Pharmaceutical CDMO Market to Grow by 7.6% CAGR, Reaching USD 298.8 Billion by 2033

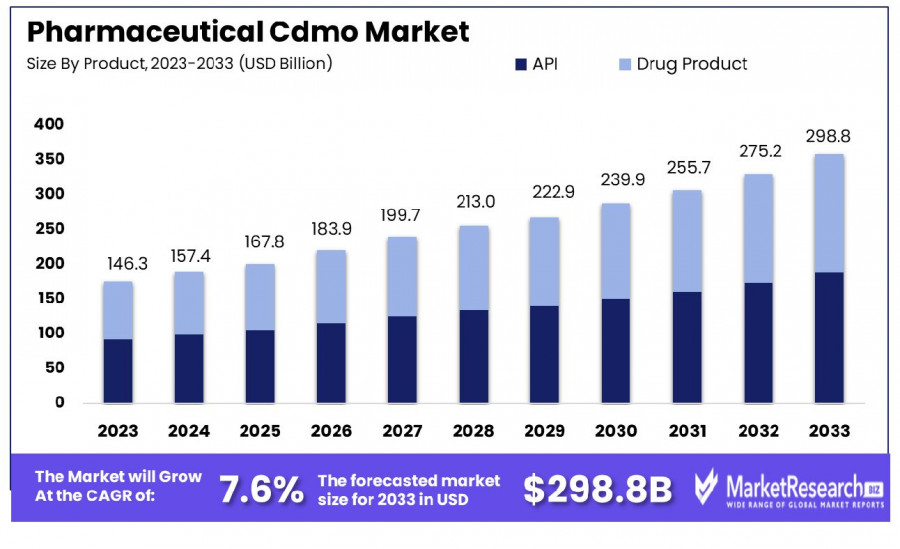

The Global Pharmaceutical CDMO Market was valued at USD 146.3 billion in 2023. It is expected to reach USD 298.8 billion by 2033, with a CAGR of 7.6%

NEW YORK CITY, NY, UNITED STATES, February 17, 2025 /EINPresswire.com/ -- Overview

The Global Pharmaceutical CDMO Market was valued at USD 146.3 billion in 2023. It is expected to reach USD 298.8 billion by 2033, with a CAGR of 7.6% during the forecast period from 2024 to 2033.

A Contract Development and Manufacturing Organization (CDMO) plays a vital role in the pharmaceutical industry by offering end-to-end solutions for drug development and manufacturing. CDMOs support pharmaceutical companies by providing expertise in formulation, production, packaging, and regulatory compliance, enabling faster time-to-market for new drugs.

The pharmaceutical CDMO sector is witnessing significant growth due to increasing outsourcing trends, rising drug complexity, and stringent regulatory requirements. These organizations help pharmaceutical firms reduce costs, enhance scalability, and focus on core R&D activities. With advancements in biologics, gene therapy, and specialty drugs, CDMOs are expanding their capabilities to meet evolving market demands.

Global pharmaceutical CDMOs are investing in state-of-the-art facilities, digital transformation, and sustainable manufacturing to improve efficiency and compliance. The market is also driven by growing partnerships between CDMOs and pharma companies, ensuring innovation and faster production cycles.

As the industry shifts towards personalized medicine and complex biologics, the demand for flexible, high-quality CDMO services continues to rise. Pharmaceutical CDMOs remain essential partners in accelerating drug development, ensuring regulatory adherence, and enhancing global healthcare access.

Click here to get a Sample report copy @ https://marketresearch.biz/report/pharmaceutical-cdmo-market/request-sample/

Key Takeaways

•Market Growth: The Global Pharmaceutical CDMO Market was valued at USD 146.3 billion in 2023 and is projected to reach USD 298.8 billion by 2033, growing at a CAGR of 7.6% from 2024 to 2033.

•By Product: Active Pharmaceutical Ingredients (APIs) dominate the market, holding an 82.3% share in the product category.

•By Workflow: Commercial workflow leads the segment with a significant 88.1% market share.

•By Application: Oncology applications hold a strong position, accounting for 22.3% of the total market.

•Regional Dominance: The Asia-Pacific region leads the global Pharmaceutical CDMO market, contributing 37.6% of the total share.

•Growth Opportunity: The market expanded in 2023, driven by enhanced regulatory compliance and the adoption of continuous manufacturing, improving efficiency, product quality, and overall market appeal.

Segmentation Analysis

•By Product Analysis: The API segment dominated the Pharmaceutical CDMO Market, holding 82.3% of the total share in 2023. This growth is fueled by the increasing demand for Traditional APIs and Highly Potent APIs (HP-APIs). The API market is segmented into Synthetic and Biotech APIs, with synthetic APIs leading but biotech APIs gaining traction due to biologics growth. The shift towards continuous manufacturing and the rising adoption of generic drugs also contribute to the segment’s expansion.

