The euro area bank lending survey - First quarter of 2025

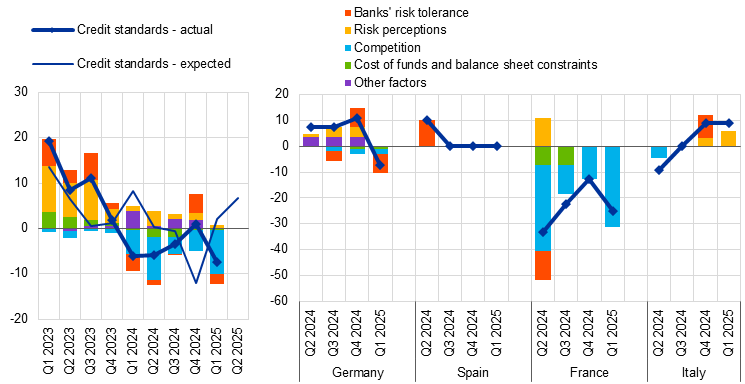

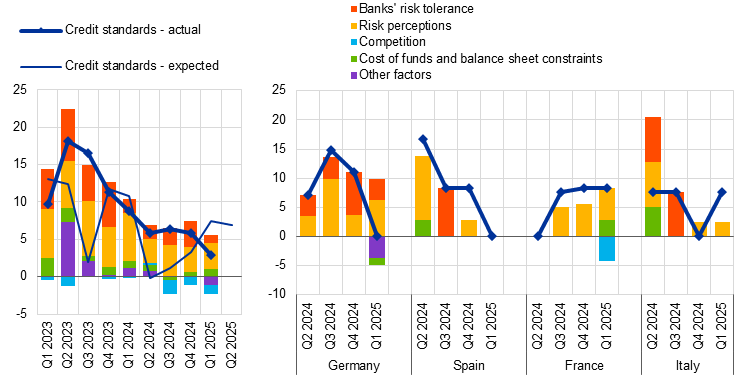

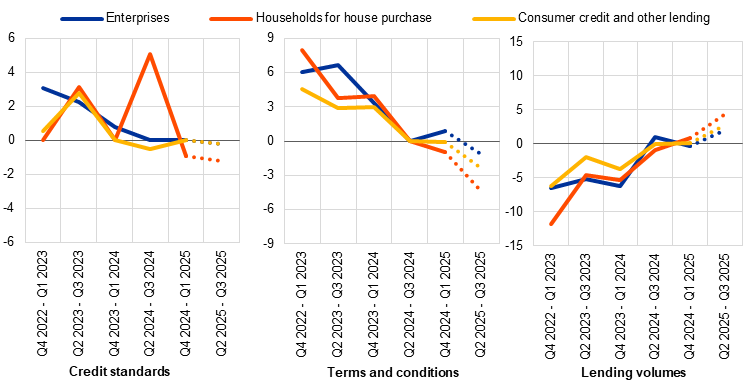

In the April 2025 bank lending survey (BLS), euro area banks reported a small, lower-than-expected net tightening of credit standards for loans or credit lines to enterprises in the first quarter of 2025 (a net 3% of banks; see Overview table).[1] This followed the renewed tightening of credit standards for loans to firms reported in the fourth quarter of 2024 and was again driven by higher perceived risks related to the general economic and firm-specific outlooks. Banks in Germany and four smaller euro area countries drove the tightening, while credit standards remained unchanged in France, following a tightening in the previous quarter. The net tightening in the first quarter of 2025 was smaller than had been expected in the previous survey round (10%), in particular for banks in Germany and France, with credit standards remaining unchanged for banks in Italy, despite expectations of an easing. For the second quarter of 2025, banks expect a further net tightening of credit standards for loans to firms (5%).

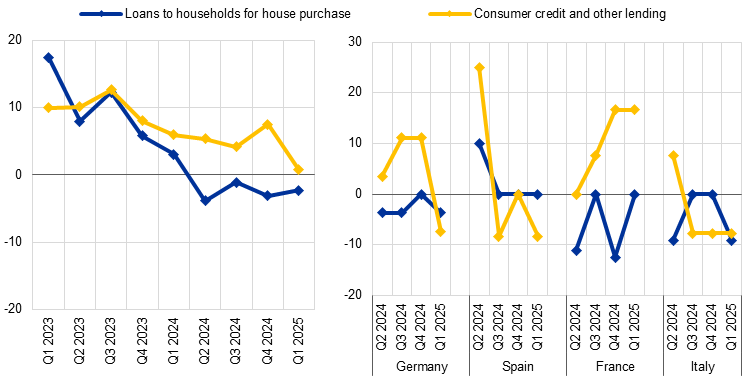

Banks reported a moderate easing of credit standards for loans to households for house purchase and a small further tightening for consumer credit (net ‑7% and 3% of banks respectively; see Overview table). For housing loans, while competition from other banks was the main driving force behind the easing of credit standards, banks’ risk tolerance also had a small impact. Across the largest euro area countries, for the first quarter of 2025 banks in France reported a net easing for the fifth consecutive quarter and those in Germany did so for the first time since the beginning of the easing cycle, while banks in Italy reported a net tightening. The easing of credit standards for euro area housing loans contrasts with the small net tightening that banks had expected in the previous quarter (2%). For credit standards for consumer credit and other lending to households, risk perceptions were the key factor in the net tightening. Credit standards for consumer credit tightened in France and Italy, while remaining unchanged in Germany and Spain. The tightening marked the twelfth consecutive quarter of net tightening in this segment, although it was smaller than banks had expected in the previous quarter (7%). For the second quarter of 2025, banks expect credit standards to tighten for housing loans and consumer credit (7% for both).

In the first quarter of 2025, firms’ net demand for loans moved back into slightly negative territory, after two quarters of weak recovery (a net ‑3% of banks; see Overview table). Loan demand decreased, mainly owing to a negative contribution from firms’ inventories and working capital and despite the support from declining interest rates. Fixed investment continued to have a broadly neutral impact on loan demand, with some banks referring to economic and (geo-)political uncertainties as a dampening factor for firms’ longer-term planning. The net decrease in demand was driven by banks in France, with banks in Italy reporting no change and banks in Germany and Spain reporting net increases. For the second quarter of 2025, banks expect a small increase in loan demand (4%).

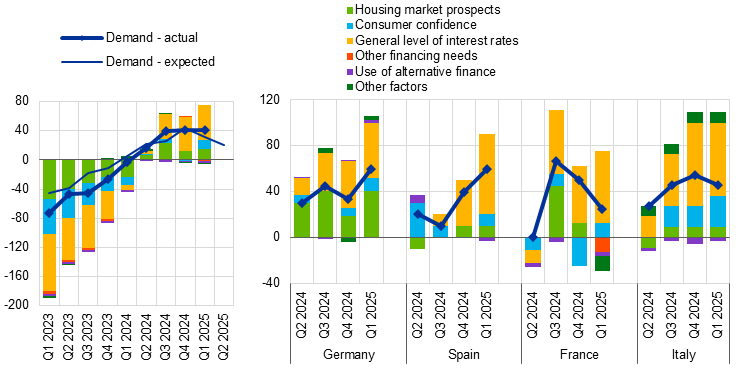

Net demand for housing loans continued to increase strongly, while consumer credit demand increased moderately (net 41% and 10% of banks respectively; see Overview table). The net increase in housing loan demand was driven primarily by the general level of interest rates and, to a lesser extent, by housing market prospects and rising consumer confidence. It followed similar strong increases in the previous two quarters and exceeded banks’ expectations in the previous quarter (31%). It was also broad based across euro area countries. Consumer credit demand was supported mainly by declining interest rates, with further small contributions from consumer confidence and spending on durable goods. The net increase in demand for consumer credit was broadly in line with banks’ expectations in the previous quarter (12%). For the second quarter of 2025, banks expect demand in both categories to increase further, albeit at a lower rate (20% for housing loans and 6% for consumer credit).

Banks eased overall credit terms and conditions for loans to firms and for housing loans, while they tightened those for consumer credit. Lower lending rates and narrower margins on average loans eased terms and conditions across all segments. There was a small tightening impact owing to stricter collateral requirements on loans to firms and to loan maturity and size for consumer credit, while margins on riskier loans eased for housing loans.

Banks reported a broadly unchanged share of rejected applications for loans to large firms and for consumer credit, a small net decrease for housing loans and a further increase for loans to small and medium-sized enterprises (SMEs).

The April 2025 survey contained several ad hoc questions.

- In the first quarter of 2025, euro area bank access to retail funding remained broadly unchanged, but eased for debt securities, money markets and securitisations. Access to debt securities improved more strongly for medium to long-term securities. For other instruments, developments were broadly homogeneous across maturities. Over the next three months, banks expect a slight easing of access to retail funding, with access to money markets, debt securities and securitisations expected to remain broadly unchanged.

- The reduction in the ECB monetary policy asset portfolio had a small negative impact on euro area banks’ market financing conditions and liquidity positions over the last six months, contributing to an increase in the holdings of euro area sovereign bonds for the first time since early 2015. Banks expect these developments to continue over the next six months, while the impact on lending conditions remains muted, reflecting the measured and predictable adjustment of the ECB monetary policy portfolio.

- In the first quarter of 2025, euro area banks reported a net tightening impact of non-performing loan (NPL) ratios and other credit quality indicators on their credit standards and terms and conditions for loans to firms and for consumer credit, while the impact for housing loans was broadly neutral. Higher perceived risks, pressures related to supervisory or regulatory requirements and lower risk tolerance were the key factors for banks reporting a tightening impact of credit quality on lending conditions. For the second quarter of 2025, euro area banks expect a further tightening impact of credit quality on their lending conditions for loans to firms and for consumer credit, and a very small tightening impact on lending conditions for housing loans.

- Banks reported a further negative net impact of the ECB key interest rate decisions on their net interest margins over the past six months, while the impact via volumes remained slightly negative. Banks expect a similar negative net impact from past and expected ECB key interest rate decisions on their margins over the next six months, and this is expected to drag down overall profitability, despite the slightly positive contribution of asset volumes. Interest rate decisions have contributed to containing, but not removing, the pressure on bank profitability from higher expected provisions and impairments, given that banks reported a slightly positive impact from rate decisions over the past six months and a zero expected impact for the next six months, after more than a year of increasing provisioning needs.

