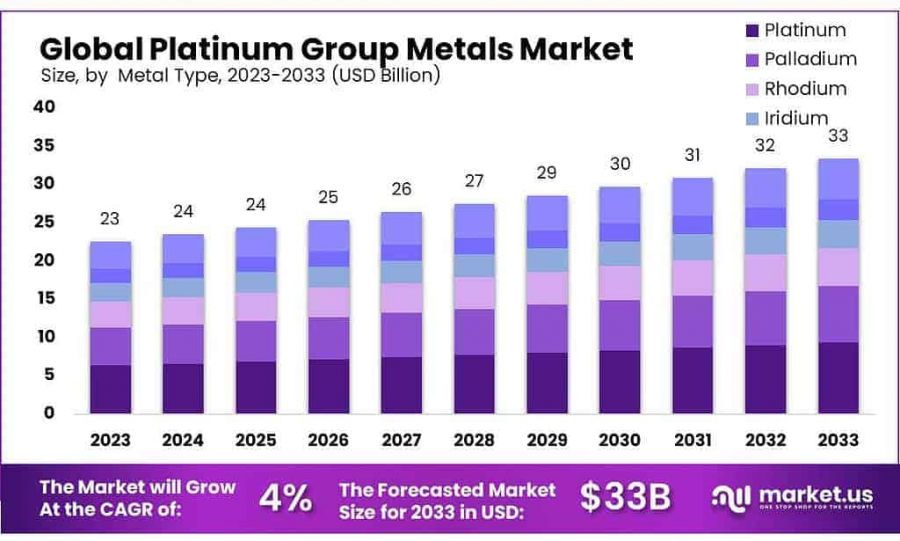

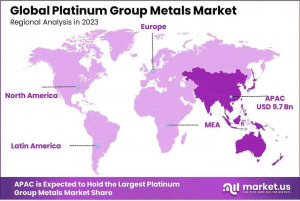

Platinum Group Metals Market Revenue to Boost Cross USD 33 Billion By 2033 | Asia Pacific Holds 43% share

Platinum Group Metals Market size is expected to be worth around USD 33 Billion by 2033, from USD 23 Billion in 2023, growing at a CAGR of 4.0%

NEW YORK, NY, UNITED STATES, January 28, 2025 /EINPresswire.com/ -- The global platinum group metals (PGM) market is a vital segment of the broader metals and mining industry, comprising six primary metals: platinum, palladium, rhodium, ruthenium, iridium, and osmium. These metals are highly valued for their unique properties, including exceptional corrosion resistance, high melting points, and catalytic abilities. PGMs are essential in various applications, such as automotive catalysts, industrial processes, jewelry, and investment products, driving substantial demand across multiple sectors.

The production of PGMs is concentrated in a few regions, with South Africa, Russia, and Zimbabwe accounting for over 80% of global supply. Mining in these regions is challenged by geopolitical instability, labor issues, and resource depletion, leading to potential supply disruptions. This has contributed to market volatility, as seen in 2022, when platinum averaged USD 1,000 per ounce, and palladium exceeded USD 2,000 per ounce, highlighting the sensitivity of PGMs to supply-side disruptions.

A major driving factor in the PGM market is the increasing demand for automotive catalysts. PGMs, particularly platinum, palladium, and rhodium, are crucial in the production of catalytic converters that reduce harmful emissions from vehicles. As of 2023, automotive applications accounted for nearly 60% of global PGM demand, with palladium being the most widely used metal in catalytic converters due to its efficiency in gasoline engine applications. The push for stricter environmental regulations and the adoption of greener technologies continue to drive demand in the automotive sector.

Looking to the future, significant growth opportunities exist in the automotive and industrial sectors. The development of fuel cell vehicles (FCVs) and hydrogen-powered transportation systems is expected to create new demand for platinum, which is essential in hydrogen fuel cells. Furthermore, as emission regulations tighten globally, the demand for PGMs in emission-control technologies is projected to increase. The PGM market for jewelry and investment remains strong, with platinum and palladium seen as safe-haven investments due to their rarity and industrial importance.

