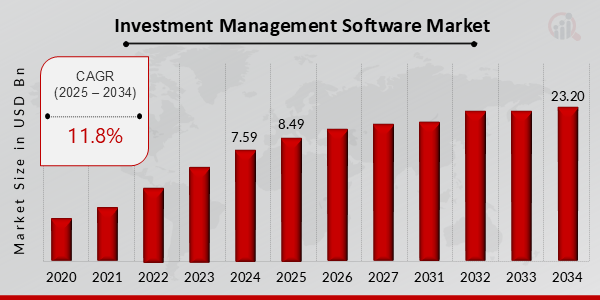

Investment Management Software Market Projected for 11.8% CAGR, Reaching $23.20 Billion by 2034

Investment Management Software Market Growth

Investment Management Software Market Research Report By, Deployment Model, Asset Class, Investment Style, End-User, Functionality, Regional

OK, UNITED STATES, April 9, 2025 /EINPresswire.com/ -- The global Investment Management Software market has experienced notable growth and is poised to continue its upward trajectory over the coming decade. In 2024, the market size was estimated at USD 7.59 billion and is projected to grow from USD 8.49 billion in 2025 to USD 23.20 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 11.8% during the forecast period (2025–2034). The rising need for efficient portfolio management, increased digitalization in financial services, and growing adoption of cloud-based solutions are key drivers contributing to the market's expansion.

Key Drivers of Market Growth

Growing Complexity of Investment Portfolios

With a rise in diverse and complex asset classes including ETFs, mutual funds, derivatives, and alternative investments, investment managers require advanced tools for efficient portfolio tracking, analysis, and rebalancing—fueling demand for sophisticated software solutions.

Digital Transformation in Financial Services

The global financial services sector is undergoing a rapid shift toward digital operations. Investment management software helps firms streamline operations, ensure compliance, automate workflows, and deliver real-time data insights—all critical for staying competitive in a tech-driven environment.

Rise of Cloud-Based and SaaS Platforms

Cloud deployment models offer flexibility, scalability, and cost efficiency. As more investment firms move away from on-premises systems, cloud-based investment management platforms are witnessing increased adoption, enabling firms to operate more securely and efficiently from anywhere.

Increased Regulatory Compliance Requirements

Global financial regulations such as MiFID II, Dodd-Frank, and GDPR have heightened the need for transparent reporting and data management. Investment management software assists firms in maintaining compliance, managing risk, and producing audit-ready reports with ease.

Demand for Personalized Client Reporting and Advisory Services

As investors increasingly seek personalized insights and digital engagement, software platforms that enable customizable reporting, performance tracking, and advisory tools are gaining popularity among investment advisors, asset managers, and wealth management firms.

Download Sample Pages – https://www.marketresearchfuture.com/sample_request/22935

Key Companies in the Investment Management Software Market Include

• State Street Global Advisors

• Invesco

• Franklin Templeton

• Vanguard

• Fidelity Investments

• Kemper Corporation

• MFS Investment Management

• T. Rowe Price

• UBS Asset Management

• Nuveen

• BlackRock

• Morgan Stanley Investment Management

• Northern Trust

• JPMorgan Chase Co.

• Goldman Sachs Asset Management

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/investment-management-software-market-22935

Market Segmentation

To provide a comprehensive analysis, the Investment Management Software market is segmented based on deployment mode, application, end-user, and region.

1. By Deployment Mode

• On-premises: Preferred by firms with strict data control requirements.

• Cloud-based: Popular for its scalability, lower maintenance costs, and accessibility.

2. By Application

• Portfolio Management: For asset allocation, risk analysis, and investment tracking.

• Trading and Exchange Management: Real-time trading, order execution, and reporting.

• Risk and Compliance Management: Ensures adherence to financial regulations.

• Accounting and Reporting: Financial consolidation and investor communications.

3. By End-User

• Banks and Financial Institutions: Leverage software for wealth and asset management services.

• Asset Management Firms: Manage complex portfolios and multi-asset strategies.

• Wealth Management Advisors: Serve individual and institutional clients with customized solutions.

• Hedge Funds and Private Equity Firms: Require robust analytics and reporting tools.

4. By Region

• North America: Leads due to early tech adoption and the presence of key players.

• Europe: Driven by regulatory compliance needs and growth in wealth management services.

• Asia-Pacific: Fastest-growing region, fueled by digital banking and increasing retail investments.

• Rest of the World (RoW): Emerging fintech ecosystems in Latin America and the Middle East are boosting demand.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=22935

The global Investment Management Software market is transforming how financial institutions and investment professionals manage portfolios, optimize operations, and engage clients. As the industry embraces digital innovation, real-time data analytics, and cloud-based platforms, the market is expected to witness significant growth, innovation, and consolidation in the years ahead.

Related Report:

Life Insurance Market

https://www.marketresearchfuture.com/reports/life-insurance-market-22927

Investment Management Software Market

https://www.marketresearchfuture.com/reports/investment-management-software-market-22935

Impact Investing Market

https://www.marketresearchfuture.com/reports/impact-investing-market-22940

High Yield Bonds Market

https://www.marketresearchfuture.com/reports/high-yield-bonds-market-22949

High Net Worth Offshore Investment Market

https://www.marketresearchfuture.com/reports/high-net-worth-offshore-investment-market-22960

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release