactor Design Ltd.

◘ PDC Machines Inc.

◘ Parr Instrument Company

Recent Developments of the Flow Chemistry Market

— In October 2024, Corning reported third-quarter core sales of $3.73 billion, an 8% year-over-year increase, and core EPS growth of 20% to $0.54. The company is progressing toward its 'Springboard' plan to add over $3 billion in annualized sales and achieve a 20% operating margin by the end of 2026.

— In 2022, Biotage reported sales of SEK 1,566 million, reflecting its global reach in over 80 countries.

Strategic Initiatives

— Product Portfolio Expansion: Companies are investing in R&D to develop advanced formulations that meet regulatory and consumer demands.

— Geographic Expansion: Focus on high-growth regions like Asia-Pacific and the Middle East to capitalize on industrialization trends.

— Sustainability Initiatives: Efforts to align with global sustainability goals and minimize environmental

Lawrence John

Prudour

+91 9130855334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Chemical Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release