Supporting Regional Integration with Payment Services: UnionPay Attends the First ASEAN-GCC-China Economic Forum

/EIN News/ -- SHANGHAI, June 03, 2025 (GLOBE NEWSWIRE) -- From May 27 to 28, the ASEAN-GCC-China Economic Forum 2025 was held in Kuala Lumpur, Malaysia. Mr. Dong Junfeng, Chairman of China UnionPay and UnionPay International, was invited to attend the Forum, including the lunch co-hosted by Dato' Seri Dr. Ahmad Zahid Hamidi, Deputy Prime Minister of Malaysia, and Mr. Ren Hongbin, Chairman of China Council for the Promotion of International Trade (CCPIT), the welcome ceremony, and dinner reception. During the Forum, Mr. Dong held talks with Mr. Miao Jianmin, Chairman of China Merchants Group and Mr. Ge Haijiao, Chairman of Bank of China. He also exchanged views with senior executives of organizations such as CCPIT, CNPC, China Unicom, COFCO Corporation, PICC, Lenovo, and China Henan Aviation Group.

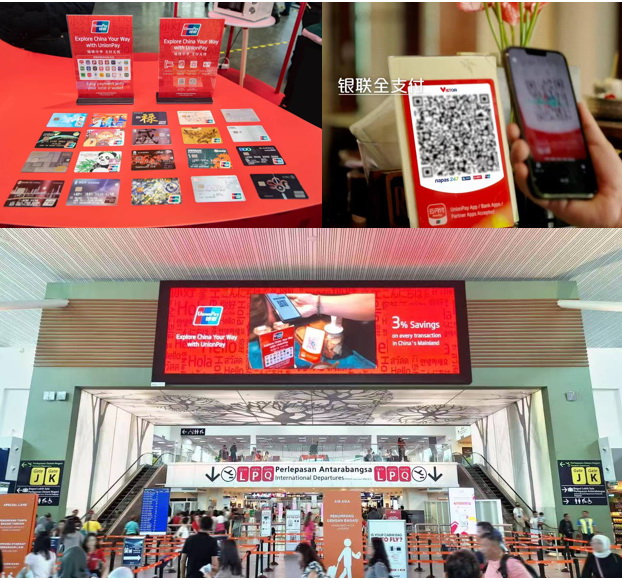

A Media Snippet accompanying this announcement is available in this link.

During discussions, Mr. Dong emphasized that as a key financial infrastructure and an international card scheme with global footprint, UnionPay adheres to the vision of "Trusted Ties, Shared Success" and actively supports the implementation of national strategies such as guiding principles from the central conference on work related to neighboring countries. UnionPay has been working with industry stakeholders in ASEAN and GCC (Gulf Cooperation Council) countries to build an inclusive and vibrant payment ecosystem, promote seamless regional trade and people-to-people exchanges and help advance the digital transformation of local payment industries, to deepen regional integration through financial services.

Currently, the UnionPay acceptance network covers all ten ASEAN member states and all six GCC member countries. In ASEAN, UnionPay cards are accepted by over 90% merchants and ATMs. In GCC countries such as Saudi Arabia, the UAE, Qatar, and Bahrain, almost every merchant takes UnionPay cards. Many ASEAN and GCC countries have also launched UnionPay mobile payment services. Whether it is Chinese visitors traveling on business or for leisure, or Chinese students studying abroad, they can all easily pay for purchases and withdraw cash in ASEAN and GCC countries with UnionPay solutions they are familiar with at home, such as bank cards, QR codes and mobile Pay solutions.

In addition to continuously improving its acceptance network, UnionPay is also localizing its presence by mobilizing a wide range of offerings to facilitate cross-border movement of people and industrial transformation. More than 70 million UnionPay cards have been issued in ASEAN countries, five of which have introduced UnionPay's SplendorPlus Card, a product tailored for international visitors to China. Responding to ASEAN consumer behavior and the overall shift towards mobile payments, UnionPay has partnered with local banks and fintech companies to launch over 40 digital wallets. UnionPay cards are also issued in GCC states such as the UAE and Saudi Arabia. In February 2025, UnionPay signed a partnership agreement with Al Etihad Payments (AEP), UAE's national payments entity, to jointly launch UnionPay-Jaywan co-badged cards, with a view to promoting the integrated development of financial payment infrastructures of the two countries. In recent years, UnionPay cards issued in Thailand, the Philippines, Cambodia, Singapore, and Malaysia have grown increasingly active in GCC countries such as the UAE, Saudi Arabia, and Qatar.

To align itself with the growing cross-border payment connectivity in multiple regions across the world, including ASEAN, UnionPay has introduced its innovative network interoperability solutions. To date, UnionPay has established or is developing partnership with local payment networks in seven ASEAN countries. These cross-border payment linkages highlight UnionPay's contributions to China-ASEAN payment collaboration. Linkages with Vietnam and Indonesia are implemented within the government-to-government (G2G) framework guided by the People's Bank of China and the respective local central bank. UnionPay entered into an agreement in April 2025 with the National Payment Corporation of Vietnam (NAPAS), Industrial and Commercial Bank of China, and Vietcombank to advance China-Vietnam QR payment interoperability, setting an example for this collaboration model. In Indonesia, UnionPay collaborates with Ant International and Bank of China Jakarta Branch to jointly "go global," providing a pilot for bringing UnionPay's new four-party model to more markets. Cross-border local currency settlement is also supported in these projects, contributing to the internationalization of the renminbi. The Malaysia linkage, launched in 2023, has already delivered results. This is evidenced by the over fourfold YOY growth in the number of transactions generated by UnionPay partner wallets at PayNet QR merchants in Malaysia from January to April 2025.

Currently, China, ASEAN, and GCC countries are working together to enhance solidarity, cooperation, and development through extensive and practical collaborations across multiple sectors. Within the regions, there is a growing call for payment industry transformation and enhanced interoperability. As a key payment infrastructure, UnionPay remains committed to supporting these efforts by striving to become an enabler of economic digitization and international exchanges, a pioneer in regional integration and collaborative market development, and a bridge for open ecosystems and long-term value creation. UnionPay will continue to leverage its financial capabilities to foster win-win partnerships between China, ASEAN, and GCC nations.

Source: UnionPay

Contact person: Ms. Zhu, Tel: 86-10-63074558

Distribution channels: Banking, Finance & Investment Industry, Culture, Society & Lifestyle, Media, Advertising & PR ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release