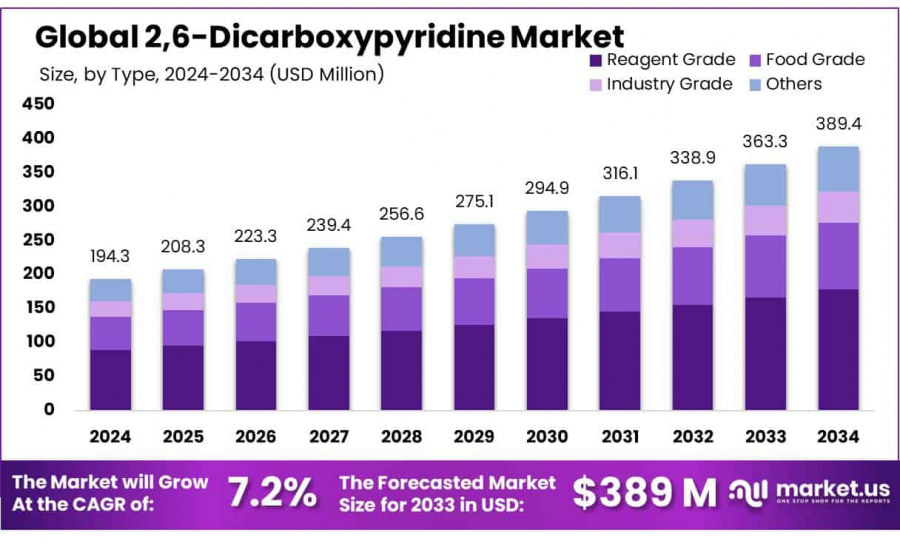

2,6-Dicarboxypyridine Market Report: USD 389.4 Billion by 2034 Growing at 7.2% CAGR

2,6-Dicarboxypyridine Market size is expected to be worth around USD 389.4 Mn by 2034, from USD 194.3 Mn in 2024, growing at a CAGR of 7.2% from 2025 to 2034.

NEW YORK, NY, UNITED STATES, January 28, 2025 /EINPresswire.com/ -- The global 2,6-Dicarboxypyridine Market, also known as dipicolinic acid, is forecasted to experience substantial growth over the next decade, with its market size projected to double from USD 194.3 million in 2024 to USD 389.4 million by 2034. This represents a compound annual growth rate (CAGR) of 7.2% from 2025 to 2034. Such growth reflects the compound's increasing importance in various industrial and scientific sectors, underlining its critical role in the synthesis of pharmaceuticals, agrochemicals, and specialty polymers.

2,6-Dicarboxypyridine is a key organic compound used extensively in the chemical industry due to its role as a versatile intermediate. The compound’s molecular structure, characterized by the presence of two carboxylic groups positioned at the 2 and 6 locations on a pyridine ring, makes it particularly effective in chelating metal ions and catalyzing certain chemical reactions. This functionality is indispensable in the manufacture of a range of products, including metal chelators, herbicides, and slow-release fertilizers, as well as in various polymerization processes.

The 2,6-Dicarboxypyridine is shaped by its growing application in niche markets, particularly in pharmaceuticals and agrochemicals. In the pharmaceutical industry, dipicolinic acid derivatives are being explored for their potential use in novel drug formulations, which can offer improved efficacy and safety profiles. The agrochemical industry relies on dipicolinic acid for producing more efficient and environmentally friendly herbicides and pesticides, responding to global food security challenges and the demand for sustainable agricultural practices.

Several factors are driving the growth of the global 2,6-Dicarboxypyridine market. The foremost among these is the rising demand for high-performance pharmaceutical intermediates amid the expanding global healthcare market. With an aging population and a growing focus on chronic disease management, the pharmaceutical sector's demand for specialized intermediates like 2,6-Dicarboxypyridine is expected to rise. Additionally, the push towards more sustainable agricultural practices has led to increased investment in developing novel agrochemicals that can improve crop yield without adverse environmental impacts, thus boosting the demand for this chemical.

Looking into the future, the 2,6-Dicarboxypyridine market is poised to capitalize on numerous growth opportunities. The ongoing research into green chemistry and sustainable industrial practices is likely to expand its uses, particularly in eco-friendly products and processes. Innovations in catalysis and polymer chemistry could open new applications in biodegradable polymers and renewable resources processing, further propelling market growth. Furthermore, as regulatory frameworks continue to evolve, emphasizing safer and more sustainable chemical processes, 2,6-Dicarboxypyridine's role as a non-toxic and effective intermediate will be increasingly crucial.

