1,4-Butanediol Market Boost Worth around USD 14.0 Bn by 2033, Region Growing at a CAGR of 7.0%

1,4-Butanediol Market size is expected to be worth around USD 14.0 Bn by 2033, from USD 7.1 Bn in 2023, growing at a CAGR of 7.0% From 2024 to 2033.

NEW YORK, NY, UNITED STATES, January 27, 2025 /EINPresswire.com/ -- The global 1,4-Butanediol (BDO) market is a dynamic segment within the chemical industry, characterized by its vital role in manufacturing polymers and solvents. 1,4-Butanediol, a colorless organic compound, serves as a pivotal precursor to several important derivatives such as Tetrahydrofuran (THF), Polybutylene Terephthalate (PBT), and Gamma-Butyrolactone (GBL), each of which has wide-ranging applications across various industries.

The automotive sector, a major consumer of PBT and THF (derivatives of 1,4-Butanediol), uses these compounds in manufacturing high-performance parts. This sector's growth, especially in developing regions like Asia-Pacific, directly correlates with increased 1,4-Butanediol consumption. Similarly, the textile industry utilizes 1,4-Butanediol derivatives for producing elastic fibers and polyurethanes, contributing further to its demand.

advancements in biotechnological methods for 1,4-Butanediol production have also emerged as a crucial driving factor. Companies are increasingly adopting bio-based routes to produce 1,4-Butanediol in a bid to reduce dependency on fossil fuels and decrease carbon footprints. This shift is supported by stringent environmental regulations and a growing preference for sustainable materials among end-users.

The development of new applications of 1,4-Butanediol in areas such as 3D printing materials and biodegradable plastics also presents significant growth opportunities. As industries continue to innovate, the demand for specialized and high-performance materials will drive the further evolution of the 1,4-Butanediol market.

Looking towards the future, the global 1,4-Butanediol market is poised to capitalize on several growth opportunities. The rising trend of sustainable and green chemicals is particularly noteworthy. The market is expected to see a surge in demand for bio-based 1,4-Butanediol, driven by the environmental regulations and shifting consumer preferences towards eco-friendly products.

👉 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐑𝐞𝐪𝐮𝐞𝐬𝐭: 𝐔𝐧𝐥𝐨𝐜𝐤 𝐕𝐚𝐥𝐮𝐚𝐛𝐥𝐞 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐟𝐨𝐫 𝐘𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://market.us/report/1-4-butanediol-market/free-sample/

Key Takeaways

— 1,4-Butanediol Market size is expected to be worth around USD 14.0 Bn by 2033, from USD 7.1 Bn in 2023, growing at a CAGR of 7.0%.

— Synthetic 1,4-Butanediol (BDO) held a dominant market position, capturing more than an 85.6% share.

— Reppe Process held a dominant market position, capturing more than a 53.3% share of the 1,4-Butanediol market.

— Tetrahydrofuran (THF) held a dominant market position, capturing more than a 45.5% share of the 1,4-Butanediol market.

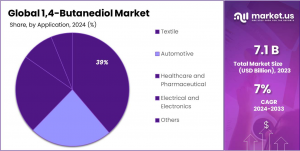

— Textile held a dominant market position, capturing more than a 38.9% share of the 1,4-Butanediol market.

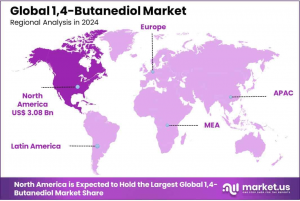

— North America holds a significant market share of 43.3%, translating to a value of USD 3.08 billion.

1,4-Butanediol Statistics

By Type

In 2023, the synthetic 1,4-butanediol (BDO) segment maintained a dominant position in the global market, accounting for over 85.6% of the total share. This leadership can be attributed to its well-established production methodologies and cost-efficiency, making it the preferred choice across various industrial applications. Primarily derived from petrochemical-based processes, synthetic BDO continues to be widely utilized due to its scalability, consistent quality, and extensive integration into downstream manufacturing sectors.

By Technology

In 2023, the Reppe process emerged as the leading production method in the global 1,4-butanediol (BDO) market, accounting for over 53.3% of the total market share. This dominance is attributed to its high operational efficiency and cost-effectiveness, making it a preferred choice for large-scale manufacturing. The process, which involves the reaction of acetylene with formaldehyde, is widely recognized for its reliability, well-established infrastructure, and ability to support high-volume production, further reinforcing its strong market presence.

By Application

In 2023, tetrahydrofuran (THF) dominated the 1,4-butanediol (BDO) market, accounting for over 45.5% of the total share. As a key solvent, THF plays a crucial role across multiple industries, including pharmaceuticals, coatings, and adhesives, owing to its exceptional solvency and versatility. Its increasing utilization in polymer production, particularly in the automotive and electronics sectors, has further reinforced its market leadership. The substantial demand for THF in these high-growth industries has established it as the largest consumer of 1,4-butanediol, driven by its essential role in the synthesis of performance-driven materials.

By End Use

In 2023, the textile industry emerged as a leading consumer of 1,4-butanediol (BDO), accounting for over 38.9% of the total market share. This dominance is primarily driven by the rising demand for synthetic fibers, particularly spandex and polyester, which rely on BDO as a critical raw material. The expanding global textile and apparel sector, coupled with increasing adoption of high-performance fabrics, continues to fuel the demand for BDO, solidifying the textile industry's position as a key market segment.