Overview table

Latest BLS results for the largest euro area countries

(net percentages of banks reporting a tightening of credit standards or an increase in loan demand)

Country |

Enterprises |

House purchase |

Consumer credit |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Credit standards |

Demand |

Credit standards |

Demand |

Credit standards |

Demand |

|||||||||||||

Q4 24 |

Q1 25 |

Avg |

Q4 24 |

Q1 25 |

Avg |

Q4 24 |

Q1 25 |

Avg |

Q4 24 |

Q1 25 |

Avg |

Q4 24 |

Q1 25 |

Avg |

Q4 24 |

Q1 25 |

Avg |

|

Euro area |

7 |

3 |

9 |

3 |

-3 |

-1 |

1 |

-7 |

6 |

42 |

41 |

1 |

6 |

3 |

5 |

2 |

10 |

0 |

Germany |

13 |

3 |

4 |

7 |

3 |

5 |

11 |

-7 |

4 |

33 |

59 |

6 |

11 |

0 |

2 |

4 |

11 |

7 |

Spain |

0 |

0 |

9 |

17 |

8 |

-6 |

0 |

0 |

14 |

40 |

60 |

-9 |

8 |

0 |

11 |

25 |

33 |

-7 |

France |

9 |

0 |

7 |

-9 |

-9 |

-5 |

-13 |

-25 |

3 |

50 |

25 |

2 |

8 |

8 |

0 |

-17 |

0 |

-2 |

Italy |

-9 |

0 |

11 |

18 |

0 |

3 |

9 |

9 |

1 |

55 |

45 |

9 |

0 |

8 |

5 |

8 |

31 |

9 |

Notes: “Avg” refers to historical averages, which are calculated over the period since the beginning of the survey, excluding the most recent round. Owing to the different sample sizes across countries, which broadly reflect the differences in the national shares in lending to the euro area non-financial private sector, the size and volatility of the net percentages cannot be directly compared across countries.

Box 1

General notes

The BLS is addressed to senior loan officers at a representative sample of euro area banks, representing all euro area countries and reflecting the characteristics of their respective national banking structures. The main purpose of the BLS is to enhance the Eurosystem’s knowledge of bank lending conditions in the euro area.[2]

Detailed tables and charts based on the responses provided can be found in Annex 1 for the standard questions and Annex 2 for the ad hoc questions. In addition, BLS time series data are available on the ECB’s website through the ECB Data Portal – see also the notes to charts throughout this report.

Detailed explanations on the BLS questionnaire, the aggregation of banks’ replies to national and euro area BLS results, the BLS indicators and information on the BLS series keys are available on the ECB’s website in the BLS user guide. A copy of the BLS questionnaire with the standard questions and a glossary of BLS terms can also be found on the ECB BLS webpage.

2.1 Further small tightening of credit standards

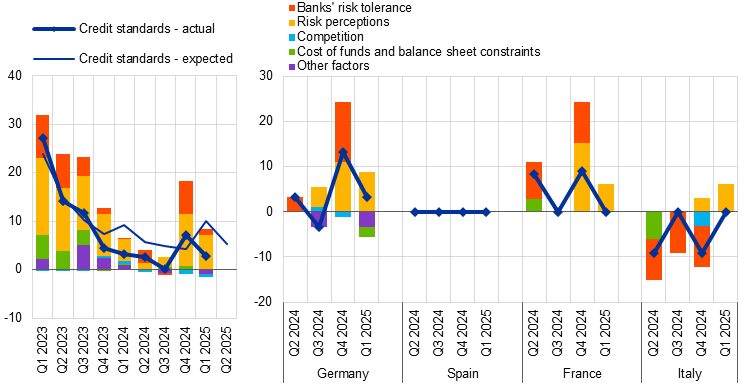

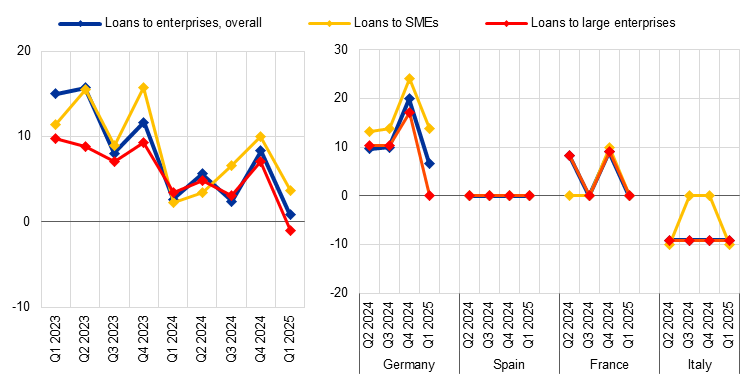

In the first quarter of 2025, euro area banks reported a small net tightening of credit standards for loans or credit lines to enterprises (a net 3% of banks; see Chart 1 and Overview table).[3] The net tightening followed the renewed tightening of credit standards for loans to firms reported in the fourth quarter of 2024. It was smaller than expected in the previous survey round (10%), in particular for banks in Germany and France, while standards remained unchanged for banks in Italy, despite expectations of an easing. The net tightening was driven primarily by banks in Germany and four smaller countries, whereas credit standards remained unchanged in the other three largest euro area economies. The net percentage was lower than the historical average since 2003 (9%).[4] Credit standards tightened very slightly for loans to large firms, while they remained broadly unchanged for loans to SMEs (net 2% and 1% of banks respectively; see Chart 2). Across maturities, banks reported a small net tightening for long-term loans (3%), whereas credit standards remained broadly unchanged for short-term loans (1%).

Higher perceived risks related to the general economic and firm-specific outlooks drove the further net tightening of credit standards (see Chart 1 and Table 1). This is consistent with the net tightening impact of NPL ratios and other asset quality indicators on banks’ credit standards on loans to enterprises (see Section 5.3). Relatedly, some banks reported, in the open-ended question, increased scrutiny of corporate borrowers particularly affected by macroeconomic and policy uncertainty (e.g. firms more exposed to exports to the United States). Banks’ risk tolerance had a broadly neutral impact on banks’ credit standards, after the tightening impact in the previous survey round. Banks’ cost of funds and balance sheet constraints and competition also had a broadly neutral impact, similarly to previous quarters, with banks in several smaller countries reporting an easing impact of competition. Higher risk perceptions were reported by banks in Germany, France and Italy.

Chart 1

Changes in credit standards applied to the approval of loans or credit lines to enterprises, and contributing factors

(net percentages of banks reporting a tightening of credit standards and contributing factors)

Notes: “Credit standards - actual” are changes that have occurred, while “Credit standards - expected” are changes anticipated by banks. Net percentages are defined as the difference between the sum of the percentages of banks responding “tightened considerably” and “tightened somewhat” and the sum of the percentages of banks responding “eased somewhat” and “eased considerably”. “Cost of funds and balance sheet constraints” is the simple average of “banks’ capital and the costs related to banks’ capital position”, “access to market financing” and “liquidity position”; “Risk perceptions” is the simple average of “general economic situation and outlook”, “industry or firm-specific situation and outlook/borrower’s creditworthiness” and “risk related to the collateral demanded”. “Competition” is the simple average of “competition from other banks”, “competition from non-banks” and “competition from market financing”. The net percentages for “Other factors” refer to an average of the further factors which were mentioned by banks as having contributed to changes in credit standards. The full set of data underlying this chart can be downloaded via the following ECB Data Portal links: euro area and largest four euro area countries.

Chart 2

Changes in credit standards applied to the approval of loans or credit lines to SMEs and large enterprises, and contributing factors

(net percentages of banks reporting a tightening of credit standards and contributing factors)

Notes: See the notes to Chart 1. The full set of data underlying this chart can be downloaded via the following ECB Data Portal links: loans to SMEs and loans to large enterprises.

In the second quarter of 2025, euro area banks expect a further moderate net tightening of credit standards for loans to firms (a net 5% of banks). Banks expect a smaller net tightening for loans to SMEs (3%) than for loans to large firms (6%), and a smaller net tightening for short-term loans (2%) than for long-term loans (6%).

Table 1

Factors contributing to changes in credit standards for loans or credit lines to enterprises

(net percentages of banks)

Country |

Cost of funds and |

Pressure from |

Perception of risk |

Banks’ risk tolerance |

||||

|---|---|---|---|---|---|---|---|---|

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

|

Euro area |

1 |

0 |

-1 |

-1 |

11 |

7 |

7 |

1 |

Germany |

0 |

-2 |

-1 |

0 |

11 |

9 |

13 |

0 |

Spain |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

France |

0 |

0 |

0 |

0 |

15 |

6 |

9 |

0 |

Italy |

0 |

0 |

-3 |

0 |

3 |

6 |

-9 |

0 |

Note: See the notes to Chart 1.

