Water Treatment Chemicals Market to hit USD 79 Bn by 2033, North America 32.2% share

Water Treatment Chemicals Market size is expected to be worth around USD 79 billion by 2033, from USD 37 billion in 2023, growing at a CAGR of 5.1%.

NEW YORK, NY, UNITED STATES, January 27, 2025 /EINPresswire.com/ -- The global water treatment chemicals market is experiencing significant growth, driven by increasing industrial activities and heightened awareness of environmental conservation. These chemicals are essential for treating water and making it suitable for various industrial and municipal applications, thus playing a pivotal role in managing the world's limited freshwater resources.

Coagulants and flocculants lead the market due to their widespread use in water purification to remove contaminants and suspended particles. Furthermore, strict regulations regarding water quality standards across the globe, especially in North America and Europe, have mandated the extensive use of these chemicals, thereby bolstering the market growth.

Driving factors for the market include rapid industrialization in emerging economies and the subsequent increase in wastewater volumes. Industries such as power generation, oil & gas, mining, and chemicals produce large quantities of wastewater, necessitating effective treatment to meet environmental standards. Moreover, the scarcity of clean water in various parts of the world has compelled governments and regulatory bodies to implement stringent water treatment regulations to ensure sustainable use and minimum wastage. This regulatory pressure has led to increased consumption of water treatment chemicals in municipal water treatment facilities as well as in industries.

The Future growth opportunities in the global water treatment chemicals market appear promising due to the ongoing innovation in chemical treatments and the expansion of industries in Asia-Pacific and Middle East regions. The Asia-Pacific market is expected to witness the highest growth due to rapid industrialization in countries like China and India, coupled with increasing government initiatives towards water preservation. Additionally, the rising demand for clean and processed water in the residential sector in this region will further drive the market.

Moreover, advancements in technology such as the integration of IoT in water treatment systems to monitor chemical dosing and water quality in real time will likely enhance market growth. Companies are also expected to leverage sustainable practices and materials to comply with international regulations, which could lead to increased demand for innovative water treatment solutions. This strategic shift towards sustainability and efficiency will enable the water treatment chemicals industry to not only address the current demands but also adapt to future environmental and regulatory changes.

👉 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐑𝐞𝐪𝐮𝐞𝐬𝐭: 𝐔𝐧𝐥𝐨𝐜𝐤 𝐕𝐚𝐥𝐮𝐚𝐛𝐥𝐞 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐟𝐨𝐫 𝐘𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://market.us/report/water-treatment-chemicals-market/free-sample/

Key Takeaways

— Market Growth Projection: The global water treatment chemicals market is anticipated to grow from USD 37.7 billion in 2023 to around USD 62.0 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 5.1%.

— Product Types and Usage: Coagulants & Flocculants: Form a significant part of the market (over 38.1% revenue in 2023), crucial in oil and gas industries for

— End-Use Segments: Municipal: Largest segment due to high usage in municipal wastewater treatment, driven by increasing water scarcity in developed countries.

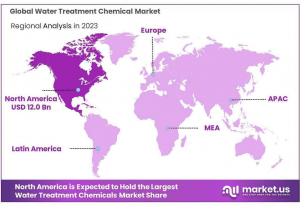

— Region Analysis: North America: Holds a significant share (more than 32.2% in 2023) due to increased water treatment plants in the oil and gas sector.

Water Treatment Chemicals Statistics

Product Analysis

In oil and gas facilities, storage tanks are used for holding essential chemical products such as coagulants and flocculants, which constituted over 38.1% of the market revenue in 2023. These chemicals, available in both organic and inorganic forms—like aluminum sulfate and aluminum hydroxide chlorine—are pivotal in water treatment processes. Following closely, biocides and disinfectants are integral for controlling microbiological activity in manufacturing and industrial processes. These chemicals not only enhance manufacturing efficiency by reducing contamination risks but also inhibit harmful microbial growth, ensuring the safety and quality of food, wastewater, and treated water systems.

End-Use Analysis

In 2023, the municipal sector, with over 39.2% of the revenue share, emerged as the largest end-use segment, primarily driven by the extensive application of chemicals in municipal wastewater treatment. Rising treatment costs have prompted industrialists to develop or enhance wastewater treatment and reuse facilities, incorporating processes like emulsion breaking, flocculation, and sludge removal. The oil and gas sector has also grown significantly as a major end-user, due to its extensive water usage in oil refineries and high wastewater output from operations such as desalination, fluid catalytic cracking units, and cooling towers. This dependence on water treatment for operational efficiency and sustainability positions the oil and natural gas industry for increased chemical demand in the future.

Key Market Segments

By Product Type

— Coagulants & Flocculants

— Biocide & Disinfectant

— pH, Adjuster & Softener

— Defoaming Agent & Defoamer

— Other product types

By End-Use

— Power

— Oil & Gas

— Chemical Manufacturing

— Mining & Mineral Processing

— Other End-Uses

👉 𝐁𝐮𝐲 𝐍𝐨𝐰 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 𝐭𝐨 𝐆𝐫𝐨𝐰 𝐲𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://market.us/purchase-report/?report_id=31750

Emerging Trends

1. Increased Demand for Eco-Friendly Chemicals: There is a growing emphasis on the environmental impact of chemicals used in water treatment. This has led to a surge in demand for eco-friendly and biodegradable chemicals that minimize environmental degradation and promote sustainability.

2. Advancements in Water Reuse Technologies: With the rising scarcity of freshwater resources, industries and municipalities are increasingly adopting advanced water reuse technologies. This trend is bolstering the use of water treatment chemicals that can effectively treat and recycle water for various applications, including industrial processes and irrigation.

