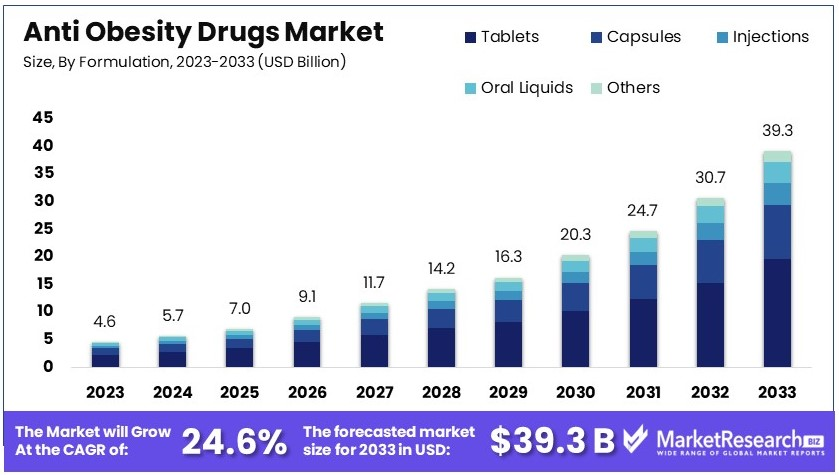

Anti-Obesity Drugs Market to Expand from USD 4.6 Billion in 2023 to USD 39.3 Billion by 2033

Anti Obesity Drugs Market Size

The Global Anti Obesity Drugs Market size is expected to be worth around USD 39.3 Billion by 2033, from USD 4.6 Billion in 2023, growing at a CAGR of 24.6%

NEW YORK, NY, UNITED STATES, February 6, 2025 /EINPresswire.com/ -- Report Overview

The Global Anti Obesity Drugs Market size is expected to be worth around USD 39.3 Billion by 2033, from USD 4.6 Billion in 2023, growing at a CAGR of 24.6% during the forecast period from 2024 to 2033.

The global demand for anti-obesity drugs is rising as obesity rates continue to increase worldwide. These drugs play a critical role in weight management, reducing obesity-related health risks such as diabetes, cardiovascular diseases, and hypertension. Anti-obesity medications work by suppressing appetite, reducing fat absorption, or regulating metabolism, helping individuals achieve sustainable weight loss.

The FDA-approved anti-obesity drugs, including Semaglutide (Wegovy), Liraglutide (Saxenda), and Orlistat (Alli, Xenical), have shown clinically significant weight reduction in patients. Recent advancements in GLP-1 receptor agonists have revolutionized obesity treatment, providing longer-lasting effects and improved safety profiles.

With obesity affecting over 1 billion people globally, healthcare providers emphasize a combination of medication, lifestyle changes, and behavioral therapy for long-term success. Governments and pharmaceutical companies are investing in new drug development to address the growing obesity epidemic.

Unlock Competitive Advantages With Our PDF Sample Report @ https://marketresearch.biz/report/anti-obesity-drugs-market/request-sample/

Key Takeaways

- Market Value: The global anti-obesity drugs market was valued at USD 4.6 billion in 2023 and is expected to reach USD 39.3 billion by 2033, growing at a CAGR of 24.6%.

- Drug Type Analysis: Prescription drugs hold a 65% market share, driven by their higher clinical efficacy and the need for medical supervision, reinforcing their market dominance.

- Mechanism of Action Analysis: GLP-1 receptor agonists lead with 40% share, due to their dual benefits in weight loss and glucose regulation, making them the most sought-after treatment.

- Formulation Analysis: Tablets account for 50% of the market, preferred for their ease of administration, widespread availability, and cost-effective manufacturing.

- End User Analysis: Hospitals dominate with 45% market share, reflecting their role in comprehensive obesity management and multidisciplinary treatment approaches.

- Dominant Region: North America holds 38.6% market share, supported by a strong healthcare infrastructure and increasing obesity rates.

- High Growth Region: Europe accounts for 27.5%, benefiting from rising health awareness and increased healthcare expenditures.

- Analyst Viewpoint: The market remains highly competitive and expanding, with opportunities in innovative drug development and regulatory approvals.

- Growth Opportunities: Companies can leverage personalized medicine advancements and expand into emerging markets to strengthen their competitive position.

How Artificial Intelligence (AI) is Transforming the Anti-Obesity Drugs Market ?

•Faster Drug Discovery: AI algorithms analyze large datasets to identify potential anti-obesity drug candidates, significantly reducing research time and costs.

•Target Identification: AI helps researchers discover new biological targets linked to obesity, leading to the development of innovative drug formulations.

•Drug Repurposing: AI-driven models predict if existing drugs can be repurposed for obesity treatment, accelerating development and lowering costs.