👉 𝐂𝐥𝐢𝐜𝐤 𝐭𝐨 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐧𝐝 𝐃𝐫𝐢𝐯𝐞 𝐈𝐦𝐩𝐚𝐜𝐭𝐟𝐮𝐥 𝐃𝐞𝐜𝐢𝐬𝐢𝐨𝐧𝐬: https://market.us/report/platinum-group-metals-market/free-sample/

𝐊𝐞𝐲 𝐓𝐚𝐤𝐞𝐚𝐰𝐚𝐲𝐬

➤ Market Growth Projection: Platinum Group Metals market to reach USD 33 billion by 2033, with a 4.0% CAGR from 2023, reflecting steady expansion.

➤ Platinum Dominance: Platinum holds 31.3% market share in 2023, favored for automotive and jewelry applications.

➤ Palladium Significance: Palladium’s demand in catalytic converters drives market share, particularly in gasoline vehicles.

➤ Auto Catalysts Demand: Auto catalysts claim over 26.2% market share in 2023, crucial for emissions control.

➤ Russia is the world’s largest producer of palladium, accounting for approximately 40% of global production.

➤ South Africa and Russia together account for over 90% of the world’s rhodium production.

𝐏𝐥𝐚𝐭𝐢𝐧𝐮𝐦 𝐆𝐫𝐨𝐮𝐩 𝐌𝐞𝐭𝐚𝐥𝐬 𝐒𝐭𝐚𝐭𝐢𝐬𝐭𝐢𝐜𝐬

𝐁𝐲 𝐌𝐞𝐭𝐚𝐥 𝐓𝐲𝐩𝐞

In 2023, Platinum dominated the market with a 31.3% share, widely used in industries such as automotive, jewelry, and chemical processing due to its corrosion resistance, catalytic properties, and aesthetic appeal. Palladium also held a significant market share, primarily driven by its rising demand in catalytic converters for gasoline-powered vehicles, where its ability to efficiently convert harmful emissions plays a crucial role in the automotive industry.

𝐁𝐲 𝐀𝐩𝐩𝐥𝐢𝐜𝐚𝐭𝐢𝐨𝐧

In 2023, Auto Catalysts dominated the market with a 26.2% share, as they play a vital role in converting harmful pollutants from vehicle exhaust into less harmful emissions, promoting cleaner air and environmental sustainability. The Electrical and Electronics segment also held a significant market share, driven by the growing demand for electronic devices and components that rely on platinum group metals for their conductivity, durability, and corrosion resistance.

👉 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞 𝐭𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐭𝐨 𝐔𝐧𝐜𝐨𝐯𝐞𝐫 𝐊𝐞𝐲 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬: https://market.us/purchase-report/?report_id=104825

𝐊𝐞𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐬

𝐁𝐲 𝐌𝐞𝐭𝐚𝐥 𝐓𝐲𝐩𝐞

➤ Platinum

➤ Palladium

➤ Rhodium

➤ Iridium

➤ Ruthenium

➤ Osmium

𝐁𝐲 𝐀𝐩𝐩𝐥𝐢𝐜𝐚𝐭𝐢𝐨𝐧

➤ Jewelry

➤ Medical Devices

➤ Electronics

➤ Auto Catalysts

➤ Glass and Ceramics

➤ Other Applications

𝐄𝐦𝐞𝐫𝐠𝐢𝐧𝐠 𝐓𝐫𝐞𝐧𝐝𝐬

1. Increased Demand in Clean Energy Technologies: Platinum group metals (PGMs) are gaining traction in the clean energy sector, particularly in hydrogen fuel cells. Platinum, for instance, plays a crucial role as a catalyst in hydrogen production and fuel cell systems. As the world shifts toward cleaner energy solutions, demand for PGMs in green technologies is expected to rise, driving market growth in renewable energy and transportation sectors.