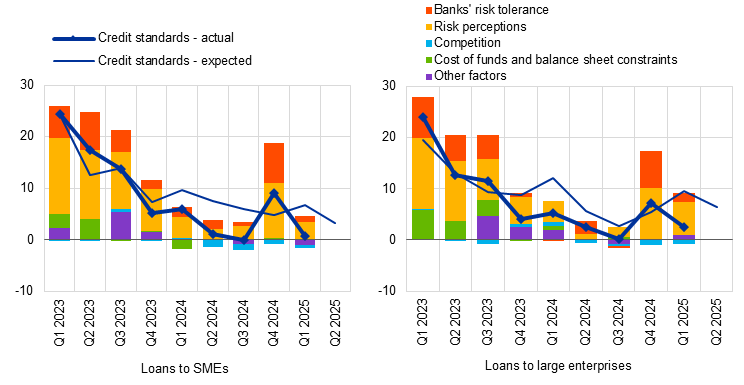

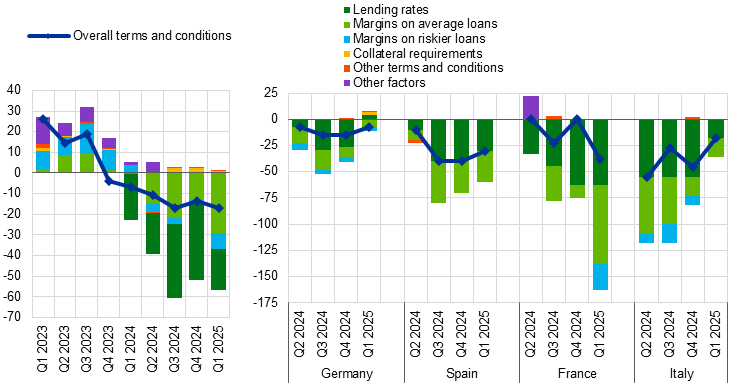

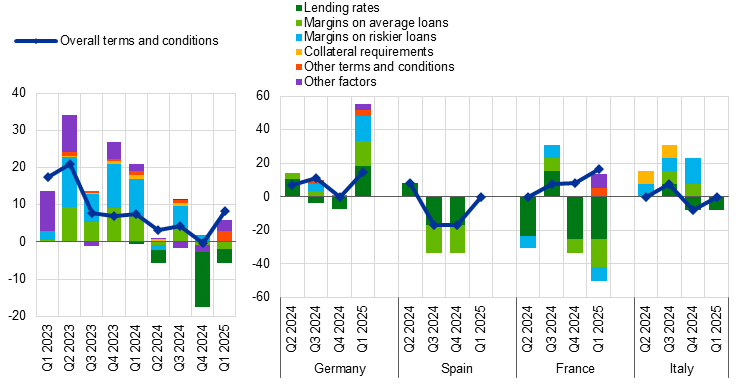

2.2 Terms and conditions eased owing to lower lending rates and narrower margins

Banks eased substantially the overall terms and conditions for new loans to enterprises (a net ‑10% of banks; see Chart 3 and Table 2), driven by lower lending rates and narrower margins on average loans.[5] The easing impact of these two factors was partly offset by stricter collateral requirements, while margins on riskier loans and other factors remained broadly unchanged. Banks in France, Spain and Italy reported an easing in overall terms and conditions, whereas those in Germany reported a net tightening. For Spanish and Italian banks, the easing was driven by lower lending rates and narrower margins on average loans. For French banks, however, the easing came from margins on both average and riskier loans, while lending rates remained unchanged. By contrast, terms and conditions tightened in net terms among German banks owing to both higher lending rates and wider loan margins. Across segments, euro area banks reported a net easing in overall terms and conditions of similar magnitude for loans to both large firms and SMEs (net ‑8% and ‑9% of banks respectively; see Chart 4). In both corporate loan segments, lending rates and narrower margins on average loans had an easing impact, while stricter collateral requirements and wider margins on riskier loans had a tightening impact.

Chart 3

Changes in terms and conditions on loans or credit lines to enterprises

(net percentages of banks reporting a tightening of terms and conditions)

Notes: “Overall terms and conditions” are the actual terms and conditions agreed in the loan contract. “Lending rates” was introduced in April 2024. “Margins” are defined as the spread over relevant market reference rates. “Other terms and conditions” is the simple average of “non-interest rate charges”, “size of the loan or credit line”, “loan covenants” and “maturity”. The net percentages for “Other factors” refer to an average of the further factors which were mentioned by banks as having contributed to changes in terms and conditions. The full set of data underlying this chart can be downloaded via the following ECB Data Portal links: euro area and largest four euro area countries.

Competitive pressures, in particular from other banks, were the main force behind the easing in terms and conditions (see Table 3). The easing impact of competition was reported primarily by banks in Italy and France. Some euro area banks also reported, under “Other factors”, an easing impact from declining benchmark rates. By contrast, higher perceived risks related to both the general economic outlook and firm-specific situations had a tightening impact on overall terms and conditions. Banks in Germany also reported a tightening impact from cost of funds and balance sheet constraints, primarily related to market financing and, to a lesser extent, liquidity positions.

Table 2

Changes in terms and conditions on loans or credit lines to enterprises

(net percentages of banks)

Country |

Overall terms and conditions |

Banks’ lending rates |

Banks’ margins on average loans |

Banks’ margins on riskier loans |

||||

|---|---|---|---|---|---|---|---|---|

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

|

Euro area |

-1 |

-10 |

-13 |

-8 |

-6 |

-9 |

0 |

0 |

Germany |

7 |

10 |

-13 |

7 |

3 |

3 |

7 |

3 |

Spain |

-8 |

-25 |

-8 |

-25 |

-8 |

-25 |

0 |

0 |

France |

9 |

-18 |

0 |

0 |

0 |

-9 |

0 |

-9 |

Italy |

-45 |

-45 |

-64 |

-55 |

-36 |

-36 |

-18 |

0 |

Note: See the notes to Chart 3.

Chart 4

Changes in terms and conditions on loans or credit lines to SMEs and large enterprises

(net percentages of banks reporting a tightening of terms and conditions)

Notes: See the notes to Chart 3. The full set of data underlying this chart can be downloaded via the following ECB Data Portal links: loans to SMEs and loans to large enterprises.

Table 3

Factors contributing to changes in overall terms and conditions for loans or credit lines to enterprises

(net percentages of banks)

Country |

Cost of funds and balance sheet constraints |

Pressure from competition |

Perception of risk |

Banks’ risk tolerance |

|||||

|---|---|---|---|---|---|---|---|---|---|

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

||

Euro area |

2 |

1 |

-3 |

-6 |

10 |

6 |

5 |

1 |

|

Germany |

2 |

6 |

-1 |

-1 |

11 |

3 |

7 |

0 |

|

Spain |

-6 |

-8 |

0 |

-3 |

0 |

-3 |

0 |

0 |

|

France |

6 |

0 |

0 |

-9 |

18 |

15 |

9 |

0 |

|

Italy |

-3 |

-3 |

-15 |

-12 |

-3 |

3 |

-9 |

0 |

|

Notes: The net percentages for these questions relating to contributing factors are defined as the difference between the percentage of banks reporting that the given factor contributed to a tightening and the percentage of banks reporting that it contributed to an easing. “Cost of funds and balance sheet constraints” is the simple average of “banks’ capital and the costs related to banks’ capital positions”, “access to market financing” and “liquidity position”. “Perception of risk” is the simple average of “general economic situation and outlook”, “industry-or-firm-specific situation and outlook/borrower’s creditworthiness” and “risk related to the collateral demanded”. “Pressure from competition” is the simple average of “competition from other banks”, “competition from non-banks” and “competition from market financing”. Aggregate series for “cost of funds and balance sheet constraints”, “perception of risk” and “pressure from competition” were discontinued from the first quarter of 2022, when detailed sub-factors were introduced. The full set of data underlying this chart can be downloaded via the following ECB Data Portal links: euro area and largest four euro area countries.

2.3 Rejection rates remained broadly unchanged for large firms but increased for SMEs

Banks reported a broadly unchanged share of rejected loan applications for large firms and a further increase in the share for loans to SMEs (see Chart 5). The latest developments in rejection rates came after an uninterrupted series of net increases since early 2022. The diverging developments across corporate loan segments, with rejection rates slightly increasing for loans to SMEs (a net 4% of banks) while remaining broadly unchanged for loans to large firms (‑1%), are consistent with the overall riskier profile of smaller firms. The share of rejected loan applications increased further in net terms in Germany, but only for SMEs, whereas a further net decrease was reported across all categories by Italian banks. Spanish and French banks had an unchanged share of rejected loan applications.

Chart 5

Changes in the share of rejected loan applications for enterprises

(net percentages of banks reporting an increase)

Notes: Share of rejected loan applications relative to the volume of all loan applications in that loan category. The breakdown by firm size was introduced in the first quarter of 2022. The full set of data underlying this chart can be downloaded via the following ECB Data Portal links: euro area and largest four euro area countries.