•Patient Recruitment: AI streamlines clinical trials by analyzing electronic health records (EHRs) to identify and recruit eligible participants efficiently.

•Predictive Analytics in Trials: AI predicts drug trial outcomes by simulating how patients may respond to a drug, reducing trial failures.

•Real-Time Monitoring: AI-powered wearable devices track health parameters like BMI and metabolic rate, ensuring accurate trial data collection.

•Personalized Treatments: AI customizes obesity treatments based on genetic, metabolic, and lifestyle data, enhancing drug efficacy and patient outcomes.

•AI-Powered Diet and Lifestyle Integration: AI-based mobile apps offer personalized diet and exercise plans alongside drug prescriptions to improve treatment adherence.

•Behavioral Analysis: AI analyzes patient habits and psychological triggers to design customized obesity intervention strategies.

Market Segments

By Drug Type

•Prescription Drugs

•Over-the-Counter (OTC) Drugs

By Mechanism of Action

•Appetite Suppressants

•Fat Absorption Inhibitors

•Serotonin-Norepinephrine Reuptake Inhibitors (SNRIs)

•GLP-1 Receptor Agonists

•Combination Drugs

•Others

By Formulation

•Tablets

•Capsules

•Injections

•Oral Liquids

•Others

By End User

•Hospitals

•Clinics

•Homecare Settings

•Weight Loss Centers

•Others

Buy This Premium Research Report: https://marketresearch.biz/purchase-report/?report_id=47873

Market Dynamics

• Driver: The increasing global prevalence of obesity is a primary driver of the anti-obesity drugs market. As of 2020, nearly 1 billion people worldwide were classified as obese, with projections indicating this number could reach 1.9 billion by 2035. This surge is attributed to factors such as sedentary lifestyles, unhealthy dietary habits, and genetic predispositions. The associated health risks, including type 2 diabetes, cardiovascular diseases, and certain cancers, have heightened the demand for effective pharmacological interventions.

• Trend: A notable trend in the anti-obesity drugs market is the development of glucagon-like peptide-1 (GLP-1) receptor agonists. Originally used for diabetes management, these medications have demonstrated significant efficacy in weight reduction. Drugs like semaglutide and tirzepatide have shown promising results, leading to their approval for obesity treatment. Their dual benefits in glycemic control and weight loss have made them a focal point in current obesity management strategies, reflecting a shift towards multifunctional therapeutic agents.

• Restraint: Despite the availability of effective anti-obesity medications, limited insurance coverage poses a significant restraint. A study comparing anti-obesity medications to treatments for other conditions found that only 10–16% of U.S. health insurance plans covered these drugs, compared to 45–59% for treatments of other conditions. This disparity leads to high out-of-pocket costs for patients, limiting access and adherence to these therapies. The financial burden discourages many individuals from pursuing pharmacological treatment, thereby hindering market growth.

• Opportunity: The emergence of personalized medicine presents a significant opportunity in the anti-obesity drugs market. Tailoring treatments based on an individual's genetic makeup, lifestyle, and metabolic profile can enhance therapeutic efficacy and minimize adverse effects. Advancements in genomics and biotechnology facilitate the identification of biomarkers associated with obesity, enabling the development of targeted therapies. This approach not only improves patient outcomes but also opens avenues for pharmaceutical companies to innovate and differentiate their products in a competitive market.

Regional Analysis

•North America holds the dominant position in the anti-obesity drugs market, accounting for 38.6% of the global market share. The high prevalence of obesity is a key driver, with the CDC reporting that 42.4% of American adults were obese in 2017-2018. Strong healthcare infrastructure, access to advanced treatments, and extensive research and development investments contribute to market expansion. Public health campaigns highlighting obesity risks further increase demand for anti-obesity medications.

The presence of major pharmaceutical companies ensures easy access to innovative drugs. Additionally, high disposable incomes and insurance coverage facilitate drug adoption, while the FDA’s strict regulatory policies enhance consumer confidence, supporting overall market growth.

•Europe holds a 27.5% share in the anti-obesity drugs market, driven by rising obesity rates, a strong healthcare system, and robust research investments. Countries such as the UK, Germany, and France play a crucial role in market expansion due to their advanced medical infrastructure and government-backed obesity prevention initiatives.

Increasing consumer awareness regarding obesity-related health risks, along with the availability of weight management drugs, further fuels market growth. Additionally, Europe benefits from stringent regulatory frameworks that ensure the safety and efficacy of anti-obesity medications. With continued investments in medical research and a focus on innovative treatments, Europe remains a significant player in the global market.

•Asia Pacific holds 18.2% of the global anti-obesity drugs market, with demand growing due to urbanization, sedentary lifestyles, and changing dietary patterns. Rising obesity rates in China, India, and Japan are increasing the need for pharmacological interventions. Improved healthcare infrastructure, rising disposable incomes, and growing public awareness about obesity’s health risks contribute to market expansion.