2. Growth in Electric Vehicle (EV) Market: As electric vehicles (EVs) become more mainstream, the need for PGMs is increasing, especially in the development of EV batteries and powertrains. Palladium, in particular, is also used in the manufacturing of gasoline engines in hybrid vehicles. This trend toward EVs and hybrids is creating new opportunities for PGMs in automotive manufacturing, including in the development of charging infrastructure and advanced battery technology.

3. Rising Importance of Recycling PGMs: With increasing demand for PGMs and concerns over their finite supply, recycling is becoming a critical focus. The automotive sector, where PGMs are used in catalytic converters, is leading the way in recycling efforts. Advanced recycling methods are enabling the recovery of PGMs from end-of-life vehicles, with recycled PGMs accounting for a growing share of the market, helping to reduce pressure on natural resources.

4. Supply Chain Disruptions and Geopolitical Factors: PGMs are primarily mined in a few countries, such as South Africa and Russia, making the market vulnerable to geopolitical instability and supply chain disruptions. The ongoing tensions in key mining regions and the impact of political instability on supply chains are prompting companies to explore alternative sources and enhance supply chain resilience, potentially reshaping global PGM distribution patterns.

5. Shift Toward Cleaner, More Efficient Mining Practices: Mining companies are under increasing pressure to adopt environmentally friendly and efficient extraction methods. Innovations in mining technologies, such as automation, robotic mining, and more precise extraction techniques, are driving the industry toward cleaner and more sustainable mining practices. These advancements aim to minimize environmental impact while maintaining PGM production levels.

6. Rising Demand for PGMs in Jewelry: Despite the increasing focus on industrial applications, demand for PGMs in jewelry, particularly platinum, remains robust. Platinum’s rarity and appeal as a luxury metal have made it a preferred choice for high-end jewelry, particularly in bridal and investment-grade products. As global wealth grows, especially in emerging markets, demand for platinum jewelry is expected to continue its upward trend.

𝐑𝐞𝐠𝐮𝐥𝐚𝐭𝐢𝐨𝐧𝐬 𝐨𝐧 𝐏𝐥𝐚𝐭𝐢𝐧𝐮𝐦 𝐆𝐫𝐨𝐮𝐩 𝐌𝐞𝐭𝐚𝐥𝐬 𝐌𝐚𝐫𝐤𝐞𝐭

1. Environmental regulations are among the most impactful factors shaping the PGM market. The extraction of PGMs, particularly from mining operations, is subject to stringent environmental standards aimed at reducing the impact of mining activities on ecosystems and local communities. In countries like South Africa, Russia, and Canada—where a large portion of PGMs are mined—the regulations require companies to adopt sustainable mining practices, including the reduction of emissions, proper waste management, and effective land reclamation after mining operations.

2. In the European Union, the REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulation plays a significant role in the PGM market by controlling the use of chemicals in the extraction and refining processes. The EU is particularly focused on reducing the environmental impact of mining activities and the chemicals used during processing. Additionally, the EU Emissions Trading System (ETS) limits greenhouse gas emissions from industrial activities, including the refining processes involved in PGM production. This has led to increased investment in cleaner technologies and more efficient energy use within the PGM industry.

3. Similarly, in the United States, the Clean Air Act and Clean Water Act regulate the emissions and effluents from mining and refining processes. The Environmental Protection Agency (EPA) ensures compliance with these regulations, and violators may face substantial fines or be required to adopt more sustainable practices. These regulatory frameworks are pushing PGM producers to adopt greener technologies, such as the use of cleaner fuels and methods that reduce carbon footprints.

4. Health and safety regulations also play a crucial role in shaping the PGM market, especially considering the potential risks to workers involved in mining and refining activities. The mining of PGMs, particularly in underground operations, can expose workers to hazardous conditions, such as dust inhalation, toxic gas exposure, and mining accidents. Regulatory bodies like the Occupational Safety and Health Administration (OSHA) in the U.S. and Health and Safety Executive (HSE) in the U.K. enforce strict safety standards to protect workers.

