Advancing the capital markets union in Europe: a roadmap for harmonising securities post-trading

Prepared by Benjamin Hanssens, David Sandín de Vega and Hannah Franziska Sowa

Published as part of the ECB Economic Bulletin, Issue 4/2025.

1 Introduction

Post-trading is a crucial part of how European capital markets operate. After a trade is made, several important steps follow. These steps involve moving the ownership of financial products, such as bonds, from the seller to the buyer and handling the assets used as security in financial transactions. For example, a bank wishing to borrow money from a central bank needs to provide some of its eligible assets as collateral, akin to a buyer using a house as collateral for a mortgage. Post-trading needs to ensure these processes happen smoothly and securely.[1] Safe and efficient post-trading is the foundation for well-functioning capital markets, supporting their attractiveness and lowering the costs of savings and investments.

A harmonised approach to post-trade processes is essential for an efficient capital market in Europe. The report by Mario Draghi on the future of European competitiveness identifies post-trade fragmentation in Europe as a major barrier to developing a large, integrated capital market.[2] To achieve European harmonisation in post-trade now and in the future, two aspects are pertinent. First, there must be harmonisation across existing national legal and operational practices.[3] Second, it is essential to establish a framework for the development of innovative solutions for a digital capital markets union.[4] The ECB sees an urgent need to integrate Europe’s fragmented capital markets, not only in the area of post-trade but also in supervision and other areas.[5] This article focuses on the current post-trade environment.

To improve existing post-trade processes, the Eurosystem recommends having a single European rulebook. Improvements are particularly needed in three post-trade areas: (i) securities settlement (transfer of securities), (ii) collateral management (processes for managing assets used as collateral in credit operations), and (iii) asset servicing (e.g. managing coupon or dividend payments and redemptions). To this end, the Eurosystem has worked with market participants to create standards for the rulebook which address the barriers for these areas.[6] The Eurosystem’s Advisory Group on Market Infrastructures for Securities and Collateral (AMI-SeCo) has developed these standards and called for the adoption of the single rulebook.[7]

This article reviews the challenges of the existing post-trading ecosystem and provides a roadmap to overcome them. Section 2 provides an overview of the current fragmented European post-trade landscape. Section 3 looks at the role of the central bank in post-trade while Section 4 explores the barriers in securities settlement, collateral management and asset servicing, and the challenges to adopting and implementing European standards in these areas. It also explains the Eurosystem’s efforts to overcome these barriers by actively promoting a single European post-trade rulebook to harmonise business processes, data definitions and data exchange. Lastly, Section 5 outlines a proposal for a roadmap to implement the single rulebook in these areas.

2 Europe does not yet have a single financial market

Current European post-trade ecosystem

The European financial market relies on country-specific post-trade processes. Historically, markets in Europe operated independently from one another. For this reason, financial assets like bonds or shares are still mostly issued, held, traded and settled on a national basis. All the parties involved in handling these assets within a country communicate effectively throughout the process. However, when financial transactions occur between different countries, the exchange of information becomes complicated and inefficient. Entities have not yet transitioned to using unified approaches across the continent, and cross-border transactions often rely on less effective methods. Except for the TARGET services provided by the Eurosystem, most processes have not yet been fully integrated across Europe (Figure 1).

Figure 1

Capital market value chain, organised along national boundaries

Note: The colours in the figure relate to the same functions. Pink refers to trading and pre-trading, yellow refers to clearing, blue refers to settlement and green refers to asset servicing.

Central securities depositories (CSDs) and custodians are major parties in the national markets. In the post-trading space, they are crucial in two areas: (i) settling securities transactions where the details of the transaction are recorded electronically, ensuring that buyers receive their assets and sellers get paid and (ii) offering collateral management and asset servicing. TARGET services provide a strong European foundation for these parties, offering a streamlined pathway for securities settlement, which is crucial for an integrated value chain in the post-trade sector. However, many securities transactions are settled outside TARGET services, through internalised settlement flows, e.g. within custodians or CSD groups, which weakens this pathway. This mainly reflects the fragmentation in areas such as asset servicing. Additionally, not all CSDs have joined TARGET services or have established links with other CSDs across Europe.[8]

The location of assets has a considerable impact on post-trading, leading to national clusters, otherwise referred to as home bias. Consider a French company that owns German shares and wants to use them as collateral for a loan in Italy. Owing to different rules and systems in each country, handling these shares across borders becomes complicated, making it difficult to use them efficiently in Italy. Country-specific features and asset servicing practices make it difficult for the securities to be used as collateral on a cross-border basis. This creates vertical silos, with the clustering extending to national chains of trading, clearing and settlement. As shown in Figure 2, most layers remain largely confined to national boundaries.

