Surety Market is Projected to Grow Expeditiously: to Reach US$ 26.78 billion by 2034, Report

Surety Market Growth

Surety Market Research Report By, Exposure Type, Construction Industry, Surety Underwriting Criteria, Contract Type, Regional

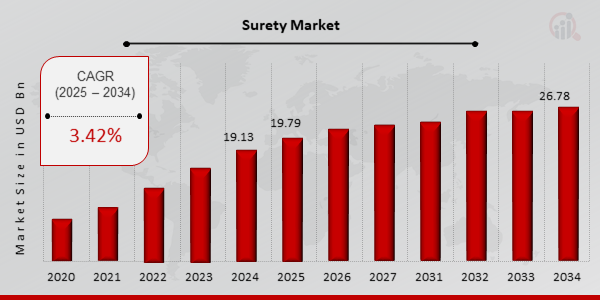

VA, UNITED STATES, April 9, 2025 /EINPresswire.com/ -- The global Surety market has shown steady growth over the years and is expected to maintain this momentum through the coming decade. In 2024, the market size was estimated at USD 19.13 billion and is projected to grow from USD 19.79 billion in 2025 to USD 26.78 billion by 2034, reflecting a compound annual growth rate (CAGR) of 3.42% during the forecast period (2025–2034). This growth is primarily fueled by increasing infrastructure development projects, stricter regulatory frameworks, and rising demand for financial risk mitigation across sectors.

Key Drivers of Market Growth

Infrastructure Development and Government Contracts

The rise in public-private partnerships and large-scale government-funded infrastructure initiatives has significantly increased the demand for surety bonds. Contractors and construction firms are required to secure bonds that guarantee project completion, compliance, and payment obligations.

Growing Need for Risk Mitigation in Business Transactions

Surety bonds offer a valuable form of financial assurance, protecting project owners, clients, and governments from potential default or non-performance. With the rise in complex and high-value contractual agreements, the reliance on surety solutions is becoming increasingly vital.

Stringent Regulatory and Legal Requirements

Many countries mandate the use of surety bonds across industries such as construction, energy, and real estate. Regulatory bodies and financial institutions are enforcing bonding requirements to ensure financial compliance and accountability in contractual arrangements.

Expansion of Small and Medium Enterprises (SMEs)

SMEs entering into new markets or bidding for government projects often rely on surety products to meet qualification criteria and build credibility. The growing number of SMEs, especially in emerging markets, is contributing to increased demand for surety services.

Digital Transformation and Automation in Underwriting

Insurers and surety providers are integrating digital platforms, AI-driven underwriting, and blockchain to streamline bond issuance, risk assessment, and claims processing. These technologies are enhancing operational efficiency and enabling broader access to surety products.

Download Sample Pages – https://www.marketresearchfuture.com/sample_request/22868

Key Companies in the Surety Market Include

• Berkshire Hathaway Specialty Insurance Company

• Tokio Marine Nichido Fire Insurance Co., Ltd.

• Allianz SE

• XL Group Ltd.

• QBE Insurance Group Ltd.

• Beazley Plc

• Swiss Reinsurance Co.

• RSA Insurance Group Plc

• American International Group Inc.

• Chubb Limited

• Munich Reinsurance Co.

• The Hartford Financial Services Group Inc.

• AIG

• Arch Insurance Group Inc.

• Zurich Insurance Group Ltd.

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/surety-market-22868

Market Segmentation

To provide a holistic understanding, the Surety market is segmented based on bond type, end-user, and region.

1. By Bond Type

• Contract Surety: Guarantees performance and payment obligations in construction and infrastructure projects.

• Commercial Surety: Covers licenses, permits, customs, and court bonds for businesses and professionals.

• Fidelity Bonds: Protect against employee dishonesty or fraud within an organization.

• Court Bonds: Ensure compliance in legal proceedings and judicial responsibilities.

2. By End-User

• Construction: Major consumer of surety bonds, especially for public works and private projects.

• Government: Requires bonding for vendors and contractors in procurement processes.

• Individual Professionals: Includes notaries, brokers, and other licensed professionals.

• Corporates & SMEs: Use surety products to secure commercial contracts and manage liabilities.

3. By Region

• North America: Largest market, driven by robust construction activity and strict bonding regulations.

• Europe: Growing due to increasing cross-border contracts and EU-backed infrastructure development.

• Asia-Pacific: Rapid urbanization, rising infrastructure spending, and evolving regulatory frameworks fuel growth.

• Rest of the World (RoW): Emerging markets in Latin America and the Middle East present untapped potential for surety products.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=22868

The global Surety market continues to be a vital component of risk management strategies across industries. As businesses, governments, and contractors seek financial protection and performance assurance, the demand for surety bonds is expected to grow steadily. With evolving technology and regulatory landscapes, the market is poised for greater innovation, transparency, and accessibility in the years ahead.

Related Report:

Locker Market

Litigation Funding Investment Market

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release