Key Market Segments

By Type

— Synthetic

— Bio-based

By Technology

— Reppe Process

— Davy Process

— Propylene Oxide Process

— Others

By Application

— Tetrahydrofuran (THF)

— γ-Butyrolactone (GBL)

— Polybutylene Terephthalate (PBT)

— Polyurethane

— Other

By End Use

— Textile

— Automotive

— Healthcare and Pharmaceutical

— Electrical and Electronics

— Others

👉 𝐁𝐮𝐲 𝐍𝐨𝐰 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 𝐭𝐨 𝐆𝐫𝐨𝐰 𝐲𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://market.us/purchase-report/?report_id=135597

Emerging Trends

1. Growing Demand in Biodegradable Plastics: The market for 1,4-Butanediol (BDO) is experiencing significant growth due to its critical role in producing polybutylene terephthalate (PBT) and biodegradable plastics. As global efforts to reduce plastic waste intensify, the demand for biodegradable plastics that utilize 1,4-Butanediol is expected to rise. This trend is driven by the environmental regulations and shifting consumer preferences towards sustainable products.

2. Expansion in Textile and Automotive Industries: 1,4-Butanediol is also widely used in the manufacture of thermoplastic polyurethanes, which are extensively used in the textile and automotive sectors. The recovery and growth of these industries, particularly in emerging markets, are expected to boost the demand for 1,4-Butanediol. The automotive sector, for instance, utilizes 1,4-Butanediol-derived products for manufacturing high-performance parts and coatings that are durable and resistant to wear.

3. Technological Advances in Production Processes: Technological innovation in the production of 1,4-Butanediol is a prominent trend. Companies are increasingly adopting bio-based routes to produce 1,4-Butanediol, which is seen as a more sustainable alternative to traditional petrochemical processes. These bio-based methods not only reduce dependency on fossil fuels but also align with global sustainability goals by minimizing environmental impact.

4. Increased Investment in Research and Development: There is a noticeable increase in investment in R&D activities related to 1,4-Butanediol to enhance production efficiency and product quality. Research is focused on improving yield, reducing energy consumption, and lowering production costs. These innovations are critical as they help manufacturers maintain competitiveness in a market that is becoming increasingly driven by cost and environmental considerations.

5. Strategic Alliances and Expansions: Strategic alliances between key players and geographical expansions are significant trends in the 1,4-Butanediol market. Companies are forming partnerships to leverage mutual technological and regional strengths, facilitating the expansion into new markets and enhancing supply chain efficiencies. These collaborations are particularly prominent in regions with rapidly growing industrial sectors, such as Asia-Pacific.

Regulations on 1,4-Butanediol Market

In the European Union, BDO (Butanediol) is subject to stringent regulations under the REACH framework, which requires manufacturers to register and detail the chemical’s properties, its impact on the environment, and guidelines for safe handling. This classification is reinforced by the CLP Regulation that mandates clear labeling of BDO as an irritant, highlighting the risks associated with its ingestion or inhalation. These regulatory measures ensure that stakeholders are well-informed about the handling and use of BDO, potentially influencing market strategies and compliance protocols within the EU chemical industry.

In the United States, BDO falls under the regulatory oversight of the Environmental Protection Agency (EPA) via the Toxic Substances Control Act (TSCA). This act obligates manufacturers to report on the production, processing, and utilization of BDO. Furthermore, the EPA's implementation of significant new use rules (SNURs) places restrictions on certain applications of BDO, pending specific review and approval by the agency. This regulatory environment could affect market dynamics by limiting the scope of applications for BDO or by imposing additional compliance costs, thereby influencing business decisions and competitive strategies in the chemical sector.

Regional Analysis

The 1,4-butanediol (BDO) market exhibits diverse dynamics across regions, driven by varying industrial activities, regulations, and consumer preferences. North America leads with a 43.3% market share, valued at USD 3.08 billion, due to strong manufacturing sectors like automotive and plastics. Asia Pacific is poised for the highest growth, supported by industrial expansion, especially in China and India, along with low production costs.

Europe focuses on sustainability, with a preference for bio-based alternatives, influenced by strict environmental regulations and a mature automotive industry. The Middle East & Africa sees gradual growth, mainly in construction and automotive sectors, while Latin America experiences moderate growth, driven by increasing demand in automotive and consumer goods in countries like Brazil and Mexico.

Key Players Analysis

Leading companies in the 1,4-butanediol market are adopting strategies such as innovation, partnerships, and geographic expansion to maintain their dominance. Key players include:

— Ashland

— BASF SE

— China Petroleum & Chemical Corporation (China Petrochemical Corporation)

— Dairen Chemical Corporation

— DCC

— Evonik Industries AG

— Genomatica, Inc.

— Henan GP Chemicals Co.,Ltd

— KH Chemicals BV (Ravago S.A.)

— Lanxess AG

— LyondellBasell Industries Holdings B.V.

— Mitsubishi Chemical Group Corporation

— Nan Ya Plastics Corporation

— NOVEL CHEM

— Otto Chemie Pvt. Ltd.

— Shandong LanDian Biological Technology Co., LTD.

— Shanxi Sanwei Group Co. Ltd.

— Sipchem Company

— Suvchem, Univar Solutions LLC

— Tokyo Chemical Industry Co., Ltd. (TCI)

— Xinjiang Blue Ridge Tunhe Sci.&Tech. Co. Ltd.

Strategic Initiatives

Product Portfolio Expansion: Companies are investing in R&D to develop advanced formulations that meet regulatory and consumer demands.

Geographic Expansion: Focus on high-growth regions like Asia-Pacific and the Middle East to capitalize on industrialization trends.

Sustainability Initiatives: Efforts to align with global sustainability goals and minimize environmental impact.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Chemical Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release