Figure 2

A simplified overview of the European securities infrastructure

Source: ECB.

Notes: The European Economic Area (EEA) consists of 90 trading venues along with 14 central counterparties and 34 CSDs. This number includes 27 CSDs from the private sector (for the complete list, please consult the CSD Register published by the European Securities and Markets Authority) and seven CSDs operated by a public body (a central bank in every case but one). The colours in the figure relate to the same functions.

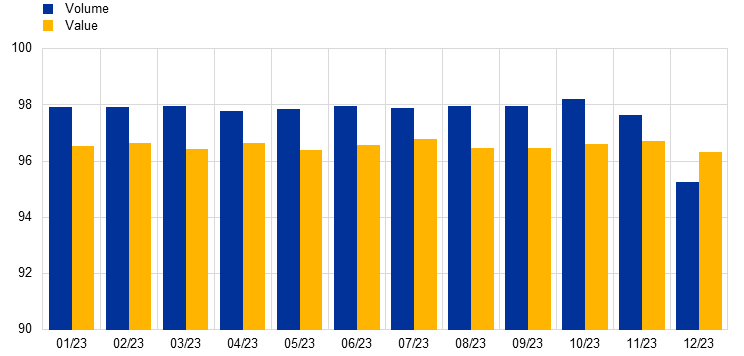

Despite some entities merging into larger groups that cover the value chain, cross-border settlement remains limited. CSDs in many cases are now parts of larger, consolidated groups that encompass trading, clearing, asset servicing and settlement. The three main CSDs in terms of value and volume are in the Euroclear Group, Euronext Group and Deutsche Börse Group (Chart 1, panel b).[9] However, securities are still predominantly held and settled within the local CSDs and barely move outside them (Chart 1, panel a). Even in CSDs belonging to the same group, there is a home bias with most settlement volumes occurring within each CSD of the group, with limited cross-border transactions. For 2023, close to 98% of transactions in value and more than 95% of volumes were settled between parties in the same individual CSD (i.e. both the delivering and receiving party belonged to the same CSD).[10]

Clusters confine capital within national boundaries. Clusters could limit cross-border investment and reduce the amount of capital available. The absence of harmonised standards and a harmonised operational framework prevents issuers from finding efficient alternative locations. Companies that issue financial assets, like shares or bonds, are often operating (or need to operate) within their own country's rules. Without a unified framework (a single European rulebook), they cannot easily choose to issue their assets in another country that might offer better conditions. This limits their ability to optimise their operations and potentially reduces their access to wider pools of capital. It also makes it harder for investors to take the most efficient decisions based on risk and return, as investors might not have access to the best opportunities or face higher costs when trying to invest across borders. Costs are related to several areas, such as quality of information (estimated at €1.6 to €8 billion per year globally), processing errors (€300 to €700 million per year), delays (€3.4 million) and ineffective processes.[11] While financial products like exchange-traded funds (ETFs) can help investors gain exposure to international markets, they do not completely solve the problem. ETFs still depend on the underlying markets being efficient and accessible.

Chart 1

Intra-CSD settlement in T2S and value of settlement turnover by groups of CSDs in 2023

a) Intra-CSD settlement

(percentages, daily averages)

b) CSDs by settlement turnover

(2023 values in EUR trillions)

Sources: TARGET2-Securities Annual Report for 2023 and ECB staff calculations.

Expansion of the EU capital market has consistently lagged behind that of the United States due to fragmentation. Over the past 15 years, issuance activity in the United States has doubled, whereas in the EU it has grown by only one third, thereby widening the gap between these two markets (Chart 2 shows the stock of issued securities). The difference is particularly significant given that the EU’s population surpasses that of the United States by over 100 million. In the United States, issuers benefit from a unified framework for issuance practices and corporate actions that allows them to reach all potential investors. By contrast, European issuers face a complex landscape of specific national practices and local requirements.

Chart 2

Issuances in the European Union vs the United States

(EUR trillions)

Source: ECB staff calculations (ECB statistics and BIS Red Book).