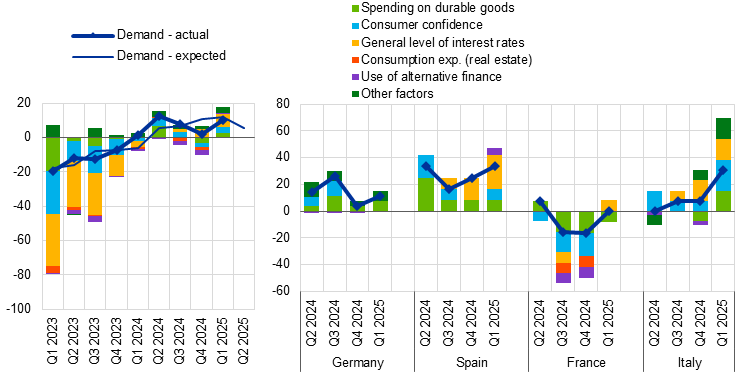

2.4 Renewed slight decrease in net demand for loans

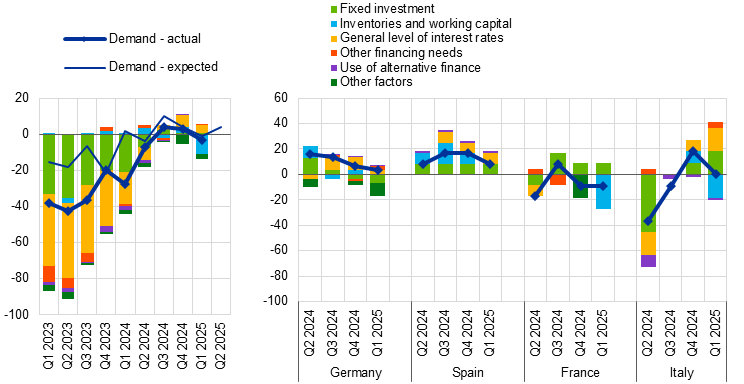

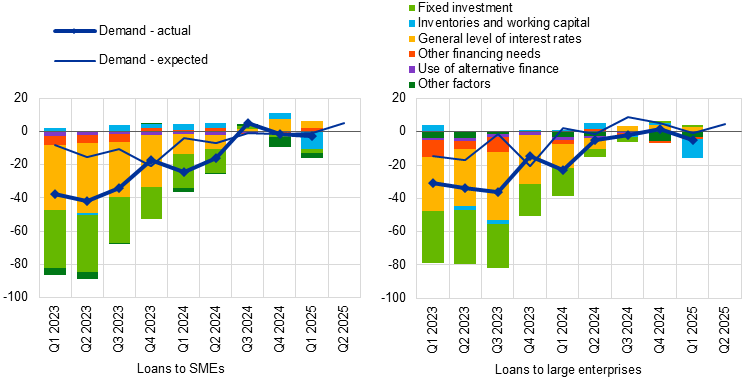

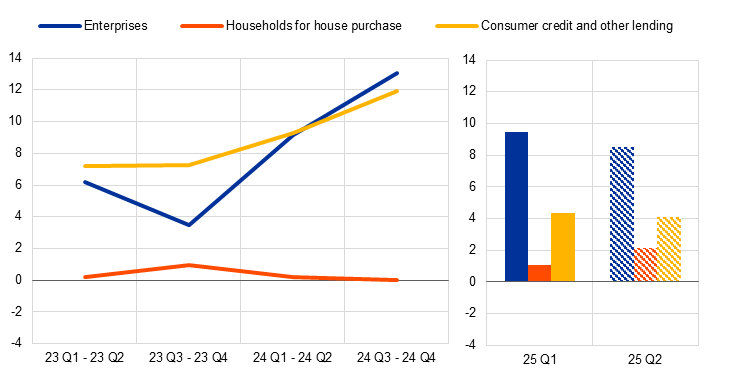

In the first quarter of 2025, euro area banks reported a renewed small decrease in net loan demand by firms, after two quarters of weak recovery (a net ‑3% of banks; see Chart 6).[6] The net decrease in demand was driven by banks in France, with banks in Italy reporting no change and banks in Germany and Spain reporting net increases. The decline across the euro area was below what banks had expected in the previous quarter, the expectation being that demand would remain broadly unchanged in net terms (‑1%). Across loan segments, banks reported net decreases in loan demand from large firms and SMEs (net ‑5% and ‑3% of banks respectively; see Chart 7). Net decreases were reported for short-term loans (‑9%), driven by banks in France and Italy, and for long-term loans (-3%).

Chart 6

Changes in demand for loans or credit lines to enterprises, and contributing factors

(net percentages of banks reporting an increase in demand, and contributing factors)

Notes: “Demand - actual” represents changes that have occurred, while “Demand - expected” represents changes anticipated by banks. Net percentages for the questions on demand for loans are defined as the difference between the sum of the percentages of banks responding “increased considerably” and “increased somewhat” and the sum of the percentages of banks responding “decreased somewhat” and “decreased considerably”. “Other financing needs” is the simple average of “mergers/acquisitions and corporate restructuring” and “debt refinancing/restructuring and renegotiation”. “Use of alternative finance” is the simple average of “internal financing”, “loans from other banks”, “loans from non-banks”, “issuance/redemption of debt securities” and “issuance/redemption of equity”. The net percentages for “Other factors” refer to an average of the further factors which were mentioned by banks as having contributed to changes in loan demand. The full set of data underlying this chart can be downloaded via the following ECB Data Portal links: euro area and largest four euro area countries.

Chart 7

Changes in demand for loans or credit lines to SMEs and large enterprises, and contributing factors

(net percentages of banks reporting an increase in demand, and contributing factors)

Notes: See the notes to Chart 6. The full set of data underlying this chart can be downloaded via the following ECB Data Portal links: loans to SMEs and loans to large enterprises.

Net loan demand decreased, mainly owing to a negative contribution from firm inventories and working capital and despite support from declining interest rates (see Chart 6 and Table 4). At the same time, fixed investment continued to have a broadly neutral impact on loan demand, with some banks referring, under “Other factors”, to economic and (geo-)political uncertainties as a dampening factor for firms’ longer-term planning. Among the four largest euro area economies, inventories and working capital financing needs were the factor exerting pressure on loan demand in France and Italy, consistent with the decrease in demand for short-term loans (see above) and with early indications, from the latest releases of the manufacturing purchasing managers’ indexes (PMIs) for Italy and France, pointing to a continued fall in input inventory purchases in March in these two countries. Similarly to the previous quarter, banks in Germany pointed to a dampening impact of fixed investment, in contrast to the supportive impact reported by banks in Spain, France and Italy. Banks in Italy, Spain and Germany indicated additional support from declining interest rates, while banks in France reported a zero net impact. Financing needs for inventories and working capital were reported to have a negative impact in net terms on loan demand from both SMEs and large firms, while, for loans to SMEs, fixed investment exerted further pressure (see Chart 7).

Table 4

Factors contributing to changes in demand for loans or credit lines to enterprises

(net percentages of banks)

Country |

Fixed investment |

Inventories and working capital |

Other financing needs |

General level of interest rates |

Use of alternative finance |

|||||

|---|---|---|---|---|---|---|---|---|---|---|

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

|

Euro area |

1 |

0 |

3 |

-11 |

0 |

1 |

7 |

5 |

0 |

0 |

Germany |

-3 |

-7 |

3 |

0 |

-2 |

3 |

10 |

3 |

1 |

1 |

Spain |

8 |

8 |

8 |

0 |

0 |

0 |

8 |

8 |

2 |

2 |

France |

9 |

9 |

0 |

-27 |

0 |

0 |

0 |

0 |

0 |

0 |

Italy |

9 |

18 |

9 |

-18 |

0 |

5 |

9 |

18 |

-2 |

-2 |

Note: See the notes to Chart 6.

Banks expect a small net increase in loan demand from firms for the second quarter of 2025 (a net 4% of banks). They expect a similar development for loans to both large enterprises and SMEs (a net 5% of banks for both), as well as for long-term loans (4%), whereas a further, albeit small, net decrease is expected in demand for short-term loans (‑2%).

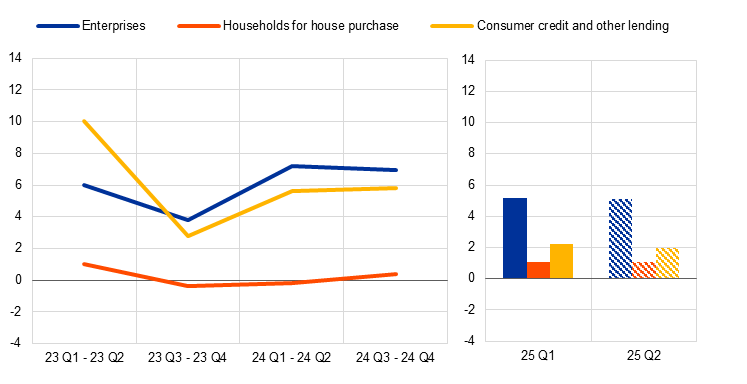

3.1 Moderate easing of credit standards

Banks reported a moderate easing of credit standards for loans to households for house purchase (a net ‑7% of banks; see Chart 8 and Overview table). Banks thus resumed easing credit standards, after keeping them broadly unchanged in the fourth quarter of 2024 and despite having expected a small tightening (2%).[7] Developments varied across the largest euro area countries. Banks in France reported a net easing for the fifth consecutive quarter, and those in Germany did so for the first time since the beginning of the interest rate cuts. At the same time, banks in Spain reported unchanged credit standards on housing loans, while banks in Italy reported a net tightening for the second consecutive quarter.

Chart 8

Changes in credit standards applied to the approval of loans to households for house purchase, and contributing factors

(net percentages of banks reporting a tightening of credit standards, and contributing factors)

Notes: “Credit standards - actual” are changes that have occurred, while “Credit standards - expected” are changes anticipated by banks. Net percentages are defined as the difference between the sum of the percentages of banks responding “tightened considerably” and “tightened somewhat” and the sum of the percentages of banks responding “eased somewhat” and “eased considerably”. “Cost of funds and balance sheet constraints” is the simple average of “banks’ capital and the costs related to banks’ capital positions”, “access to market financing” and “liquidity position” (the aggregate series was discontinued from the first quarter of 2022, when detailed sub-factors were introduced). “Risk perceptions” is the simple average of “general economic situation and outlook”, “housing market prospects, including expected house price developments” and “borrower’s creditworthiness”. “Competition” is the simple average of “competition from other banks” and “competition from non-banks”. The net percentages for “Other factors” refer to an average of the further factors which were mentioned by banks as having contributed to changes in credit standards. The full set of data underlying this chart can be downloaded via the following ECB Data Portal links: euro area and largest four euro area countries.

Competition was the main factor behind the easing of credit standards on housing loans, with higher bank risk tolerance also making a small contribution (see Chart 8 and Table 5). As in the previous quarters, the net easing impact of competition reflected competition from other banks, while competition from non-banks had a neutral impact. It was mainly reported by banks in France, with German banks also indicating that competition had played a small role in easing credit standards. German banks also reported increased risk tolerance. At the other end of the spectrum, higher risk perceptions drove Italian banks’ net tightening.

In the second quarter of 2025, euro area banks expect to tighten credit standards on housing loans (a net 7% of banks). Across the largest euro area economies, this expected tightening is driven by banks in France and Germany, whereas Italian and Spanish banks expect unchanged credit standards on housing loans.

Table 5

Factors contributing to changes in credit standards for loans to households for house purchase

(net percentages of banks)

Country |

Cost of funds and balance sheet constraints |

Pressure from competition |

Perception of risk |

Banks’ risk tolerance |

||||

|---|---|---|---|---|---|---|---|---|

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

|

Euro area |

0 |

0 |

-5 |

-10 |

2 |

1 |

4 |

-2 |

Germany |

-1 |

-1 |

-2 |

-2 |

4 |

0 |

7 |

-7 |

Spain |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

France |

0 |

0 |

-13 |

-31 |

0 |

0 |

0 |

0 |

Italy |

0 |

0 |

0 |

0 |

3 |

6 |

9 |

0 |

Note: See the notes to Chart 8.