Government initiatives promoting weight management and preventive healthcare further support drug adoption. Additionally, pharmaceutical companies are expanding operations in emerging economies, introducing cost-effective anti-obesity treatments. With continuous advancements in medical research and greater accessibility to obesity drugs, the Asia Pacific market is poised for steady growth.

•The Middle East & Africa region accounts for 8.4% of the global anti-obesity drugs market, with increasing obesity rates and growing healthcare spending driving demand. Countries like Saudi Arabia and South Africa are at the forefront of market expansion, implementing national health initiatives to combat obesity.

Rising disposable incomes and an expanding middle class are contributing to greater healthcare expenditures, increasing access to medical treatments. Additionally, governments are partnering with healthcare organizations to promote obesity awareness. Despite challenges like limited healthcare access in certain areas, the growing focus on obesity prevention is expected to support market growth in the coming years.

•Latin America holds 7.3% of the anti-obesity drugs market, with demand increasing due to urbanization, lifestyle changes, and rising healthcare investments. Countries such as Brazil and Mexico are leading the region’s market expansion through public health campaigns and obesity management programs. Government initiatives promoting weight-loss treatments and increasing healthcare awareness contribute to growth.

However, economic disparities and limited insurance coverage can hinder market access. Despite these challenges, pharmaceutical companies are focusing on expanding distribution networks and offering affordable obesity treatments, ensuring broader accessibility. With rising obesity rates and healthcare infrastructure improvements, Latin America’s market is expected to grow steadily.

Top Key Players

•Novo Nordisk A/S

•F. Hoffmann-La Roche Ltd

•GlaxoSmithKline plc

•AstraZeneca

•Boehringer Ingelheim International GmbH

•Pfizer Inc.

•Merck & Co., Inc.

•Johnson & Johnson Services, Inc.

•Takeda Pharmaceutical Company Limited

•Eisai Co., Ltd.

•Orexigen Therapeutics, Inc.

•Rhythm Pharmaceuticals, Inc.

•Zafgen, Inc.

•Vivus, Inc.

•Norgine B.V.

•Other Key Players

Emerging Trends in Anti-Obesity Drugs

• Development of Oral GLP-1 Receptor Agonists: Traditionally, GLP-1 receptor agonists, effective in weight management, have been administered via injections. Recent advancements focus on developing oral alternatives, aiming to enhance accessibility and patient compliance. Early clinical trials of oral GLP-1 drugs, such as those by Viking Therapeutics and AstraZeneca, have demonstrated promising weight loss results. These developments could make weight loss treatments more convenient for patients.

• Combination Therapies Targeting Multiple Pathways: Emerging research suggests that using lower doses of multiple agents targeting different pathways may yield better weight loss results than modifying a single pathway. This approach, common in treating conditions like diabetes and hypertension, is gaining attention in obesity treatment to enhance efficacy and minimize side effects.

• Personalized Medicine Approaches: There is a growing emphasis on tailoring anti-obesity treatments to individual patient profiles. By considering factors such as genetics, metabolism, and lifestyle, healthcare providers aim to improve treatment outcomes and reduce adverse effects. This personalized approach is becoming more prevalent in developing and prescribing anti-obesity medications.

Use Cases of Anti-Obesity Drugs

• Weight Loss in Adults with Obesity: Anti-obesity medications are prescribed to adults with a body mass index (BMI) of 30 or higher to facilitate weight loss. For instance, semaglutide (Wegovy) has been shown to result in an average weight loss of about 12% over 68 weeks in clinical trials. This significant reduction aids in decreasing the risk of obesity-related conditions such as type 2 diabetes and cardiovascular diseases.

• Assisting Weight Loss Maintenance Post-Dieting: Maintaining weight loss after initial reduction through dieting is challenging. Studies indicate that anti-obesity drugs, when used alongside lifestyle interventions, can improve weight-loss maintenance. For example, medications like orlistat have been associated with better weight maintenance after a very-low-calorie diet period.

• Support for Patients Undergoing Bariatric Surgery: Anti-obesity medications can be beneficial for patients both before and after bariatric surgery. Pre-surgery, these drugs may help reduce weight to lower surgical risks. Post-surgery, they can assist in maintaining weight loss and preventing weight regain, thereby enhancing the long-term success of surgical interventions.

• Treatment of Obesity in Adolescents: The FDA has approved certain anti-obesity medications for use in adolescents aged 12 and older. For example, semaglutide (Wegovy) is indicated for weight management in adolescents with obesity, providing a pharmacological option alongside lifestyle modifications to address adolescent obesity.

Lawrence John

Prudour

+91 91308 55334

email us here

Distribution channels: Healthcare & Pharmaceuticals Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release