For a deeper understanding, click on the sample report link: https://market.us/report/26-dicarboxypyridine-market/free-sample/

Key Takeaways

2,6-Dicarboxypyridine Market size is expected to be worth around USD 389.4 Mn by 2034, from USD 194.3 Mn in 2024, growing at a CAGR of 7.2%.

Reagent Grade held a dominant market position in the 2,6-Dicarboxypyridine market, capturing more than a 46.3% share.

Powder held a dominant market position in the 2,6-Dicarboxypyridine market, capturing more than a 66.4% share.

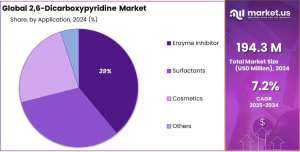

Enzyme Inhibitor held a dominant market position in the 2,6-Dicarboxypyridine market, capturing more than a 39.5% share.

Direct Sales held a dominant market position in the 2,6-Dicarboxypyridine market, capturing more than a 53.2% share.

Asia Pacific (APAC) region holds the dominant position in the 2,6-Dicarboxypyridine market, capturing more than a 37.2% share.

Key Market Segments

By Type

In 2024, the Reagent Grade segment of the 2,6-Dicarboxypyridine market held a dominant position, capturing more than 46.3% of the market share. The substantial demand for Reagent Grade 2,6-Dicarboxypyridine is largely due to its high purity and utility in various laboratory and industrial applications, particularly in chemical analysis and research. This grade is especially crucial in academic and pharmaceutical labs, where precision and consistency are paramount. The year-over-year growth for Reagent Grade is projected to continue its upward trajectory, driven by the increasing reliance on high-purity chemicals for advanced research and the development of new chemical compounds, as pharmaceutical companies and research institutions globally intensify their focus on innovation.

By Form

The Powder form of 2,6-Dicarboxypyridine held a significant market position in 2024, capturing more than 66.4% of the market share. The preference for powder is attributed to its versatility, ease of handling, storage, and transportation, making it highly favored in industrial and laboratory settings. Widely used in pharmaceuticals, chemical synthesis, and as a reagent in research labs, powdered 2,6-Dicarboxypyridine's ability to dissolve quickly and yield consistent results underpins its market dominance. The demand for this form is expected to remain robust, particularly in research and industrial processes where precise measurements are crucial for accurate product formulations and production efficiency.

By Application

The Enzyme Inhibitor application of 2,6-Dicarboxypyridine held a dominant market share in 2024, capturing more than 39.5%. This widespread use is due to its efficacy in regulating enzymatic reactions, a vital function in various pharmaceutical and biotechnological processes. As an enzyme inhibitor, 2,6-Dicarboxypyridine plays a critical role in drug development, particularly in the treatment of diseases like cancer, metabolic disorders, and viral infections. The increasing focus on precision medicine and biologics is expected to drive the demand for enzyme inhibitors, with biotechnology and pharmaceutical companies utilizing 2,6-Dicarboxypyridine to develop more targeted therapeutic interventions. This growing emphasis on enzyme-related research and an expanding drug pipeline is anticipated to further bolster the demand for 2,6-Dicarboxypyridine in this application segment.

By Type

- Reagent Grade

- Food Grade

- Industry Grade

- Others

By Form

- Powder

- Crystals

By Application

- Cosmetics

- Surfactants

- Enzyme Inhibitor

- Others

By Distribution Channel

- Direct Sales

- Distributors and Wholesalers

- Online Platforms

- Others

Emerging Trends

1. Increasing Pharmaceutical Applications: There's a growing use of 2,6-Dicarboxypyridine in pharmaceutical applications, particularly in the synthesis of more efficient drug formulations. This trend is supported by the increasing demand for advanced medical treatments and the ongoing research in drug development.

2. Technological Advancements in Production: New technologies are enhancing the production processes for 2,6-Dicarboxypyridine, leading to improved efficiency and reduced costs. These advancements are making it feasible for manufacturers to meet the rising demand from various industries.

3. Expansion in Biodegradable Products: 2,6-Dicarboxypyridine is finding new applications in the development of biodegradable materials, particularly in the packaging and consumer goods sectors. This is driven by the global shift towards sustainable manufacturing practices.

4. Growth in Agrochemicals: The use of 2,6-Dicarboxypyridine in agrochemical formulations is increasing. This is due to its effectiveness in developing pesticides and herbicides that are safer and more environmentally friendly.