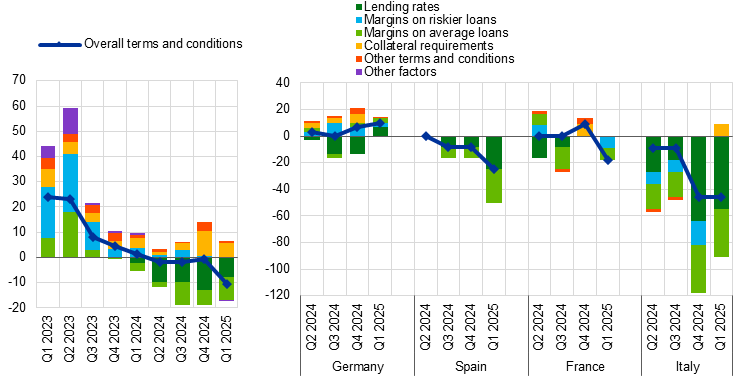

3.2 Terms and conditions continued to ease strongly

In the first quarter of 2025, banks continued the strong easing of the overall credit terms and conditions for housing loans (a net ‑17% of banks; see Chart 9 and Table 6). Similarly to recent quarters, the net easing was mainly driven by lower lending rates and narrower margins on average loans as well as on riskier loans, albeit to a lesser extent. The net percentage of banks reporting an easing of terms and conditions was slightly higher than the previous peak of the third quarter of 2024 and the highest since the start of the series in 2015.[8] Banks in all four largest euro area economies reported a net easing, with a positive contribution from narrower margins on average loans. On the other hand, lower lending rates contributed to the easing in France, Spain and Italy, but not in Germany, where banks reported a small tightening effect of higher lending rates that was consistent with the mortgage rates seen in February 2025 and with recent developments in longer-term market rates in March. Narrower margins on riskier loans were reported by French and German banks. In addition, German banks also reported a small tightening contribution from higher collateral requirements.

Chart 9

Changes in terms and conditions on loans to households for house purchase

(net percentages of banks reporting a tightening of terms and conditions)

Notes: “Overall terms and conditions” are the actual terms and conditions agreed in the loan contract. “Lending rates” was introduced in April 2024. “Margins” are defined as the spread over relevant market reference rates. “Other terms and conditions” is the simple average of “loan-to-value ratio”, “other loan size limits”, “non-interest rate charges” and “maturity”. The net percentages for “Other factors” refer to an average of the further factors which were mentioned by banks as having contributed to changes in terms and conditions. The full set of data underlying this chart can be downloaded via the following ECB Data Portal links: euro area and largest four euro area countries.

Table 6

Changes in terms and conditions on loans to households for house purchase

(net percentages of banks)

Country |

Overall terms and conditions |

Banks’ lending rates |

Banks’ margins on average loans |

Banks’ margins on riskier loans |

||||

|---|---|---|---|---|---|---|---|---|

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

|

Euro area |

-14 |

-17 |

-37 |

-20 |

-13 |

-29 |

-2 |

-8 |

Germany |

-15 |

-7 |

-26 |

4 |

-11 |

-7 |

-4 |

-4 |

Spain |

-40 |

-30 |

-40 |

-30 |

-30 |

-30 |

0 |

0 |

France |

0 |

-38 |

-63 |

-63 |

-13 |

-75 |

0 |

-25 |

Italy |

-45 |

-18 |

-55 |

-18 |

-18 |

-18 |

-9 |

0 |

Note: See the notes to Chart 9.

Competition was the main driver of the net easing of overall terms and conditions, similarly to the previous quarter (see Table 7). This impact strengthened further in the first quarter of 2025 (a net ‑24% of banks, up from ‑20%), was broad based across the largest euro area countries and was particularly pronounced for French banks. Banks’ cost of funds and balance sheet constraints, perceptions of risk and risk tolerance played a broadly neutral role in altering banks’ terms and conditions, apart from a small contribution from lower risk tolerance in Germany.

Table 7

Factors contributing to changes in overall terms and conditions on loans to households for house purchase

(net percentages of banks)

Country |

Cost of funds and |

Pressure from |

Perception of risk |

Banks’ risk tolerance |

||||

|---|---|---|---|---|---|---|---|---|

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

|

Euro area |

-1 |

-1 |

-20 |

-24 |

2 |

0 |

2 |

1 |

Germany |

-1 |

-1 |

-7 |

-4 |

4 |

0 |

4 |

4 |

Spain |

-10 |

0 |

-20 |

-30 |

0 |

0 |

0 |

0 |

France |

0 |

0 |

-25 |

-63 |

0 |

0 |

0 |

0 |

Italy |

-3 |

0 |

-55 |

-18 |

0 |

0 |

0 |

0 |

Notes: The net percentages for these questions relating to contributing factors are defined as the difference between the percentage of banks reporting that the given factor contributed to a tightening and the percentage of banks reporting that it contributed to an easing. “Cost of funds and balance sheet constraints” is the simple average of “banks’ capital and the costs related to banks’ capital positions”, “access to market financing” and “liquidity position” (the aggregate series was discontinued from the first quarter 2024, when detailed sub-factors were introduced). The full set of data underlying this chart can be downloaded via the following ECB Data Portal links: euro area and largest four euro area countries.

3.3 Rejection rates declined slightly for housing loans

Banks reported a slight reduction in the share of rejected applications for housing loans (a net ‑2% of banks; see Chart 10). This followed a decrease of similar magnitude reported in the previous three quarters, pointing to a very gradual easing of credit restrictions after the large cumulative net increases in the share of rejected applications seen between the second quarter of 2022 and the first quarter of 2024. Among the four largest euro area economies, the share of housing loan rejections decreased in Germany and Italy, while remaining unchanged in France and Spain.

Chart 10

Changes in the share of rejected loan applications for households

(net percentages of banks reporting an increase)

Notes: Share of rejected loan applications relative to the volume of all loan applications in that loan category. The full set of data underlying this chart can be downloaded via the following ECB Data Portal links: euro area and largest four euro area countries.

3.4 Net demand for loans increased strongly

For the third quarter in a row, banks reported a strong net increase in demand for housing loans (a net 41% of banks; see Chart 11 and Overview table).[9] The net increase in demand for housing loans is consistent with the gradual recovery of lending flows observed in this segment since mid-2024. The net increase follows similar strong increases observed in the previous two quarters and is above what had been expected in the fourth quarter of 2024 (31%). It was broad-based across the four largest euro area countries.

Chart 11

Changes in demand for loans to households for house purchase, and contributing factors

(net percentages of banks reporting an increase in demand, and contributing factors)

Notes: “Demand - actual” represents changes that have occurred, while “Demand - expected” represents changes anticipated by banks. Net percentages for the questions on demand for loans are defined as the difference between the sum of the percentages of banks responding “increased considerably” and “increased somewhat” and the sum of the percentages of banks responding “decreased somewhat” and “decreased considerably”. “Other financing needs” is the simple average of “debt refinancing/restructuring and renegotiation” and “regulatory and fiscal regime of housing markets”. “Use of alternative finance” is the simple average of “internal finance of house purchase out of savings/down payment”, “loans from other banks” and “other sources of external finance”. The net percentages for “Other factors” refer to an average of the further factors which were mentioned by banks as having contributed to changes in loan demand. The full set of data underlying this chart can be downloaded via the following ECB Data Portal links: euro area and largest four euro area countries.

Declining interest rates was the main factor behind the positive impact, while housing market prospects and consumer confidence also supported loan demand (see Chart 11 and Table 8). In France, consumer confidence made a first substantial contribution to higher demand, rebounding from a negative contribution in the fourth quarter of 2024, and possibly reflects reduced political uncertainty, the appointment of a new government in December and the agreement on a new budget in February. Positive housing market prospects supported demand in three of four largest countries, although not in France, which was consistent with the lower loan and house price dynamics in this country. “Other factors” also played a negative role in France, owing to the ending of the tax incentives supporting rental investment under the Pinel scheme,[10] which was consistent with the adverse impact of “other financing needs”.

In the second quarter of 2025, banks expect housing loan demand to continue to increase, but at a lower pace (a net 20% of banks). Expectations for a further but lower increase in housing loan demand were reported in Germany and Spain, while Italian banks expect unchanged loan demand in the next quarter. Banks in France expect mortgage demand to accelerate in the next quarter.

Table 8

Factors contributing to changes in demand for loans to households for house purchase

(net percentages of banks)

Country |

Housing market prospects |

Consumer confidence |

Other financing needs |

General level of interest rates |

Use of alternative finance |

|||||

|---|---|---|---|---|---|---|---|---|---|---|

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

|

Euro area |

13 |

15 |

-2 |

12 |

0 |

-2 |

46 |

48 |

-1 |

-2 |

Germany |

19 |

41 |

7 |

11 |

0 |

0 |

41 |

48 |

1 |

2 |

Spain |

10 |

10 |

0 |

10 |

0 |

0 |

40 |

70 |

0 |

-3 |

France |

13 |

0 |

-25 |

13 |

-13 |

0 |

50 |

63 |

0 |

-4 |

Italy |

9 |

9 |

18 |

27 |

0 |

0 |

73 |

64 |

-6 |

-3 |

Note: See the notes to Chart 11.

4.1 Credit standards tightened further

Banks reported a small further net tightening of credit standards for consumer credit and other lending to households (a net 3% of banks; see Chart 12 and Overview table). The net percentage decreased somewhat compared with the previous quarter and was smaller than had been expected by the banks in that quarter (7%), although it marked the twelfth consecutive quarter of net tightening in this segment. The net tightening was below the historical average for credit standards for consumer credit since 2003 (5%) and around the historical average since 2014 (3%).[11] Among the four largest euro area economies, a net tightening was observed in France for the third consecutive quarter and renewed in Italy, while remaining unchanged in Germany and Spain after 11 quarters of net tightening.

Chart 12

Changes in credit standards applied to the approval of consumer credit and other lending to households, and contributing factors

(net percentages of banks reporting a tightening of credit standards, and contributing factors)

Notes: “Credit standards - actual” are changes that have occurred, while “Credit standards - expected” are changes anticipated by banks. Net percentages are defined as the difference between the sum of the percentages of banks responding “tightened considerably” and “tightened somewhat” and the sum of the percentages of banks responding “eased somewhat” and “eased considerably”. “Cost of funds and balance sheet constraints” is the simple average of “banks’ capital and the costs related to banks’ capital position”, “access to market financing” and “liquidity position” (the aggregate series was discontinued from the first quarter of 2022, when detailed sub-factors were introduced). “Risk perceptions” is the simple average of “general economic situation and outlook”, “creditworthiness of consumers” and “risk on the collateral demanded”. “Competition” is the simple average of “competition from other banks” and “competition from non-banks”. The net percentages for “Other factors” refer to an average of the further factors which were mentioned by banks as having contributed to changes in credit standards. The full set of data underlying this chart can be downloaded via the following ECB Data Portal links: euro area and largest four euro area countries.