Two initiatives, namely the EU Issuance Service (EIS) and the Eurobond market, serve as examples of a more integrated approach. Since January 2024 the EIS offers a pan-European platform for the primary market issuance and initial distribution of EU debt instruments, treating the EU as a single domestic market.[12] This service which is used by the European Commission to issue EU debt securities provides a consistent approach to debt issuance and offers standardised asset servicing (as outlined in the single rulebook described below), facilitating access to a broad investor base within the EU. Although the EIS still has a limited scope and use, it serves as a strong example of a more harmonised and integrated European financial solution.[13] The Eurobond market is also a solution that is not linked to a national market; it has emerged as a workaround solution aiming to address and overcome various barriers that typically hinder seamless financial activities across national borders.[14]

3 The role of the central bank in post-trade

The Eurosystem plays a key role in the infrastructure of the financial markets. As operator, the Eurosystem provides common platforms and services. TARGET services offer a unified platform for the payment and settlement of securities transactions, thus ensuring safety, efficiency and integration with a single pool of euro liquidity in central bank money. As a catalyst, the Eurosystem promotes harmonisation and explores new technologies for central bank money settlement, fostering innovation and preventing re-fragmentation. Lastly, as an overseer, the Eurosystem supports common oversight requirements to enhance resilience and efficiency in Europe’s capital markets.

Table 1

The Eurosystem’s role in post-trading

Operations (through TARGET Services) |

T2 |

Large value payment system: real-time gross settlement (RTGS) system of payments in euro, which are processed and settled in central bank money, i.e. money held in an account with a central bank. |

T2S |

Securities settlement platform: common platform operated by the Eurosystem on which securities and cash can be transferred between investors across Europe using harmonised rules and practices. Banks pay for securities on the platform using the account they have with their central bank, so the money used to settle transactions is central bank money. |

|

TIPS |

Faster payments: market infrastructure service enabling payment service providers to offer fund transfers to their customers in real time and around the clock, every day of the year, irrespective of their local bank’s opening hours. |

|

ECMS |

Collateral management system: unified system for Eurosystem central banks to manage assets used as collateral in Eurosystem credit operations. The Eurosystem Collateral Management System will replace the existing euro area national central bank systems currently in use. |

|

Harmonisation |

SCoRE and T2S standards |

The Single Collateral Management Rulebook for Europe (SCoRE) establishes the common rules for managing collateral in the areas of corporate actions, triparty collateral management and billing. Facilitates collateral management processes for market participants, investors and financial entities. The T2S standards aim to harmonise securities settlement across the European T2S markets. |

Oversight |

The mandate covers payment systems, electronic payment instruments, T2S, securities settlement systems, critical service providers and correspondent and custodian banks. Responsibilities are shared between the ECB and national central banks. |

The Eurosystem facilitates standardisation through market coordination. Through initiatives such as AMI-SeCo, the Eurosystem is examining the root causes of technical barriers in Europe. To tackle these issues, harmonisation standards are being developed, comprising uniform rules and formats aimed at eliminating discrepancies in post-trading across Europe, thus improving the quality of data for processing securities transactions, including settlement and asset servicing. Harmonisation standards also define how new technologies could be integrated into existing settlement and collateral management processes. These standards are adopted by AMI-SeCo as part of creating a single European rulebook.

The Eurosystem fosters the resilience of capital markets. By offering the TARGET services as a strong and harmonised fundament in Europe, there is a common pathway (highway) for safe and efficient cross-border settlement and to preserve the region’s autonomy. The Eurosystem ensures the safe settlement of transactions by using deposits/reserves held by financial institutions at the central bank, known as central bank money settlement. It provides tools for pooling liquidity, which enhances resilience during periods of market stress and improves risk management.

4 Improving the existing European post-trade ecosystem

A holistic approach, with a single set of rules, is necessary to reduce the impediments in securities settlement, collateral management and asset servicing. Adopting a single European rulebook is essential to remove barriers in operational frameworks, with differing business processes and messaging, which, for example, restrict collateral mobility. While legal and regulatory barriers also affect post-trade arrangements, these are largely addressed by other initiatives, notably the European Commission’s savings and investments union efforts (Box 1).

To eliminate operational impediments, the following measures are necessary:

- Harmonisation to remove technical fragmentation: harmonisation of rules and practices is needed to improve the quality and consistency of data for cross-border transactions. Further harmonisation in several areas would lead to common operational frameworks that would reduce complexity and compliance burdens for market participants involved in cross-border activities.

- Coordination: an agreement by the financial industry on a roadmap for switching to a single set of rules (rulebook) would allow specific national practices to be brought into line. It would establish a consistent data source and a set of processing requirements for interactions with asset owners across markets.

- Incentivise: promote European solutions based on harmonisation, which support the interoperability of financial market structures and reduce incentives for internalised settlement. The Eurosystem’s TARGET services play a key role as a European pathway, maintaining the stability of central bank money as a settlement asset and ensuring that new technologies are integrated safely and effectively in financial market infrastructures. The focus should be on creating a shared environment with settlement links among all CSDs in Europe, aimed at reducing transaction costs, enhancing market efficiency and fostering financial innovation.