3. Integration of Smart Technologies: The water treatment industry is integrating smart technologies such as IoT and AI to enhance the efficiency and effectiveness of water treatment processes. These technologies enable real-time monitoring and control of chemical dosing, ensuring optimal water quality and reducing chemical wastage.

4. Regulatory and Standard Compliance: Stricter regulatory standards globally are compelling water treatment facilities to maintain high water quality standards. This regulatory push is driving the continuous innovation and adoption of new and improved water treatment chemicals that comply with these stringent regulations.

5. Growth in Industrial Applications: As industrial sectors such as pharmaceuticals, power generation, and manufacturing expand, the need for effective water treatment solutions to handle complex industrial effluents is increasing. This trend is driving the development of specialized chemicals tailored for specific industrial applications.

Regulations on Water Treatment Chemicals Market

In North America, the regulatory landscape is dominated by the Clean Water Act (CWA) and the Safe Drinking Water Act (SDWA), both enforced by the U.S. Environmental Protection Agency (EPA). These regulations mandate stringent limits on chemical residues in treated water and promote advanced treatment processes. Compliance with these laws is driving the demand for innovative and environmentally friendly water treatment chemicals. The U.S. accounted for approximately 25% of the global water treatment chemicals market revenue in 2023, reflecting the region’s commitment to maintaining water quality.

Europe enforces rigorous regulations under the European Union Water Framework Directive (EU-WFD) and the REACH Regulation (Registration, Evaluation, Authorization, and Restriction of Chemicals). These frameworks emphasize minimizing the environmental impact of chemical usage in water treatment. For instance, REACH requires manufacturers to register and demonstrate the safety of their products before commercialization. In 2023, eco-friendly chemicals represented nearly 18% of the total water treatment chemicals market in Europe, with growth anticipated to reach 25% by 2030, driven by regulatory shifts towards sustainability.

The Asia-Pacific region, particularly emerging economies like China and India, is strengthening its regulatory framework to address water pollution and resource scarcity. China’s Water Pollution Prevention and Control Action Plan and India’s National Water Policy are encouraging investments in wastewater treatment infrastructure.

Regional Analysis

In 2023, North America accounted for more than 32.2% of the global water treatment chemicals market, driven by increased hydraulic fracturing activities that have expanded the use of unconventional energy sources like tight oil and shale in regions such as North Dakota and West Texas. This has led to greater adoption of water treatment facilities within the upstream oil and gas sector, positively influencing market growth over the forecast period.

The United States is projected to grow at a CAGR of 2.4%, largely due to strict regulations governing wastewater production and disposal. According to the International Trade Administration (ITA), the U.S. remains a global leader in energy production, consumption, and supply, with thermoelectric power plants playing a crucial role in driving demand for water treatment chemicals. The increasing need for chemical solutions in the U.S. power industry will further support market expansion.

In the Asia-Pacific region, demand for boiler treatment chemicals is expected to rise, fueled by rapid industrialization and growth in the manufacturing and power sectors. China, in particular, is increasingly focusing on pretreated water solutions to address the high levels of heavy metals and suspended particles in its water supply. Organizations like China Water Risk (CWR) collaborate with government agencies in China and internationally to assess and mitigate wastewater-related risks across industries such as agriculture, power, food, and textiles. These initiatives contribute significantly to advancing water treatment efforts in the region, ensuring sustainable industrial practices and regulatory compliance.

Key Players Analysis

Leading companies in the water treatment chemicals market are adopting strategies such as innovation, partnerships, and geographic expansion to maintain their dominance. Key players include:

— SUEZ

— BASF SE

— Ecolab

— Solenis

— Nouryon

— Kemira Oyj

— Dow Chemical Company

— SNF Group

— Cortec Corporation

— Buckman

— Solvay S.A.

— Other Key Players

Strategic Initiatives

—Product Portfolio Expansion: Companies are investing in R&D to develop advanced formulations that meet regulatory and consumer demands.

—Geographic Expansion: Focus on high-growth regions like Asia-Pacific and the Middle East to capitalize on industrialization trends.

—Sustainability Initiatives: Efforts to align with global sustainability goals and minimize environmental impact.

𝐄𝐱𝐭𝐞𝐧𝐬𝐢𝐯𝐞 𝐂𝐨𝐯𝐞𝐫𝐚𝐠𝐞 𝐢𝐧 𝐭𝐡𝐞 𝐂𝐡𝐞𝐦𝐢𝐜𝐚𝐥 𝐃𝐨𝐦𝐚𝐢𝐧:

Water Based Resins Market : https://market.us/report/water-based-resins-market/

Water Based Coatings Market : https://market.us/report/water-based-coatings-market/

Water Clarifiers Market : https://market.us/report/water-clarifiers-market/

Water Desalination Equipment Market : https://market.us/report/water-desalination-equipment-market/

The US Reusable Water Bottles Market : https://market.us/report/the-us-reusable-water-bottles-market/

The US Municipal Water And Wastewater Plant Pipe Market : https://market.us/report/the-us-municipal-water-and-wastewater-plant-pipe-market/

Solar Water Purifiers Market : https://market.us/report/solar-water-purifiers-market/

Functional Water Market : https://market.us/report/functional-water-market/

Bottled Water Market : https://market.us/report/bottled-water-market/

Water and Wastewater Treatment Equipment Market : https://market.us/report/water-and-wastewater-treatment-equipment-market/

Lawrence John

Prudour

+91 91308 55334

email us here

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Chemical Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release