Higher risk perceptions were the main driver of the net tightening of credit standards for consumer credit (see Chart 12 and Table 9). The economic outlook and borrowers’ creditworthiness were the main reasons for the higher risk perceptions, which were reported as tightening factors by banks in France, Germany and Italy. Competition from other banks and non-banks, banks’ cost of funds and balance sheet situations, as well as bank’s risk tolerance, had a broadly neutral impact.

In the second quarter of 2025, euro area banks expect credit standards for consumer credit and other lending to households to tighten further (a net 7% of banks). Across the four largest euro area economies, banks in Germany, France and Italy expect a net tightening, while banks in Spain expect credit standards to remain unchanged.

Table 9

Factors contributing to changes in credit standards for consumer credit and other lending to households

(net percentages of banks)

Country |

Cost of funds and balance sheet constraints |

Pressure from competition |

Perception of risk |

Banks’ risk tolerance |

||||

|---|---|---|---|---|---|---|---|---|

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

|

Euro area |

1 |

1 |

-1 |

-1 |

3 |

3 |

3 |

1 |

Germany |

0 |

-1 |

0 |

0 |

4 |

6 |

7 |

4 |

Spain |

0 |

0 |

0 |

0 |

3 |

0 |

0 |

0 |

France |

0 |

3 |

0 |

-4 |

6 |

6 |

0 |

0 |

Italy |

0 |

0 |

0 |

0 |

3 |

3 |

0 |

0 |

Note: See the notes to Chart 12.

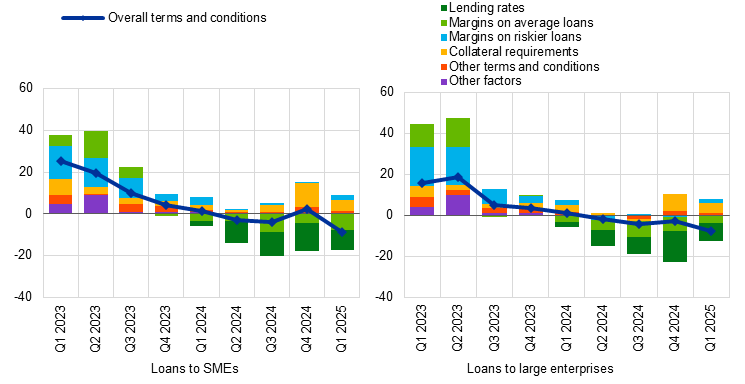

4.2 Terms and conditions tightened moderately

The overall terms and conditions applied by banks in granting consumer credit and other lending to households tightened in net terms in the first quarter of 2025 (a net 8% of banks; see Chart 13 and Table 10). After keeping credit terms and conditions broadly unchanged in the fourth quarter of 2024, the net percentage of banks reporting a net tightening was the highest seen since the second quarter of 2023 and was above the historical average since 2015 (2%). Lending rates and narrower margins on average loans had a small easing impact, while margins on riskier loans remained broadly unchanged. There was a small tightening impact as regards loan maturity and size, as well as from “other factors” primarily related to stricter risk assessments. Across the four largest euro area economies, overall terms and conditions tightened in France and Germany and remained unchanged in Spain and Italy. Banks in France and Italy reported an easing impact from declining lending rates, while banks in Germany pointed to a tightening impact from lending rates. Lending margins narrowed in France for average and riskier loans, but widened in Germany for both average and riskier loans.

Higher perceived risks and a lower risk tolerance of banks contributed the most to the net tightening of banks’ overall terms and conditions (see Table 11). Competitive pressure had a small net easing impact, driven by French banks. Banks’ risk perceptions contributed to the tightening in Germany and France, with German banks also reporting a lower risk tolerance.

Chart 13

Changes in terms and conditions on consumer credit and other lending to households

(net percentages of banks reporting a tightening of terms and conditions)

Notes: “Overall terms and conditions” are the actual terms and conditions agreed in the loan contract. “Lending rates” was introduced in April 2024. “Margins” are defined as the spread over a relevant market reference rate. “Other terms and conditions” is the simple average of “size of the loan”, “non-interest rate charges” and “maturity”. The net percentages for “Other factors” refer to an average of the further factors which were mentioned by banks as having contributed to changes in terms and conditions. The full set of data underlying this chart can be downloaded via the following ECB Data Portal links: euro area and largest four euro area countries.

Table 10

Changes in terms and conditions on consumer credit and other lending to households

(net percentages of banks)

Country |

Overall terms and conditions |

Banks’ lending rates |

Banks’ margins on average loans |

Banks’ margins on riskier loans |

||||

|---|---|---|---|---|---|---|---|---|

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

|

Euro area |

0 |

8 |

-15 |

-4 |

-1 |

-2 |

2 |

0 |

Germany |

0 |

15 |

-7 |

19 |

0 |

15 |

0 |

15 |

Spain |

-17 |

0 |

-17 |

0 |

-17 |

0 |

0 |

0 |

France |

8 |

17 |

-25 |

-25 |

-8 |

-17 |

0 |

-8 |

Italy |

-8 |

0 |

-8 |

-8 |

8 |

0 |

15 |

0 |

Note: See the notes to Chart 13.

Table 11

Factors contributing to changes in overall terms and conditions on consumer credit and other lending to households

(net percentages of banks)

Country |

Cost of funds and balance sheet constraints |

Pressure from competition |

Perception of risk |

Banks’ risk tolerance |

||||

|---|---|---|---|---|---|---|---|---|

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

|

Euro area |

0 |

1 |

-8 |

-3 |

7 |

4 |

3 |

4 |

Germany |

1 |

1 |

-11 |

4 |

4 |

7 |

4 |

15 |

Spain |

-8 |

0 |

-8 |

0 |

0 |

0 |

0 |

0 |

France |

0 |

3 |

-8 |

-8 |

17 |

8 |

8 |

0 |

Italy |

-3 |

0 |

0 |

0 |

8 |

0 |

0 |

0 |

Notes: The net percentages for these questions relating to contributing factors are defined as the difference between the percentage of banks reporting that the given factor contributed to a tightening and the percentage of banks reporting that it contributed to an easing. “Cost of funds and balance sheet constraints” is the simple average of “banks’ capital and the costs related to banks’ capital positions”, “access to market financing” and “liquidity position” (the aggregate series was discontinued from the first quarter of 2024, when detailed sub-factors were introduced). The full set of data underlying this chart can be downloaded via the following ECB Data Portal links: euro area and largest four euro area countries.

4.3 Rejection rates remained broadly unchanged

Euro area banks reported a broadly unchanged share of rejected loan applications for consumer credit (a net 1% of banks; see Chart 10 above). This is the first quarter since the second quarter of 2022 in which banks, on aggregate, did not report a net increase in the share of rejected applications. However, a net increase was observed in France, although German, Italian and Spanish banks reported a net decrease.

4.4 Net demand for loans increased moderately

Banks reported a moderate net increase in demand for consumer credit and other lending to households (a net 10% of banks; see Chart 14 and Overview table).[12] The net increase was larger than in the previous quarter (2%) and broadly in line with banks’ expectations in the previous quarter (12%). A net increase in loan demand was observed in Germany, Spain and Italy, while net demand for consumer credit remained unchanged in France.

The increase in loan demand was primarily supported by declining interest rates (see Chart 14 and Table 12). This was reported by banks in France, Italy and Spain. Higher spending on durable goods and consumer confidence had an additional small positive impact on loan demand and was driven by banks in Spain and Italy, consistent with the increase in the Italian consumer confidence index in January and February 2025. Marketing campaigns, reported by some banks as part of “other factors”, further supported the net increase in consumer credit. The use of alternative finance from other banks and non-banks, as well as consumption expenditure, had a broadly neutral impact on loan demand.

Chart 14

Changes in demand for consumer credit and other lending to households, and contributing factors

(net percentages of banks reporting an increase in demand, and contributing factors)

Notes: “Demand - actual” represents changes that have occurred, while “Demand - expected” are changes anticipated by banks. Net percentages for the questions on demand for loans are defined as the difference between the sum of the percentages of banks responding “increased considerably” and “increased somewhat” and the sum of the percentages of banks responding “decreased somewhat” and “decreased considerably”. “Use of alternative finance” is the simple average of “internal financing out of savings”, “loans from other banks” and “other sources of external finance”. “Consumption exp. (real estate)” denotes “consumption expenditure financed through real estate-guaranteed loans”. The net percentages for “Other factors” refer to an average of the further factors which were mentioned by banks as having contributed to changes in loan demand. The full set of data underlying this chart can be downloaded via the following ECB Data Portal links: euro area and largest four euro area countries.

For the second quarter of 2025, banks expect a further net increase in demand for consumer credit and other lending to households (a net 6% of banks). Demand for consumer credit is expected to increase in Germany and Spain and to remain unchanged in France and Italy.

Table 12

Factors contributing to changes in demand for consumer credit and other lending to households

(net percentages of banks)

Country |

Spending on durable goods |

Consumer confidence |

Consumption exp. (real estate) |

General level of interest rates |

Use of alternative finance |

|||||

|---|---|---|---|---|---|---|---|---|---|---|

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

Q4 2024 |

Q1 2025 |

|

Euro area |

-3 |

2 |

-2 |

3 |

-2 |

0 |

5 |

8 |

-3 |

1 |

Germany |

4 |

7 |

0 |

0 |

0 |

0 |

0 |

0 |

-1 |

0 |

Spain |

8 |

8 |

0 |

8 |

0 |

0 |

17 |

25 |

0 |

6 |

France |

-17 |

-8 |

-17 |

0 |

-8 |

0 |

0 |

8 |

-8 |

0 |

Italy |

-8 |

15 |

8 |

23 |

0 |

0 |

15 |

15 |

-3 |

0 |

Note: See the notes to Chart 14.