These measures have to be aligned with innovative solutions for digital capital markets to avoid new fragmentation and contain risk. Wholesale (or large value) financial transactions are currently based on the settlement in central bank money via the Eurosystem TARGET services. Market participants are increasingly anticipating that tokenisation and use of distributed ledger technology (DLT) will revolutionise financial transactions by allowing assets to be issued or represented as digital tokens. The Eurosystem is currently broadening its initiatives to settle DLT-based transactions using central bank money.[15] By providing central bank money based on a harmonised rulebook (aligned with the current environment), the Eurosystem aims to mitigate the risks associated with using alternative settlement assets, which could reintroduce credit risk, market fragmentation and reliance on non-European solutions.[16]

Box 1

Post-trading activities: areas for harmonisation under the single European rulebook

Harmonisation and use of common standards in the following areas would be particularly beneficial.

- Barriers in legal and regulatory frameworks: eliminating specific national practices and frameworks, such as purely national shareholder and bondholder definitions, or restrictions on issuance.

- Barriers in operational frameworks

- Securities settlement: further integrating market practices and architecture for securities issuance and settlement, as well as aligning standards and requirements across jurisdictions to accelerate settlement.

- Collateral management: reducing heterogeneity in processes across European financial markets to increase the efficient use of collateral (collateral mobility).

- Asset servicing (corporate events): adopting a single set of rules for corporate events (as part of the single rulebook), which defines common data elements, business processes and messaging standards for Europe.

5 A roadmap to harmonise the existing post-trading landscape

The Eurosystem proposes a clear path forward for the European post-trading sector. Collective action and a migration strategy – roadmap – are needed to collectively implement the single rulebook, detailing the future landscape and the steps required to achieve it. This roadmap is needed for the financial community to coordinate the move to a single set of rules and stop the parallel use of different messaging formats. It should be advanced by the Eurosystem, CSDs, their participants and custodians through existing or, where needed, new national stakeholder groups.

The roadmap should focus on specific areas: initially addressing collateral management and asset servicing. The migration strategy has advanced in AMI-SeCo in respect of collateral management and asset servicing and will be presented for adoption by the financial community. Different waves for adoption allow for a smooth transitioning. From the Eurosystem perspective, a cohesive and ambitious strategy is pertinent, providing momentum, with a clear timeline for transitioning to a single message format, ISO 20022, with plans that include specific milestones to be achieved by 2028 and earlier, and with an aspirational deadline of no later than 2030. The strategy will be most effective if it defines clear dates for stopping the use of different messaging standards.

- June 2025: the Eurosystem, CSDs and counterparties are part of the first wave. The Eurosystem Collateral Management System (ECMS) – a unified system for managing assets used as collateral in Eurosystem credit operations – will go live in June 2025 and operate according to the core areas of the rulebook, thereby ensuring that the handling of securities eligible as collateral in monetary policy and related collateral operations is standardised through the adoption of rules and practices and the use of ISO 20022 messaging standards. Other parties could join gradually.

- End 2028: CSD participants will be able to join. CSDs participants will be able to use harmonised interactions based on the common rulebook, which includes common data elements, business processes and workflows and ISO 20022 messaging standards. CSD participants also start offering the common messaging to their clients.

- End 2030: the remaining parties should have joined. From that point onward, the implementation of the single rulebook and ISO 20022 messaging standards in these areas should be completed. Transactions will be streamlined, thus reducing costs and boosting the efficiency of Europe's financial markets.

Figure 3

Roadmap

Source: ECB.

6 Conclusion

Integration of post-trade activities at European level is important for developing deeper and broader capital markets serving European citizens and businesses. Harmonised solutions must be applied to enhance cross-border competition and foster efficiency. Building on the advancements of the TARGET services, attention is required for non-harmonised areas related to securities settlement, collateral management and asset servicing.

The single European post-trade rulebook should provide clarity on the future shape of market structures. The single rulebook will minimise uncertainty and stimulate innovation. It should provide clarity on standards for exchanging data to facilitate machine-readable and standardised end-to-end processing from issuers through to investors. Addressing discrepancies in data usage and exchange at their source is critical, as these discrepancies can be propagated throughout the entire transaction chain, underscoring the need for a single rulebook.

An agreed roadmap is essential for making the switch to the single rulebook. A coordinated approach across Europe should be adopted, with a timeline to phase out current national practices and establish a unified standard for processing securities. Doing so will contribute to achieving truly European capital markets. The roadmap initially focuses on collateral management and asset servicing, with the aim of overcoming these longstanding pain points in the securities industry.

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release