5. Stricter Environmental Regulations: Regulatory changes are prompting companies to adopt greener chemicals and production techniques. 2,6-Dicarboxypyridine is benefiting from this trend as it is considered a safer alternative in various chemical synthesis processes compared to more toxic substances.

Major Factors Driving the Growth of 2,6-Dicarboxypyridine Market

1. Increased Demand in Pharmaceutical and Biotech Industries: There's a growing use of 2,6-Dicarboxypyridine in the pharmaceutical and biotechnology sectors, particularly for developing new medications and biotech applications. This demand is fueled by the ongoing research and development activities aiming to discover novel therapeutic agents.

2. Technological Innovations in Production: Advances in technology are improving the production methods for 2,6-Dicarboxypyridine, making processes more efficient and cost-effective. These advancements help in scaling up production to meet the growing industry demands without compromising quality.

3. Stringent Environmental Regulations: Increasingly strict environmental regulations are forcing companies to look for safer and more sustainable chemicals. 2,6-Dicarboxypyridine is seen as a preferable option due to its lesser environmental impact compared to other chemicals, driving its adoption across various industries.

4. Expansion into New Markets: The market is expanding into new geographical regions, which opens up numerous opportunities for the growth of the 2,6-Dicarboxypyridine industry. This expansion is supported by the globalization of pharmaceutical and chemical manufacturing.

5. Growing Applications in Agriculture and Food Industries: There is an increasing application of 2,6-Dicarboxypyridine in agriculture for producing pesticides and herbicides, as well as in the food industry where it’s used as a preservative and a pH regulator. These applications are propelled by the need for more efficient and safer products.

Regulations On the 2,6-Dicarboxypyridine Market

1. Cosmetics Regulation in the EU: In the European Union, 2,6-Dicarboxypyridine is regulated under cosmetic regulations. It is mainly used as a chelating agent in cosmetic products, binding metal ions that could otherwise affect the stability and appearance of cosmetics. The regulations ensure that all cosmetics containing this ingredient adhere to safety standards to protect consumer health.

2. U.S. Food and Drug Administration (FDA) Regulations: In the United States, 2,6-Dicarboxypyridine is recognized in the inventory of food contact substances under the FDA regulations. It is approved for certain uses in materials that come into contact with food. These regulations specify the conditions under which this substance can be safely used in food contact applications, ensuring that it does not pose a risk to consumer health when used under these conditions.

3. Global Cosmetic Ingredient Standards: As a cosmetic ingredient, 2,6-Dicarboxypyridine must also adhere to international standards governing its use in personal care products. This includes assessments of its potential as an allergen and its overall safety in formulations, ensuring that products are safe for consumer use worldwide.

4. Regulatory Compliance for Environmental Impact: The production and industrial use of 2,6-Dicarboxypyridine are also subject to environmental regulations that aim to minimize the chemical's impact on the environment. This includes regulations on emissions and waste management during the manufacturing process, ensuring that the use of 2,6-Dicarboxypyridine does not contribute to pollution or other environmental harm.

Safety Protocols in Handling and Storage: Regulations also cover the safe handling, storage, and transportation of 2,6-Dicarboxypyridine to prevent accidents and exposures. These guidelines ensure that workers are protected from potential hazards associated with chemical exposure and that the chemical is stored in conditions that prevent environmental contamination.

To Get Moment Access, Buy Report Here: Enjoy Discounts of Up to 30%! https://market.us/purchase-report/?report_id=138183

Regional Analysis

In 2024, the Asia Pacific region will emerge as the leader in the 2,6-Dicarboxypyridine market, claiming a 37.2% market share, which translates to about USD 72.2 million. The strong demand from sectors like pharmaceuticals, agriculture, and textiles, particularly in China, India, and Japan, drives this dominance. The region benefits from established manufacturing infrastructures, cost-efficient production, and an expanding consumer base. Additionally, environmental policies in China and India that encourage the use of sustainable chemicals further boost the uptake of 2,6-Dicarboxypyridine.

In the United States, the market is significantly propelled by the pharmaceutical sector, which is leveraging 2,6-dicarboxypyridine for drug development. The growth is also supported by its increased use in agrochemicals, driven by strict regulatory standards and innovative chemical formulations.

Key Players Analysis

- Alfa Aesar

- AMSAL-CHEM

- Dow Chemical

- Organo Fine Chemicals

- Shanghai Wisacheam Pharmaceutical Technology Co

- Sunwin Biotech Shandong Co., Ltd.

- Tokyo Chemical Industry Co., Ltd. (TCI)

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Distribution channels: Chemical Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release