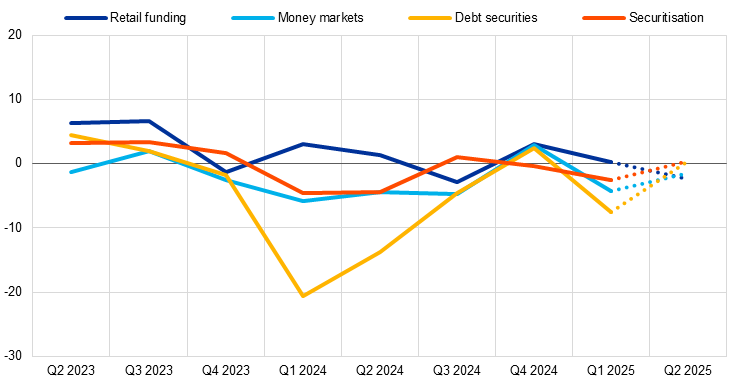

5.1 Bank access to funding slightly improved[13]

In the first quarter of 2025, access for euro area banks to retail funding remained unchanged, but eased for debt securities, money markets, and securitisations (Chart 15 and Table 13). Access to retail funding was broadly unchanged across maturities. As regards money markets and debt securities, access to funding eased slightly in the first quarter of 2025 (net ‑4% and ‑7% of banks respectively), resuming the gradual easing that had started in the fourth quarter of 2023, amid rate cuts, and that was interrupted by a slight tightening in the fourth quarter of 2024. The easing of access to money market funding was broad based across maturities, while that to debt securities was stronger in the medium to long-term segment. With regard to securitisations, the net percentage of banks reporting an easing stood at ‑3%.

For the second quarter of 2025, banks expect a slight easing of access to retail funding, with access to money markets, debt securities and securitisations expected to remain broadly unchanged. The small expected easing of access to retail funding is driven by the long-term segment, while conditions are expected to remain broadly unchanged in the short-term segment. Banks expect broadly unchanged access to money markets. Finally, it is expected that access to debt securities will ease slightly in the short-term segment, but tighten slightly in the long-term segment, remaining unchanged overall.

Chart 15

Changes in banks’ access to retail and wholesale funding

(net percentages of banks reporting a deterioration in access)

Notes: The net percentages are defined as the difference between the sum of the percentages of banks responding “deteriorated considerably” and “deteriorated somewhat” and the sum of the percentages of banks responding “eased somewhat” and “eased considerably”. “Retail funding” is the simple average of “short-term deposits (up to one year)” and “long-term deposits (more than one year)” and other retail funding instruments; “Money markets” refers to the interbank unsecured money market and is the simple average of “very short-term money market (up to one week)” and “short-term money market (more than one week)”; “Debt securities” is the simple average of “short-term debt securities (e.g. certificates of deposit or commercial paper)” and “medium to long-term debt securities (incl. covered bonds)”. “Securitisation” is the simple average of “securitisation of corporate loans”, “securitisation of loans for house purchase” and “ability to transfer credit risk off balance sheet”. The last period denotes expectations indicated by banks in the current round. The full set of data underlying this chart can be downloaded via the following ECB Data Portal link: changes in banks’ access to retail and wholesale funding.

Table 13

Changes in bank access to retail and wholesale funding

(net percentages of banks reporting a deterioration in access)

Retail funding |

Money markets |

Debt securities |

Securiti-sation |

|||||

|---|---|---|---|---|---|---|---|---|

Total |

Short-term |

Long-term |

Total |

Short-term |

Medium to |

|||

Q4 2024 |

3 |

3 |

3 |

3 |

2 |

4 |

1 |

0 |

Q1 2025 |

0 |

0 |

1 |

-4 |

-7 |

-3 |

-11 |

-3 |

Q2 2025 |

-2 |

0 |

-4 |

-1 |

0 |

-2 |

2 |

0 |

Notes: See the notes to Chart 15. The last period denotes expectations indicated by banks in the current round.

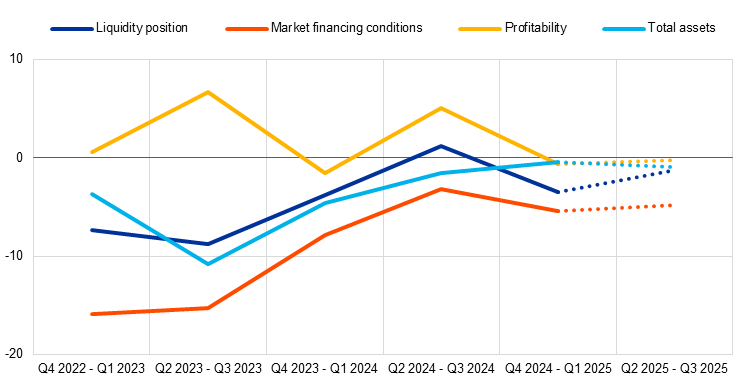

5.2 Slight pressure on market financing and neutral impact on lending from reduction in ECB monetary policy asset portfolio[14]

The reduction in the ECB monetary policy asset portfolio had a small negative impact on both the market financing conditions and liquidity positions of euro area banks over the last six months (net ‑5% and ‑3% of banks respectively; see Chart 16 and Table 14). This reflects the tightening impact of redemptions of the Eurosystem’s bond holdings under the ECB’s asset purchase programme (APP) and under the pandemic emergency purchase programme (PEPP). The deterioration in market financing was slightly stronger than in the previous six months (‑3%). The small worsening of liquidity positions marked another six months of deterioration in a series that had started in mid-2022, with the ending of net purchases, and that was interrupted only by a marginal easing in the second and third quarters of 2024. The reduction in the Eurosystem portfolios was associated with a neutral impact on total assets after having contributed to a contraction between the fourth quarter of 2022 and the first quarter of 2023. This is consistent with quantitative tightening contributing to an increase in euro area bank sovereign bond holdings for the first time since early 2015 (a net 3% of banks), given that euro area banks appear to have maintained a broadly stable volume of high-quality liquid assets (HQLA) despite the reduction in central bank reserves.[15] These policies had a broadly neutral impact on bank profitability in the past six months, after a small positive impact in the previous period.

Chart 16

Overview of the impact of the ECB’s monetary policy asset portfolio on euro area banks’ financial situations

(net percentages of banks reporting an increase or improvement)

Notes: The net percentages are defined as the difference between the sum of the percentages for “increased/improved considerably” and “increased/improved somewhat” and the sum of the percentages for “decreased/deteriorated somewhat” and “decreased/deteriorated considerably”. The last period denotes expectations indicated by banks in the current round. The full set of data underlying this chart can be downloaded via the following ECB Data Portal link: impact of the ECB’s monetary policy asset portfolio on euro area banks’ financial situation.

Over the next six months, euro area banks expect a further moderate negative impact of the ECB’s monetary policy asset portfolio reduction on their market financing conditions and a broadly unchanged impact on their liquidity positions. Banks also expect to continue increasing their sovereign bond holdings, with a neutral impact on total assets. The effects on bank profitability are expected to be broadly neutral.

Table 14

Impact of the ECB monetary policy asset portfolio on euro area banks’ financial situation

(net percentages of banks reporting an increase or improvement)

Assets |

Liquidity position |

Market financing conditions |

Profitability |

||||

|---|---|---|---|---|---|---|---|

Total |

Of which: Euro area sovereign bond holdings |

Total |

Owing to: net interest income |

Owing to: capital gains/losses |

|||

Q2 2024- Q3 2024 |

-2 |

-2 |

1 |

-3 |

5 |

5 |

-1 |

Q4 2024-Q1 2025 |

0 |

3 |

-3 |

-5 |

-1 |

2 |

-2 |

Q2 2025-Q3 2025 |

-1 |

4 |

-1 |

-5 |

0 |

1 |

-1 |

Notes: See the notes to Chart 16. The breakdown for net interest income was introduced from the first quarter of 2020, substituting the breakdown for the net interest margin. The last period denotes expectations indicated by banks in the current round. The full set of data underlying this chart can be downloaded via the following ECB Data Portal link: impact of the ECB’s monetary policy asset portfolio on banks’ financial situation.

Over the past six months, euro area banks reported a broadly neutral impact of the ECB’s monetary policy asset portfolio reduction on their lending conditions and volumes (see Chart 17 and Table 15). Banks reported a broadly neutral impact of these policies on credit standards, terms and conditions and lending volumes across all three credit segments (firms, households for house purchase and consumer credit) for the second consecutive six-month period. The exception to this was credit standards for mortgages, which had moderately tightened over the past six months owing to these policies. Overall, and similarly to the previous six months, the impact of the reduction of the ECB’s monetary policy asset portfolio over the past six months appears to be limited, reflecting the measured and predictable adjustment of the portfolio.

Over the next six months, banks expect that the reduction in the ECB’s monetary policy asset portfolio will have a small easing effect on lending conditions. Across lending segments, the increase is expected to be slightly more pronounced for mortgages.

Chart 17

Impact of the ECB monetary policy asset portfolio on bank lending

(net percentages of banks reporting a tightening or increase)

Notes: The net percentages are defined as the difference between the sum of the percentages for “tightened/increased considerably” and “tightened/increased somewhat” and the sum of the percentages for “eased/decreased somewhat” and “eased/decreased considerably”. The last period denotes expectations indicated by banks in the current round. The full set of data underlying this chart can be downloaded via the following ECB Data Portal links: impact of the ECB’s monetary policy asset portfolio on credit standards, terms and conditions, and lending volumes.

Table 15

Impact of the ECB monetary policy asset portfolio on bank credit standards, terms and conditions and lending volumes

(net percentages of banks reporting a tightening/an increase)

Credit standards |

Terms and conditions |

Lending volumes |

|||||||

|---|---|---|---|---|---|---|---|---|---|

Q2 24- Q3 24 |

Q4 24-Q1 25 |

Q2 25- Q3 25 |

Q2 24-Q3 24 |

Q4 24-Q1 25 |

Q2 25-Q3 25 |

Q2 24- Q3 24 |

Q4 24-Q1 25 |

Q2 25 -Q3 25 |

|

Loans to enterprises |

0 |

0 |

0 |

0 |

1 |

-1 |

1 |

0 |

2 |

Loans to households for house purchase |

5 |

-1 |

-1 |

0 |

-1 |

-4 |

-1 |

1 |

4 |

Consumer credit and other lending to households |

-1 |

0 |

0 |

0 |

0 |

-2 |

0 |

0 |

3 |

Notes: See the notes to Chart 17. The last period denotes expectations indicated by banks in the current round.