5. In response to these risks, companies are increasingly adopting automated mining technologies, improving ventilation systems, and providing better protective equipment to enhance worker safety. Additionally, countries like South Africa, which accounts for over 70% of the global platinum production, have established comprehensive health and safety regulations under the Mine Health and Safety Act (MHSA) to ensure the well-being of workers in the platinum mines.

6. The global demand for PGMs is primarily driven by the automotive sector, which consumes around 50% of the platinum and palladium produced each year. As governments impose stricter emissions standards, especially in the European Union and China, the demand for catalytic converters using PGMs is expected to increase. The global automotive PGM market is forecasted to reach $16 billion by 2027, representing a significant portion of overall PGM demand.

👉 𝐁𝐮𝐲 𝐍𝐨𝐰 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 𝐭𝐨 𝐆𝐫𝐨𝐰 𝐲𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://market.us/purchase-report/?report_id=104825

𝐑𝐞𝐠𝐢𝐨𝐧𝐚𝐥 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬

Asia Pacific dominates the PGM market with a 43% share, valued at USD 9.7 billion, driven by rapid industrialization and strong automotive and electronics manufacturing, particularly in China and India. The region’s significant market presence is fueled by increasing vehicle production and stringent environmental regulations, boosting demand for catalytic converters using platinum and palladium.

North America sees market growth due to advanced emission control technologies and a robust automotive sector, particularly in the United States and Canada. Stringent environmental regulations like the EPA’s Tier 3 standards have amplified the demand for PGMs in automotive catalytic converters. The electronics sector in the region also contributes to PGM demand, with PGMs used in various high-tech applications.

Europe maintains a strong position in the PGM market, supported by stringent environmental policies and a large automotive manufacturing base. Countries such as Germany, the United Kingdom, and France are leading the way in using PGMs to meet emission standards. Additionally, Europe is witnessing growth in PGM recycling, enhancing sustainability in metal usage.

Middle East & Africa holds a smaller but growing market share, primarily driven by the development of the automotive sector and industrial applications. South Africa plays a pivotal role in global PGM supply due to its significant mining activities, making it a key player in the region’s PGM market growth.

Latin America shows promising growth potential in the PGM market, particularly within the automotive and electronics sectors in countries like Brazil and Mexico. The region’s expansion in manufacturing capacities and increased environmental regulations are expected to drive future demand for PGMs.

𝐊𝐞𝐲 𝐏𝐥𝐚𝐲𝐞𝐫𝐬 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬

Leading companies in the platinum group metals market are adopting strategies such as innovation, partnerships, and geographic expansion to maintain their dominance. Key players include:

➤ African Rainbow Minerals

➤ ANGLO AMERICAN PLATINUM LIMITED

➤ Glencore

➤ Implats Platinum Limited

➤ Johnson Matthey

➤ Norilsk Nickel

➤ Northam Platinum Holdings Limited

➤ Northam Platinum Limited

➤ Platinum Group Metals Ltd

➤ Royal Bafokeng Platinum

➤ Sibanye-Stillwater

➤ Vale

𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐢𝐜 𝐈𝐧𝐢𝐭𝐢𝐚𝐭𝐢𝐯𝐞𝐬

𝐏𝐫𝐨𝐝𝐮𝐜𝐭 𝐏𝐨𝐫𝐭𝐟𝐨𝐥𝐢𝐨 𝐄𝐱𝐩𝐚𝐧𝐬𝐢𝐨𝐧:Companies are investing in R&D to develop advanced formulations that meet regulatory and consumer demands.

𝐆𝐞𝐨𝐠𝐫𝐚𝐩𝐡𝐢𝐜 𝐄𝐱𝐩𝐚𝐧𝐬𝐢𝐨𝐧: Focus on high-growth regions like Asia-Pacific and the Middle East to capitalize on industrialization trends.

𝐒𝐮𝐬𝐭𝐚𝐢𝐧𝐚𝐛𝐢𝐥𝐢𝐭𝐲 𝐈𝐧𝐢𝐭𝐢𝐚𝐭𝐢𝐯𝐞𝐬: Efforts to align with global sustainability goals and minimize environmental impact.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Energy Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release