•By Workflow Analysis: The Commercial workflow segment led the Pharmaceutical CDMO Market with an 88.1% share in 2023. This dominance is driven by the rising demand for large-scale drug production, increasing pharmaceutical outsourcing, and growing drug approvals. Pharmaceutical companies rely on CDMOs for cost-effective, high-volume production, ensuring faster time-to-market. The rise of biologics and specialty drugs has also strengthened this segment, as CDMOs offer specialized manufacturing solutions to meet complex drug formulation and regulatory requirements.

•By Application Analysis: The Oncology segment held a 22.3% share in 2023, making it the largest in the Pharmaceutical CDMO Market. This leadership is driven by the growing prevalence of cancer and the rising demand for targeted therapies, immunotherapies, and biologics. Increased investment in cancer drug development and the shift towards personalized medicine further boost this segment. Pharmaceutical companies rely on CDMOs for specialized manufacturing capabilities, ensuring the rapid production and commercialization of oncology drugs to meet rising patient needs.

Market Segments

By Product

•API

○Type

-Traditional Active Pharmaceutical Ingredient (Traditional API)

-Highly Potent Active Pharmaceutical Ingredient (HP-API)

-Antibody Drug Conjugate (ADC)

-Others

○Synthesis

-Synthetic

-Solid

-Liquid

-Biotech

○Drug

-Innovative

-Generics

○Manufacturing

-Continuous manufacturing

-Batch manufacturing

•Drug Product

-Oral solid dose

-Semi-solid dose

-Liquid dose

-Others

•By Workflow

-Clinical

-Commercial

•By Application

○Oncology

-Small Molecules

-Biologics

○Infectious Diseases

○Neurological Disorders

○Cardiovascular Disease

○Metabolic Disorders

○Autoimmune Diseases

○Respiratory Diseases

○Ophthalmology

○Gastrointestinal Disorders

○Hormonal Disorders

○Hematological Disorders

○Others

To Purchase this Premium Report @ https://marketresearch.biz/purchase-report/?report_id=45768

Market Dynamics

•Driver: The pharmaceutical Contract Development and Manufacturing Organization (CDMO) market is primarily driven by the increasing trend of outsourcing in the pharmaceutical industry. Pharmaceutical companies are leveraging CDMOs to enhance efficiency, reduce costs, and expedite time-to-market for new drugs. This strategic shift allows companies to focus on core competencies such as research and development, while CDMOs handle complex manufacturing processes. The demand for specialized services, including the production of biologics and advanced therapeutic modalities, further propels the growth of the CDMO sector.

•Trend: A significant trend in the pharmaceutical CDMO market is the consolidation through mergers and acquisitions. For instance, Novo Holdings' planned $16.5 billion acquisition of Catalent highlights the industry's move towards integrating capabilities to meet the growing demand for pharmaceutical manufacturing services. This consolidation aims to enhance service offerings, expand global reach, and improve operational efficiencies, positioning companies to better serve the evolving needs of pharmaceutical clients.

•Restraint: Regulatory scrutiny poses a considerable restraint in the pharmaceutical CDMO market. Mergers and acquisitions, such as the Novo Holdings-Catalent deal, often undergo rigorous antitrust evaluations by authorities like the European Commission. These assessments aim to prevent anti-competitive practices and ensure market fairness, potentially leading to delays or modifications in proposed transactions. Such regulatory hurdles can impact strategic planning and operational timelines for companies within the CDMO sector.

•Opportunity: The growing demand for injectable drugs presents a substantial opportunity for the pharmaceutical CDMO market. Companies like Laboratorios Rovi are investing in expanding their injectable manufacturing capacities, anticipating significant growth in this segment over the next five years. This focus on injectable medications, including biologics and vaccines, aligns with the increasing prevalence of chronic diseases and the need for advanced drug delivery systems, offering CDMOs a pathway to capitalize on emerging market needs.

Market Key Players

•Bushu Pharmaceuticals Ltd.

•Nipro Corporation

•Thermo Fisher Scientific Inc.

•Samsung Biologics

•Laboratory Corporation of America Holdings

•Siegfried Holding Ag

•Catalent, Inc

•Lonza Group AG

•Recipharm Ab

•Piramal Pharma Solutions

•Cordenpharma International

•Cambrex Corporation

•Wuxi Apptec

Regional Analysis

•Asia-Pacific: Market Leader with 37.6% Share: Asia-Pacific dominates the Pharmaceutical CDMO Market, holding a 37.6% share. This leadership is driven by cost-effective manufacturing, strong infrastructure, and increasing pharmaceutical investments in countries like China and India. Favorable government policies and a highly skilled workforce further contribute to the region’s rapid growth, making it a key global hub for CDMO services.

•North America: Innovation and Advanced Manufacturing: North America is a highly competitive market, driven by technological advancements, strong regulatory frameworks, and significant R&D investments. The United States plays a crucial role, with a focus on biologics and personalized medicine. The region’s well-established pharmaceutical industry ensures steady demand for CDMO services, particularly in advanced drug development and large-scale manufacturing.

•Europe: Strong Market with High Regulatory Standards: Europe holds a substantial market share, supported by a robust pharmaceutical industry, strict regulations, and rising demand for biopharmaceuticals. Countries like Germany, the UK, and Switzerland lead the sector, emphasizing high-quality manufacturing and sustainable practices. The region's compliance-driven approach enhances its global competitiveness.

•Middle East & Africa: Gradual Expansion: Though smaller in market share, the Middle East & Africa region is witnessing steady growth due to increasing healthcare investments and improving pharmaceutical infrastructure. Countries like UAE and South Africa are emerging as potential CDMO hubs, driven by rising demand for pharmaceutical products and regional collaborations.

•Latin America: Emerging Market Potential: Latin America, led by Brazil and Mexico, is showing promising growth in the CDMO market. Expanding pharmaceutical production, economic development, and foreign investments are key factors driving the region’s progress. Efforts to enhance manufacturing capabilities are strengthening Latin America’s position in the global pharmaceutical supply chain.

Emerging Trends in Pharmaceutical CDMOs

•Expansion into Biologics Manufacturing: Pharmaceutical Contract Development and Manufacturing Organizations (CDMOs) are increasingly focusing on biologics, including monoclonal antibodies and gene therapies. This shift addresses the growing demand for complex biologic treatments, which require specialized manufacturing capabilities. The biopharmaceutical CDMO market surpassed $10 billion in 2018 and is projected to grow annually by 10.2% from 2020 to 2025, outpacing the small molecule drug market's 8.0% growth rate. citeturn0search0

•Adoption of Continuous Manufacturing Processes: CDMOs are implementing continuous manufacturing to enhance efficiency and product quality. This method streamlines production by integrating processes, reducing time and costs associated with traditional batch manufacturing. Continuous manufacturing is particularly beneficial for small molecule solid oral dosage forms, offering improved scalability and consistency.

•Digitalization and Automation in Manufacturing: The integration of digital technologies and automation is transforming CDMO operations. End-to-end automation can increase productivity tenfold compared to traditional methods, minimize contamination risks, and reduce labor requirements. This technological advancement is crucial for meeting the complex demands of modern pharmaceutical manufacturing.

•Strategic Mergers and Acquisitions: The CDMO industry is experiencing consolidation through mergers and acquisitions. For example, in December 2024, Lonza announced plans to exit its capsules and health ingredients business to focus on its core CDMO services. This strategic move aims to enhance service offerings and operational efficiency, positioning the company to better meet the evolving needs of pharmaceutical clients.

Use Cases of Pharmaceutical CDMOs

•Accelerated Vaccine Production: During the COVID-19 pandemic, CDMOs played a pivotal role in scaling up vaccine manufacturing. The unprecedented demand required rapid production increases, with billions of vaccine doses needed in a short timeframe. CDMOs provided the necessary infrastructure and expertise, enabling pharmaceutical companies to meet global vaccination needs efficiently.

•Development of Monoclonal Antibody Therapies: CDMOs have been instrumental in the swift development and production of monoclonal antibody treatments for COVID-19. Several companies received emergency use authorizations within 1–2 years of the pandemic's onset, a process that typically takes much longer. This rapid response was facilitated by CDMOs' capabilities in scaling up manufacturing and ensuring regulatory compliance.

•Support for Small and Medium-Sized Enterprises (SMEs): SMEs often lack the resources to establish in-house manufacturing facilities. CDMOs offer these companies access to advanced technologies and expertise, enabling them to develop and produce pharmaceuticals without significant capital investment. This partnership model allows SMEs to bring innovative therapies to market more efficiently.

•Enhancing Production of Complex Injectables: The demand for complex injectable products, such as biologics and vaccines, has increased. CDMOs specializing in sterile manufacturing provide the necessary facilities and expertise to produce these intricate formulations. Their involvement ensures that pharmaceutical companies can meet market demands while adhering to stringent regulatory standards.

Check More Healthcare Reports:

Veterinary Artificial Insemination Market-https://marketresearch.biz/report/veterinary-artificial-insemination-market/

Wound Debridement Market-https://marketresearch.biz/report/wound-debridement-market/

Wound Irrigation System Market-https://marketresearch.biz/report/wound-irrigation-system-market/

X-Ray Detectors Market-https://marketresearch.biz/report/x-ray-detectors-market/

Tyrosine Kinase Inhibitors Market-https://marketresearch.biz/report/tyrosine-kinase-inhibitors-market/

Thyroid Gland Disorder Treatment Market-https://marketresearch.biz/report/thyroid-gland-disorder-treatment-market/

Vitamin D Therapy Market-https://marketresearch.biz/report/vitamin-d-therapy-market/

Women’s Health Market-https://marketresearch.biz/report/womens-health-market/

Surgical Glue Market-https://marketresearch.biz/report/surgical-glue-market/

Surgical Site Infection Control Market-https://marketresearch.biz/report/surgical-site-infection-control-market/

Subdermal Contraceptive Implants Market-https://marketresearch.biz/report/subdermal-contraceptive-implants-market/

Uveitis Treatment Market-https://marketresearch.biz/report/uveitis-treatment-market/

Lawrence John

Prudour

+91 91308 55334

email us here

Distribution channels: Healthcare & Pharmaceuticals Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release