5.3 Perceived risks to credit quality had a tightening impact on lending conditions for firms and consumers[16]

Euro area banks reported a net tightening impact of NPL ratios and other credit quality indicators on their credit standards for loans to firms and, to a lesser extent, consumer credit in the first quarter of 2025 (net 9% and 4% of banks respectively; see Chart 18 and Table 16). A more moderate tightening impact of credit quality was observed for terms and conditions across both segments (5% and 2% of banks respectively; see Chart 19). At the same time, credit quality had a broadly neutral tightening impact on credit standards and terms and conditions for housing loans (a net 1% of banks for both).

Chart 18

Impact of banks’ NPL ratios and other credit quality indicators on credit standards

(net percentages of banks reporting a tightening impact)

Notes: Net percentages are defined as the difference between the sum of the percentages of banks responding “contributed considerably to tightening” and “contributed somewhat to tightening” and the sum of the percentages of banks responding “contributed somewhat to easing” and “contributed considerably to easing”. The frequency of the question was increased to quarterly (from biannual) from the first quarter of 2025. Until the second quarter of 2023, this question referred solely to the impact of banks’ NPL ratios. The last period denotes expectations indicated by banks in the current round. The full set of data underlying this chart can be downloaded via the following ECB Data Portal link: impact of banks’ NPL ratios and other indicators of credit quality on credit standards.

Chart 19

Impact of banks’ NPL ratios and other credit quality indicators on terms and conditions

(net percentages of banks reporting a tightening impact)

Notes: Net percentages are defined as the difference between the sum of the percentages of banks responding “contributed considerably to tightening” and “contributed somewhat to tightening” and the sum of the percentages of banks responding “contributed somewhat to easing” and “contributed considerably to easing”. The frequency of the question was increased to quarterly (from biannual) from the first quarter of 2025. Until the second quarter of 2023, this question referred solely to the impact of banks’ NPL ratios. The last period denotes expectations indicated by banks in the current round. The full set of data underlying this chart can be downloaded via the following ECB Data Portal link: impact of banks’ NPL ratios and other indicators of credit quality on terms and conditions.

Table 16

Impact of bank NPL ratios and other credit quality indicators on credit standards and terms and conditions

(net percentages of banks reporting a tightening impact)

Credit standards |

Terms and conditions |

|||||

|---|---|---|---|---|---|---|

Q3‑Q4 2024 |

Q1 2025 |

Q2 2025 |

Q3‑Q4 2024 |

Q1 2025 |

Q2 2025 |

|

Loans to enterprises |

13 |

9 |

9 |

7 |

5 |

5 |

Loans to households for house purchase |

0 |

1 |

2 |

0 |

1 |

1 |

Consumer credit and other lending to households |

12 |

4 |

4 |

6 |

2 |

2 |

Notes: See the notes to Chart 19. The last period denotes expectations indicated by banks in the current round.

Higher perceived risks, pressures related to supervisory or regulatory requirements and lower risk tolerance were the key factors behind the tightening impact of credit quality on bank lending conditions (see Chart 20 and Table 17). The impact of costs of balance sheet clean-up was neutral for the euro area.

Table 17

Impact of factors through which NPL ratios and other credit quality indicators affect banks’ policies on lending to enterprises and households

(net percentages of banks reporting a tightening impact)

Q2‑Q4 2024 |

Q1 2025 |

Q2 2025 |

|

|---|---|---|---|

Costs related to banks’ capital positions |

2 |

5 |

2 |

Costs related to balance sheet clean-up operations |

0 |

0 |

2 |

Supervisory or regulatory requirements |

5 |

7 |

7 |

Access to market financing |

2 |

1 |

-1 |

Liquidity position |

0 |

1 |

0 |

Perception of risk |

15 |

8 |

9 |

Banks’ risk tolerance |

8 |

6 |

7 |

Notes: See the notes to Chart 19. The last period denotes expectations indicated by banks in the current round.

For the second quarter of 2025, euro area banks expect a further tightening impact of credit quality on their lending conditions for loans to firms and for consumer credit, and a very small tightening impact for housing loans. The impact on credit standards and terms and conditions for loans to both firms and households is expected to remain similar to the impact in the first quarter of 2025. Higher perceived risks, pressure related to supervisory or regulatory requirements and a lower bank risk tolerance are expected to continue to drive the net tightening impact of credit quality.

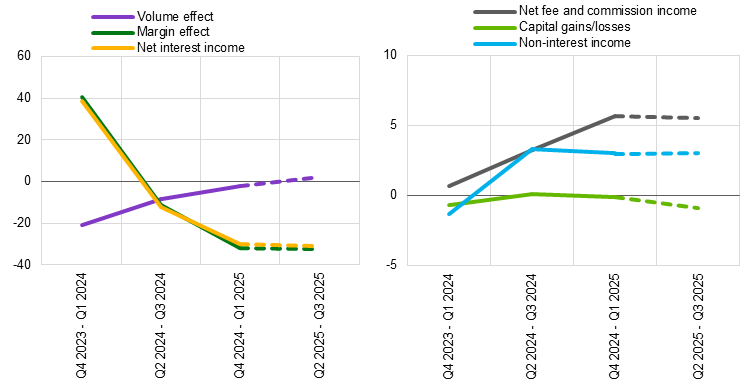

5.4 Impact of ECB key interest rate decisions on bank interest margins and volumes remained negative[17]

Banks reported a further negative impact of the ECB key interest rate decisions on their net interest margins over the past six months (a net ‑32% of banks, up from ‑11%; see Chart 21 and Table 18), while the impact through volumes remained slightly negative (-2%).[18] Although the negative impact on margins was in line with banks’ expectations six months ago (‑33%), the slightly negative impact on volumes contrasted with the expectation of a recovery (8%). Banks reported a small positive impact on non-interest income that was similar to the previous quarter, despite a slightly larger net increase in net fee and commission income. Rate decisions were reported to have had a very small positive impact on provisioning needs and impairments.

Chart 21

Impact of the ECB’s interest rate decisions on euro area bank net interest income and non-interest income

(net percentages of banks; over the past six months and the next six months)

Notes: The net percentages refer to the difference between the sum of the percentages of banks responding “increased considerably” and “increased somewhat” and the sum of the percentages of banks responding “decreased somewhat” and “decreased considerably”. The last period denotes expectations indicated by banks in the current round. The full set of data underlying this chart can be downloaded via the following ECB Data Portal link: impact of the ECB’s interest rate decisions on euro area bank net interest income and non-interest income.

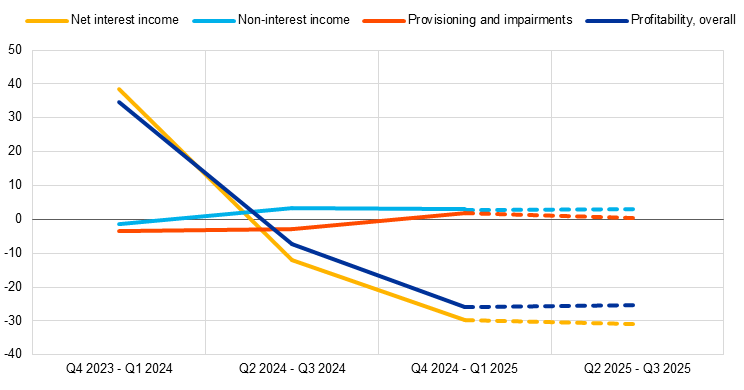

Chart 22

Impact of the ECB’s interest rate decisions on euro area bank profitability

(net percentages of banks; over the past six months and the next six months)

Notes: The net percentages refer to the difference between the sum of the percentages of banks responding “increased considerably” and “increased somewhat” and the sum of the percentages of banks responding “decreased somewhat” and “decreased considerably”. Net percentages are inverted in the case of provisioning and impairments. The last period denotes expectations indicated by banks in the current round. The full set of data underlying this chart can be downloaded via the following ECB Data Portal link: impact of the ECB’s interest rate decisions on euro area bank profitability.

Euro area banks expect similar net impacts of past and expected ECB key interest rate decisions on their profitability and margins over the next six months (net ‑25% and ‑32% of banks respectively). It is expected that the impact on loan volumes will turn slightly positive (2%), while there will continue to be no impact on provisioning needs (see Charts 21 and 22 and Table 18).[19] A slightly positive impact is expected for non-interest income, driven by a moderately positive impact on net fee and commission income.

Table 18

Impact of the ECB’s interest rate decisions on bank profitability

(net percentages of banks reporting an increase)

Q2 2024 -Q3 2024 |

Q4 2024-Q1 2025 |

Q2 2025 -Q3 2025 |

|

|---|---|---|---|

Profitability |

-7 |

-26 |

-25 |

Net interest income |

-12 |

-30 |

-31 |

Owing to: margin effect |

-11 |

-32 |

-32 |

Owing to: volume effect |

-9 |

-2 |

2 |

Non-interest income |

3 |

3 |

3 |

Owing to: capital gains/losses |

0 |

0 |

-1 |

Owing to: net fee and commission income |

3 |

6 |

6 |

Provisioning and impairments |

-3 |

2 |

0 |

Notes: See the notes to Charts 21 and 22. The last period denotes expectations indicated by banks in the current round. The full set of data underlying this chart can be downloaded via the following ECB Data Portal link: impact of the ECB’s interest rate decisions on bank profitability.

See more.

© European Central Bank, 2025

Postal address 60640 Frankfurt am Main, Germany

Telephone +49 69 1344 0

Website www.ecb.europa.eu

All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged.

For specific terminology please refer to the ECB glossary (available in English only).

PDF ISSN 1830-5989, QB-01-25-134-EN-N

HTML ISSN 1830-5989, QB-01-25-134-EN-Q

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer: